During bull runs and hype cycles, fraudulent giveaways surge and try to piggyback on excitement. In simple terms, crypto airdrop frauds impersonate legitimate token distributions to trick users into signing malicious transactions or sharing sensitive data. If you’re rotating positions while researching new tokens, you can rebalance quickly via exchange ETH to BTC — but first, let’s break down why airdrop frauds work and how to identify fake airdrops before you click anything risky.

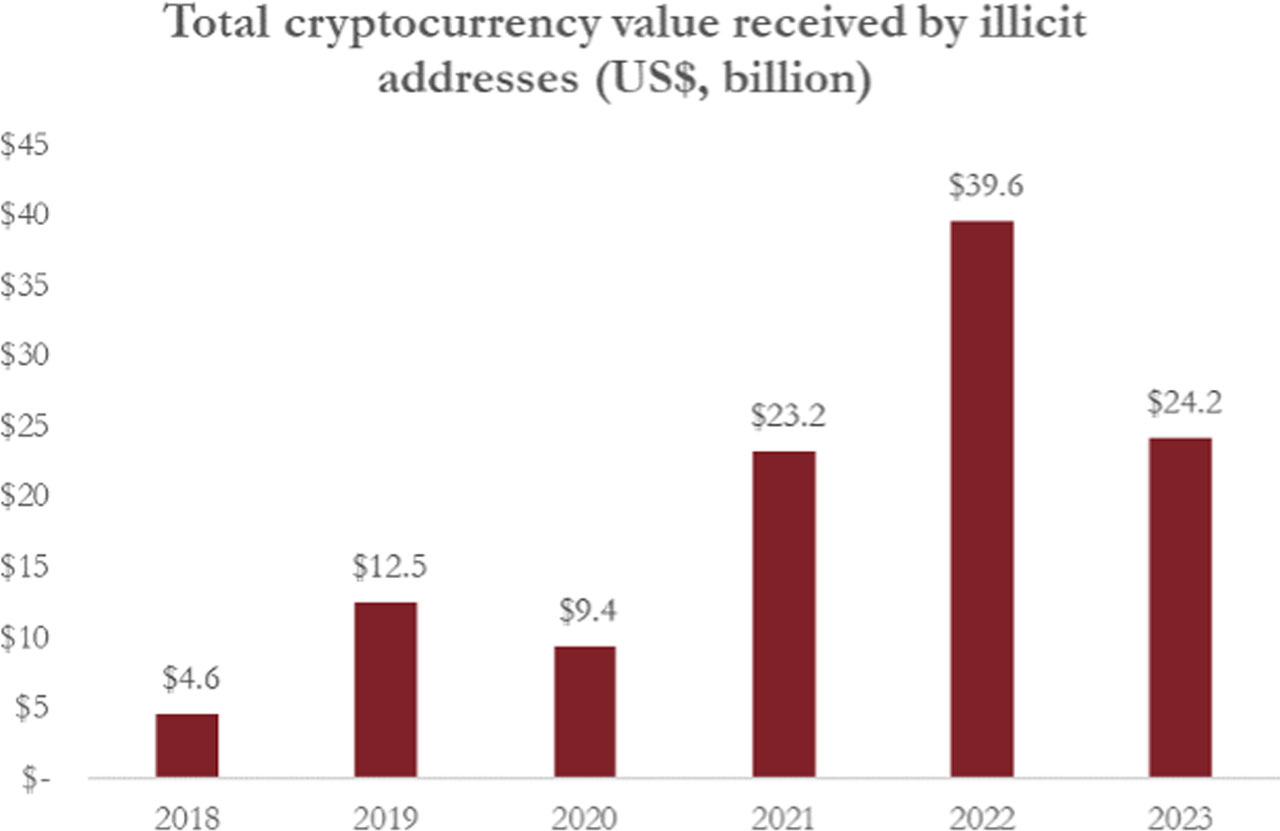

Illicit crypto inflows peaked in 2022, fell in 2023. Source: Global Investigations Review

Airdrop basics and where scams sneak in

Legitimate airdrops distribute tokens to grow a project’s community or reward early adopters. Scammers copy the surface (branding, countdowns, social posts) but change the substance: they aim to drain wallets or harvest credentials. Because the flow resembles authentic campaigns, it’s easy to mistake an airdrop scam for the real thing — especially when everyone’s talking about it.

Typical mechanics of a scam airdrop:

- You connect a wallet to “claim,” then sign an unlimited approval that lets a drainer move assets.

- A fake portal requests a “permit” signature that grants spend rights without a clear on-chain approval you recognize.

- Phishing pages collect seed phrases under the guise of KYC or whitelist sign-ups.

