Before we dive in, one important clarification: this article is about Official TRUMP —not older or unrelated “Trump tokens”. Always verify the contract before transacting (TRUMP is an ERC-20 token; see the Etherscan contract page linked from CMC/CG).

Trumpcoin Today: Current Price and Market Data

Source: Coinmarketcap

As of October 16, 2025, Official TRUMP trades near the mid-$6s, with 24-hour volume in the mid-$300M range. CoinMarketCap’s live page shows a market cap around $1.2B, a circulating supply near 200M TRUMP, and a max supply just under 1B TRUMP. Use CMC (or CoinGecko) for the current print and venue list, since figures shift throughout the day.

For contract verification, follow the Etherscan link from those trackers; you should see the active ERC-20 token page (holders, transfers, and official links). This simple step helps you avoid copycat tickers.

Historical Price Trends of TRUMP

Trumpcoin price trends have behaved like a classic PoliFi (political-finance) meme cycle: rapid upside during headline-heavy periods, followed by equally sharp retracements when attention rotates. In late 2024, CoinDesk documented how PoliFi tokens—including Trump-themed names—rallied and then slumped around U.S. election milestones, underscoring how crowd narratives—and not just “good news”—drive flows. That behavior pattern persisted into 2025 as Official TRUMP listings and campaign-adjacent news pulled traders in and out of the theme.

Key Drivers That Impact Trumpcoin Price

1) News velocity & narrative fit

TRUMP is unusually sensitive to political headlines, influencer posts, and platform pushes. When the narrative lines up (endorsements, policy soundbites, or viral posts), liquidity and short-term demand can surge; when it stalls, ranges compress or unwind. CoinDesk’s PoliFi coverage explains how quickly these narratives invert.

2) Liquidity & venue coverage

Listings matter. Major exchanges and brokers created deeper order books for Official TRUMP in January 2025 (e.g., OKX spot listing with a TRUMP/USDT pair; Binance.US listing; broader price pages at Coinbase, Bybit, etc.). More venues and market-maker support generally mean tighter spreads and more consistent execution.

3) Token mechanics & contract assurances

Memecoins live on perceived fairness. Check the token contract for mint authority, burn rules, and any admin permissions. Etherscan’s token page plus official links from CMC/CG are your first stop in minimizing contract risk.

4) The broader PoliFi cycle

PoliFi tokens tend to move as a basket. When the theme is hot, correlations rise; when the crowd rotates away, even “strong” names soften. Coverage across 2024–2025 shows this sector-beta effect clearly.

