If you’ve watched Solana’s memecoin scene, you know BONK is the crowd favorite: volatile, liquid, and highly narrative-driven. BONK prices whip around on sentiment, listings, and Solana-wide risk appetite—so anchoring your BONK price forecast to data is the only sane way to play it. Below, you’ll find: where BONK trades today, what’s historically moved the chart, short- and long-term outlooks, and what others actually predict, with links to their methodologies so you can vet the numbers yourself.

Where BONK Stands Today: Price & Market Snapshot

Source: Coinmarketcap

As of October 14, 2025, BONK changes hands around $0.000015 with deep daily turnover. CoinMarketCap and CoinCodex both show price and supply in real time; CoinDesk’s market desk has tracked recent swings between the $0.000024–0.000027 area earlier this quarter and the latest pullbacks. For a live reading, check: CoinMarketCap’s BONK page and CoinDesk’s BONK market coverage.

BONK trades thick enough to attract short-term traders, but its beta (sensitivity to risk-on/risk-off moves) is high. That’s great for momentum, tricky for hands-off investors.

A Quick Look in the Rearview: BONK Price Trends

BONK price trends have mirrored Solana’s cycles:

- Risk-on bursts (new listings, ecosystem catalysts) send flows into BONK and other SOL-native memes. CoinDesk recorded several fast pops and fades in August–September 2025, the classic memecoin rhythm.

- Range compression, then expansion. BONK often coils on declining volatility before a narrative spark—then ranges expand quickly, rewarding early entries and punishing chasers.

- Mean reversion. After spikes, price tends to retest recently built supports; CoinDesk’s August note flagged $0.000024 as a level traders were watching.

The big lesson: timing and risk controls matter more than grand theories.

What Actually Drives the BONK Chart

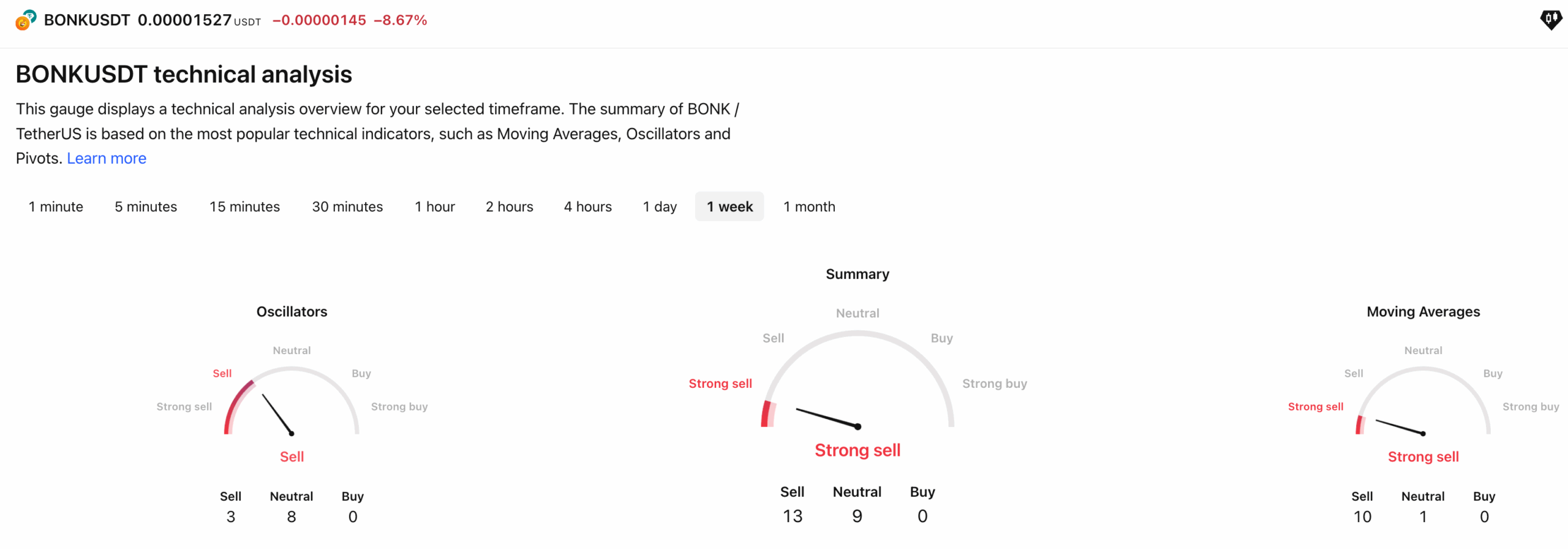

Source: TradingView

1) Solana liquidity (macro within the ecosystem). When SOL rallies and DeFi activity revs up, memes benefit from spillover demand. BONK, with strong brand recognition and exchange depth, is the first port of call.

2) Listings, venues, and derivatives. New markets or pairs concentrate liquidity and tighten spreads, improving the trade experience. Even headline-light weeks can move prices if market structure improves.

