If you’re searching for a balanced Solana forecast grounded in current data and credible analyst views, you’re in the right place. Below, we cover the live market picture, Solana price trends, what truly moves SOL, and a SOL crypto forecast from 2025 to 2030—plus straightforward steps for buying or swapping Solana.

Solana (SOL) Today: Current Price and Market Data

Source: Coinmarketcap

As of September 12, 2025, Solana (SOL) trades around $238 with a market capitalization near $129B and sits among the top five crypto assets by market cap. CoinMarketCap and CoinGecko both show strong 24-hour volume and a circulating supply around 540–542 million SOL.

Historical Price Trends of Solana

SOL’s journey has been volatile and fast-moving. After its breakout cycle in 2021—when the asset’s price pressed close to $259–$260 all-time highs—Solana retraced in the 2022 bear market, then staged a powerful recovery through 2024–2025. Recent history also shows SOL approaching the prior peak during late-2024 rallies before consolidating again in 2025.

On-chain activity has accelerated: Total Value Locked (TVL) on Solana reached record highs above $12B in September 2025, reflecting rising DeFi and staking engagement across protocols. Higher TVL is not a guarantee of price appreciation, but it often correlates with healthier network demand.

Key Drivers That Impact Solana Price

Technology & Use Cases

Solana’s performance narrative continues to center on high throughput and low fees, with stress tests showing 100k+ TPS peaks (largely synthetic “noop” transactions) and ongoing work to improve real-world throughput. A critical milestone is Firedancer, a next-gen validator client by Jump Crypto designed to increase speed, resilience, and client diversity—key to long-term scalability.

Beyond raw speed, payments and stablecoins are an expanding use case. Visa publicly integrated USDC settlement on Solana and continues to broaden stablecoin support—evidence that mainstream payment rails are experimenting with Solana’s capacity.

Adoption & Demand

On-chain dashboards and independent trackers show robust activity—ranging from DEX volumes to monthly active addresses—reinforced by the TVL highs noted above. Institutional access is also improving via CME-listed Solana futures launched in March 2025, a building block for hedging and, potentially, future ETP/ETF approvals.

Regulations & Market Trends

In the U.S., Solana spot ETF proposals have advanced through multiple amendments, though the SEC recently delayed Franklin Templeton’s SOL ETF decision to November 14, 2025. Futures availability at CME can help regulators assess market integrity, but spot approvals may still take time. Macro conditions (rates, liquidity) and Bitcoin cycles also shape SOL beta.

Short-Term Solana Forecast (2025–2026)

- Finder’s expert panel (April 2025) projects $331 for SOL by year-end 2025, signaling cautious optimism relative to current levels. Near-term technical commentary from reputable desks often highlights the $200–$250 zone as pivotal for trend continuation, in line with the asset’s 2025 range.

- Aggregated market coverage suggests some analysts, such as Yahoo Finance see $1,042 by 2030 (longer-term), implying a bias to the upside from today’s price path if adoption persists; while this figure is not a 2025–2026 target, it frames the multi-year narrative influencing near-term positioning.

Bottom line (2025–2026): Expect elevated volatility inside a broad range, with catalysts including ETF headlines, Firedancer progress, and continued TVL/active-address growth. A convincing break above the old ATH typically requires sustained liquidity inflows and positive macro risk appetite.

Long-Term Solana Forecast (2027–2030)

Serious long-horizon Solana future prediction frameworks come from institutional research:

- VanEck models a 2030 price range: bear $9.81 → base ~$335 → bull ~$3,211, depending on market-share capture across DeFi, payments, consumer apps, and broader crypto activity. The dispersion is wide, but it’s one of the more transparent, assumption-driven frameworks from a major asset manager.

- Finder’s expert panel estimates ~$892 by 2030, reflecting a moderated consensus view compared with the most bullish sell-side scenarios.

These outlooks underscore a key point for any Solana outlook: long-term returns hinge on execution (client diversity like Firedancer, network reliability), regulatory clarity (ETFs/ETPs), and real utility (payments, DeFi, gaming, tokenized assets).

Expert Opinions on Solana Price

- VanEck Research: Multi-scenario valuation with explicit revenue share assumptions, offering base, bear, and bull cases through 2030 (see above).

- Finder Panel: Aggregates inputs from academics, analysts, and founders to produce quarterly targets (e.g., $331 end-2025; $892 in 2030).

- Market Roundups: Mainstream financial outlets (e.g., Yahoo Finance) have relayed analyst round-ups pointing to four-digit SOL in 2030 in aggressive adoption scenarios—useful as a sentiment gauge, not a guarantee.