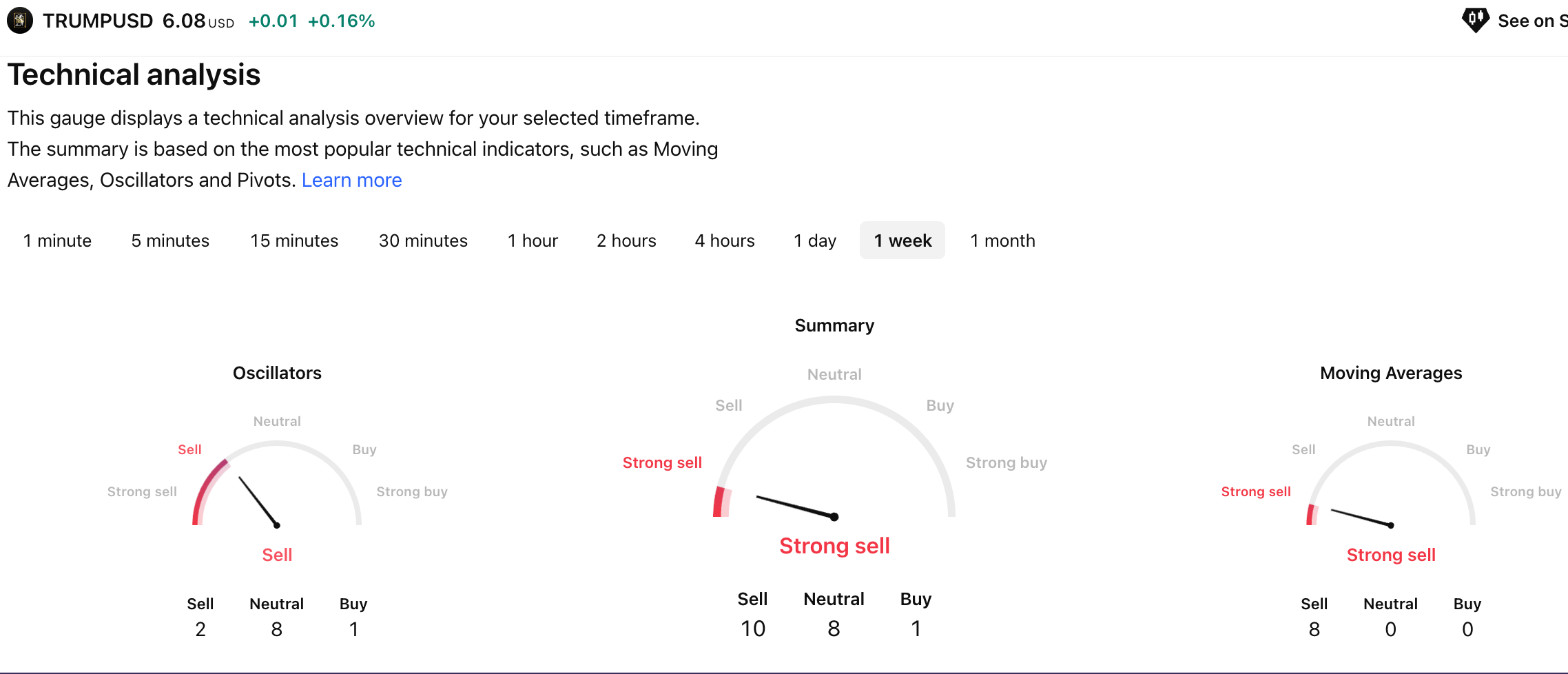

Short-Term Trumpcoin Forecast (2025–2026)

Source: TradingView

- Base case — Wide ranges, headline-led.

Expect range trading with bursts on news and exchange campaigns, then digestion. Watch live Markets tabs on CMC/CG to see where depth concentrates; spreads and slippage tell you if a move can sustain. This regime favors pre-planned exits and scaling (both in and out). - Bull case — Liquidity broadens, narrative aligns.

If more top-tier venues deepen TRUMP books (and run promos) while political attention intensifies, upside overshoots are common—memes move on flow, not discounted cash flows. OKX’s January spot listing and similar rollouts illustrate how listings can catalyze short-term demand. - Bear case — Attention fade or risk-off.

History shows PoliFi coins can dip even on “good” headlines if optimism was priced in, or if macro turns risk-off. The same media engine that fuels spikes can fuel air pockets on the way down.

Long-Term Trumpcoin Forecast (2027–2030)

Over multi-year horizons, a Trumpcoin outlook hinges on three levers:

- Community stamina. Do holder counts and on-chain activity remain high between news cycles, or does attention migrate to the next theme? (CMC/CG + Etherscan holders tab help you track this.)

- Durable market access. Are liquid TRUMP/USDT (or fiat) pairs consistently available on large venues? Early 2025 listings by OKX, Binance.US, and others were a step toward permanence; continuity matters more than day-one pops.

- Low contract drama. Absence of surprise mints or governance shocks keeps trust high—critical for any meme asset without intrinsic cash flows. (The contract page on Etherscan is the canary.)

Base path: episodic spikes tied to news + long plateaus as liquidity resets. Bull path: sustained community growth + deeper derivatives/venue access. Bear path: theme fatigue and liquidity drift, a pattern seen in prior PoliFi cycles.

Expert Opinions on Trumpcoin Forecast

Official targets from trustworthy outlets are rare for narrative tokens. Instead, look at expert coverage of the infrastructure:

- CoinDesk has chronicled PoliFi behavior—how tokens surge or slump around political milestones and why they don’t always obey simple “good news up” logic. Use these desk notes to frame risk.

- Major exchange notices (OKX listing post; Binance.US listing note) and broker price pages (Coinbase, Bybit) provide the actionable expert signal: where you can trade with depth today. That, more than a model, tends to drive short-term outcomes.

How to Buy or Swap TRUMP Easily

- Find the right asset page.

Open TRUMP on CoinMarketCap or CoinGecko. Use the contract link (Etherscan) from there—never paste addresses from random posts. - Choose a venue with real depth.

Check the Markets tab for TRUMP/USDT pairs on major exchanges, like Swapgate. Confirm volumes and spreads. Examples from January 2025 include OKX (spot pair with specific listing times) and Binance.US (U.S. access); many traders also reference Coinbase and Bybit price pages. Availability may vary by region—always check your account’s support page. - If you prefer DEX:

Ensure you’re on Ethereum, select the verified TRUMP contract, set sensible slippage, and test with a tiny amount before scaling. (Again, verify via the CMC/CG contract link.) - Custody & safety basics:

Enable phishing-resistant 2FA on CEXs; for self-custody, use a hardware wallet and keep your seed phrase offline. Beware of look-alike sites and airdrop scams—navigate from CMC/CG to official links only. - Plan exits, not just entries.

Memecoin order books can gap. Consider scaling out in tranches and using limit orders instead of market sales during thin hours.

Conclusion

Will Trumpcoin rise—or crash? With Official TRUMP (TRUMP), price is where attention, access, and trust meet. When headlines and listings align, upside can overshoot fundamentals; when the spotlight fades, gravity reappears. The most useful Trumpcoin forecast isn’t a single target—it’s a process:

- Verify the ERC-20 contract and trade only the real TRUMP.

- Favor venues with deep TRUMP/USDT liquidity and tight spreads.

- Size positions conservatively, and treat TRUMP like the high-beta, narrative-led asset it is—because that’s how it trades in the real world.

Follow those rules, and you’ll navigate this market with far fewer surprises—no matter which way the next headline breaks.