3) Social & community catalysts. Memes live on attention. Coordinated campaigns, burns, or integrations can create “reason to buy now” moments even absent deep fundamentals.

4) Rotation across chains. Capital swings between Solana, Ethereum, and BNB meme ecosystems. BONK’s relative performance is partly a function of where the crowd is playing this month.

What Experts Predict

Reputable outlets rarely publish hard targets; most “predictions” come from model-driven sites or education portals. Treat these as informational, not guarantees:

- Benzinga (aggregation of algorithmic projections): suggests BONK could reach ~$0.000045 by 2030 on a long-run basis. The page also shows shorter-dated views and methodology notes.

- CoinCodex (model-based): frames 2025 in a ~$0.000011–$0.000016 band, with a 2030 high-end around ~$0.000033 in its long-term table. The site updates near-term weekly ranges, too.

- Changelly (editorial + model blend): for October 2025, it shows a $0.000016–$0.000025 window and similar month-ahead bands. Good for “sentiment snapshot” context.

- DigitalCoinPrice (long-horizon model): puts 2030 around ~$0.000072–$0.000083 in its base view—more optimistic than others; check their historical hit rate before relying on it.

- 99Bitcoins (education site with compiled outlooks): curates a narrative forecast for 2025–2030 and links to sources/methods; useful as a summary of expectations, not an institutional target.

Short-Term BONK Forecast (2025–2026)

Base case (choppy uptrend): If Solana activity holds and liquidity spreads improve, a $0.000012–$0.000028 corridor looks sensible into 2026—rallies toward the top of the band fading into profit-taking unless a major catalyst appears. This aligns with model ranges from CoinCodex (conservative) and Changelly’s monthly windows (more elastic).

Bull case (rotation + listings): If SOL leadership persists, market-maker depth thickens, and BONK grabs new venues or integrations, a push into the $0.00003–$0.00005 zone is plausible on momentum—consistent with the upper-bound spirit of Benzinga’s and DigitalCoinPrice’s long-run paths compressing forward.

Bear case (risk-off / rotation elsewhere): A broad crypto cooldown or a shift of meme flows back to Ethereum/BNB could revisit $0.000008–$0.000012 supports, roughly in line with lower bands on model sites.

Tripwires to watch: CoinDesk has flagged local supports/resistances during recent swings (e.g., $0.000024–0.000027topside rejections in August–September). A clean reclaim with volume often precedes trend legs; repeated failures raise the odds of retests.

Long-Term BONK Outlook (2027–2030)

It’s healthier to think in scenarios, not single numbers:

- Base (network keeps compounding): BONK tracks Solana usage growth and remains the “index meme” for the chain. A gradual drift higher with sharp pullbacks is likely; long-run model clusters sit roughly between ~$0.00003–$0.00008 by 2030, per CoinCodex/DigitalCoinPrice/Benzinga pages.

- Bull (breakout meme beta): If Solana seizes a larger share of retail flows, BONK secures more exchange rails/derivatives, and brand stickiness persists, an overshoot beyond ~$0.00008 isn’t crazy during peak risk-on—though sustaining it is another story.

- Bear (narrative fatigue): If meme rotation favors other chains or community energy wanes, BONK could range or decay below today’s levels for stretches, with rallies sold.

Remember: memecoins monetize attention. Sustained upside needs persistent activity on Solana, not just one-off buzz.

How to Read Price Predictions Without Getting Burned

- Check methodology. CoinCodex and DigitalCoinPrice disclose the models behind the numbers; treat them as statistical baselines, not insight into tomorrow’s headlines.

- Watch structure, not just price. CoinDesk’s daily notes help you see where traders are leaning (support/resistance, failed breakouts). Use that to time entries around your conviction.

- Context matters. CoinMarketCap gives circulating supply and market cap; outsized “targets” often ignore how big BONK would need to be to hit them.

Will BONK Rise from Here?

It can, but the drivers are external: Solana-wide risk appetite, exchange rails, and attention cycles. If SOL keeps leading and the memecoin bid remains hot on Solana, BONK usually enjoys a premium. If flows rotate, BONK cools off quickly. This is why many traders treat BONK as a momentum sleeve rather than a passive long-term hold.

Final Words

Here’s the short version of a BONK price prediction:

- Near term (2025–2026): range-bound chop with upside bursts—~$0.000012–$0.000028 as the “normal” zone, ~$0.00003–$0.00005 on strong Solana momentum or venue wins, and sub-$0.000012 on risk-off tape.

- Longer run (2027–2030): outcome hinges on Solana’s growth + BONK’s brand durability. If both persist, model clusters around ~$0.00003–$0.00008 by 2030 make sense; if attention rotates away, expect grinding ranges with episodic spikes.

If you choose to trade it, keep it simple: size small, respect your stops, and let Solana’s activity—not social FOMO—drive your decisions. And if you want a number to tape to your screen, make it a level, not a price target. Levels help you act; targets tempt you to hope.