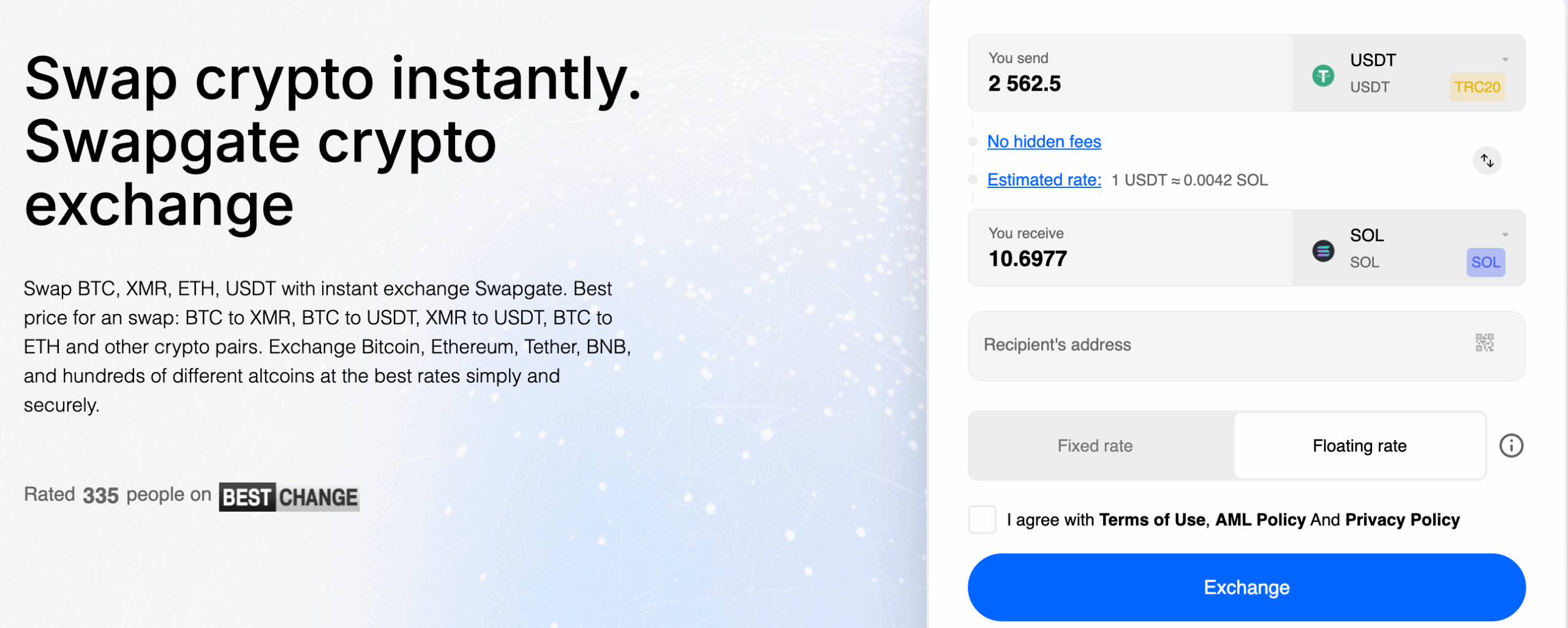

How to Buy or Swap Solana Easily

If you’re new to SOL, there are two simple routes:

- Centralized exchanges (CEXs).

- Major regulated platforms (e.g., Swapgate) offer crypto swaps in a few steps, where you paste your destination wallet address and receive the desired cryptocurrency.

- Self-custody + on-chain swaps.

- The Phantom wallet (Solana’s most popular self-custody wallet) lets you buy, bridge, or swap assets in-app and connect to DeFi protocols. For best prices, the wallet integrates with Jupiter, Solana’s leading DEX aggregator. This route gives you full control over your keys—along with the responsibility to manage them securely.

Quick steps (CEX):

- Create and verify an account, deposit fiat (or use card/PayPal where supported), search “Solana (SOL)”, and place a market or limit buy. Review the fee preview before confirming.

Quick steps (self-custody):

- Install Phantom, back up your seed phrase offline, fund with SOL, and use the in-wallet Swap (Jupiter) to trade tokens. Advanced users can interface with Jupiter’s APIs or aggregators for best-route quotes.

Tip: For staking yield, self-custody is typically required (U.S. spot ETH/BTC ETFs don’t stake; SOL ETPs with staking exist in Europe). If you choose staking, learn how validator selection and lockups work.

Conclusion: What’s Next for Solana?

Will Solana rise? The Solana price trends—from new TVL highs to robust address activity—support a constructive Solana outlook, provided execution continues. In the short run (2025–2026), expert targets cluster around the low-to-mid $300s in optimistic cases (Finder), while the long run (2027–2030) spans a broad spectrum: ~$892 median (Finder) to $3,211 bull (VanEck), depending on adoption, regulation, and network reliability.