Key red flags of airdrop crypto scams

Before we list the big warnings, remember: real projects make verification easy. They link from official websites and verified socials, publish docs, and avoid pressure tactics. With that in mind, here are the clues that often expose an airdrop scam crypto:

- Requests for seed phrases or private keys. No legitimate promo needs them, ever.

- Forced unlimited approvals. Prompts for “approve all” or “setApprovalForAll” on multiple tokens.

- Upfront fees to “unlock” rewards. Gas is normal; activation fees aren’t.

- Impersonation via look-alike domains. One character off from the official URL, or cloned UIs.

- Extreme urgency or expiring countdowns. Pressure to skip due diligence.

- No verifiable team, docs, or repo. New accounts, zero commits, vague whitepapers.

- Unsolicited DMs. Real teams don’t drop links in your inbox.

How to identify fake airdrops (a quick checklist)

The fastest way to reduce risk is to stack several small checks. Use the list below whenever you encounter airdrop frauds crypto bait or suspect a crypto airdrop scam.

- Verify the source yourself. Navigate from the project’s official website or verified X bio — not from comments.

- Use a burner wallet. Keep near-zero funds in the wallet you connect to untrusted sites.

- Read what you sign. If you don’t understand the function call, don’t approve it.

- Simulate transactions. Review “approval” or “permit” details before confirming.

- Search for community warnings. Fresh reports often surface within hours.

- Pause for five minutes. Urgency is a tool to bypass your judgment.

- Never share seed phrases. Not for KYC, not for support — never.

Legit vs. crypto airdrop scam: a side-by-side look

Before diving into new opportunities, it helps to contrast expectations. The table below highlights differences you can scan in seconds.

| Signal | Likely Legit | Likely Scam |

| Source | Linked from official site + verified socials | DMs, comments, copycat domains |

| Permissions | Minimal, scoped approvals | Unlimited approvals / multiple signatures |

| Fees | Network gas only | “Unlock” or “activation” fee |

| Transparency | Docs, GitHub, audits, known team | No docs, no repo, brand-new socials |

| Timing | Reasonable claim window | Countdown pressure, FOMO tactics |

| Support | Public channels, responsive team | Vague, evasive, or none |

Safe setup before you touch any drop

Preparation drastically lowers the blast radius if something goes wrong. A few up-front habits make airdrop scams crypto far less dangerous to your holdings. Also, when hype spikes, check fundamentals like price and liquidity before interacting — for example, review the Bitcoin price today to gauge broader market context.

- Harden your main wallet. Prefer hardware wallets and strong PINs.

- Create a dedicated burner. Use it exclusively for unknown airdrops.

- Segment funds. Keep long-term holdings away from “test” activity.

- Revoke old approvals regularly. Clean up allowances you no longer need.

- Update everything. Wallets, extensions, and OS security patches.

The most common airdrop scams you’ll see

Recognizing patterns helps you defuse them quickly. The following formats account for most airdrop crypto frauds encountered by users:

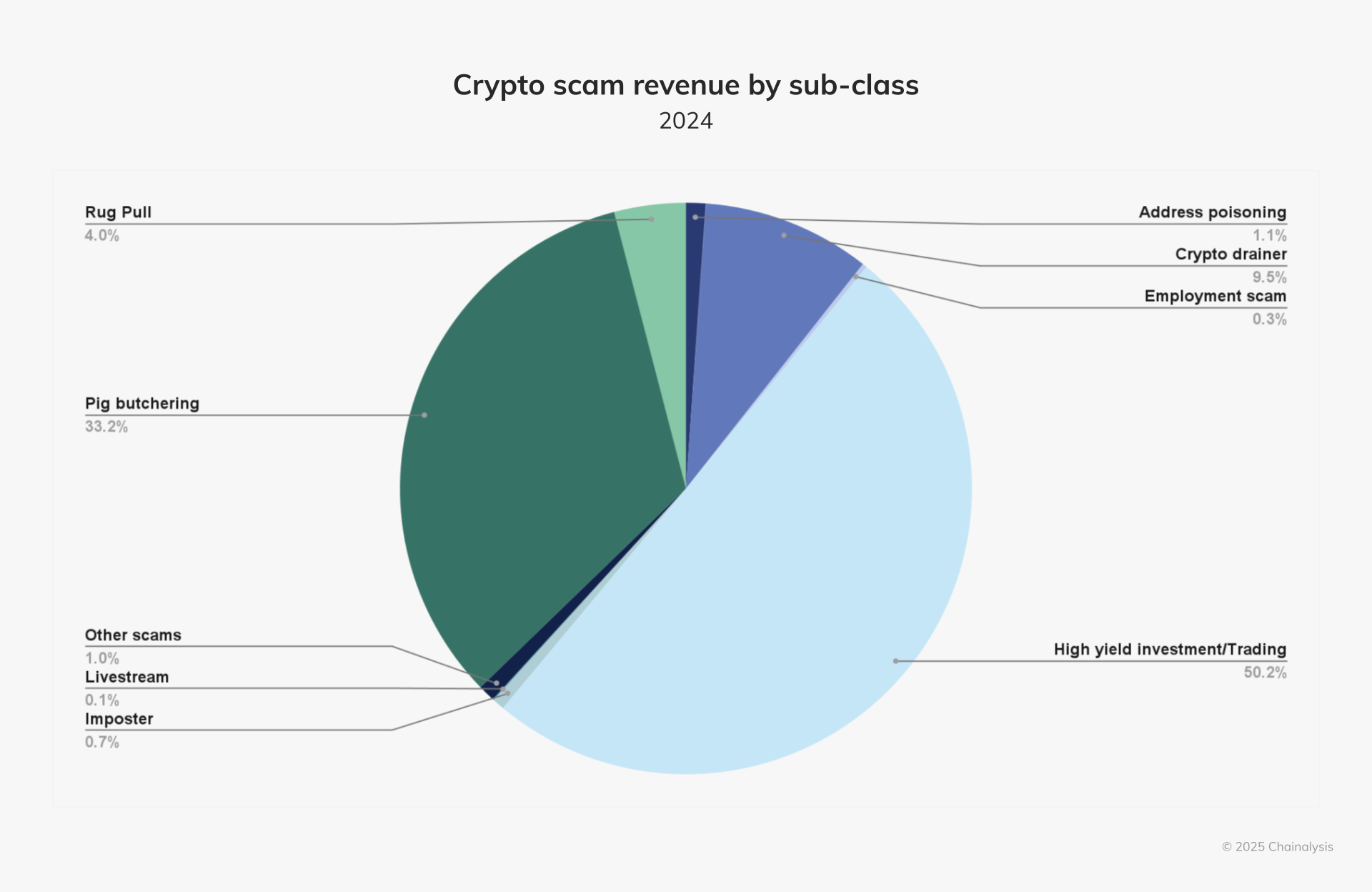

2024 crypto scam revenue by type, high-yield investment dominates. Source: Chainalysis

- Approval drainers: “Claim” flows that sneak in unlimited spend.

- Permit-based drains: Off-chain signatures that still grant spend rights.

- Pixel-perfect clones: Fake claim portals that mirror real branding but route to malicious contracts.

- Whitelist phishing: Forms that capture personal data, and sometimes trick you for seeds.

- Bridge bait: Prompts to bridge to a new chain via a malicious endpoint.

For broader context on timing and trends around drops, see the blog piece: “Crypto airdrops in 2025: all you need to know”.

What to do if you already clicked

Mistakes happen. The goal is to minimize damage quickly and stop any ongoing drain. Follow a focused response plan and then reassess your operational security.

- Disconnect the site in your wallet UI (note: this doesn’t revoke approvals).

- Revoke suspicious allowances with an allowance manager or block explorer.

- Move remaining assets to a clean wallet immediately.

- Rotate keys if you suspect seed exposure.

- Warn others in public channels to prevent more losses.

Practical defenses against airdrop scam attempts

Think of these as “always-on” policies. They reduce the odds you’ll fall for an airdrop crypto scam or similar social-engineering play.

- Default to skepticism. Assume unknown links are hostile until proven safe.

- Bookmarks allowlisted domains. Navigate from your own bookmarks.

- Limit approvals. Prefer token-specific, minimal spend limits.

- Keep records. Save tx hashes and notes; they help if you need to unwind approvals.

- Educate your circle. Shared checklists raise everyone’s security baseline.

FAQ

What exactly is a crypto airdrop scam?

A fraudulent campaign that mimics giveaways to steal funds — usually via malicious approvals, permit signatures, or phishing.

Are gas fees always a red flag?

No. Paying network gas can be normal. Upfront “unlock” or “activation” fees are the red flag.

Can I use my main wallet?

Best practice is a burner wallet with minimal funds to isolate risk from airdrop frauds crypto.

Conclusion

Crypto airdrop scams thrive on urgency, impersonation, and confusing signatures. You can avoid most traps by verifying sources yourself, using a burner wallet, reading every transaction, and revoking unnecessary approvals regularly. Spread your defenses across habits (bookmarks, segmentation, updates) and tools (hardware wallets, allowance reviews). When in doubt, step back, confirm authenticity, and only then proceed — your caution is worth more than any promised “free” tokens.