If you’ve ever watched a Solana memecoin 10× and thought “I saw the buzz yesterday,” this guide is for you. The trick isn’t magical alpha—it’s a repeatable routine: scan new listings, listen to social chatter, verify on-chain basics, and act only when your checklist is green. Below is a practical, friendly playbook for how to find memecoins early, with credible tools and references. We’ll also stress what most threads skip: how to not get rugged.

Understanding the Basics of Memecoins

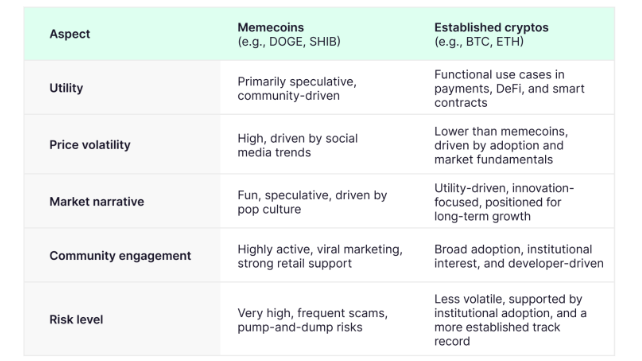

Source: Coinpaper

Memecoins are internet-native assets that trade more on attention than discounted cash flows. They often start as low market cap memecoins, migrate from DEX to CEX, and live or die by community energy. Early wins come from recognizing momentum + legitimacy before the crowd. That means you need (a) a way to see upcoming memecoins the moment they launch, (b) a way to gauge community traction, and (c) quick on-chain due diligence to avoid traps. Read our guide on how to create your own memecoin.

Tools for Searching and Analysis

Basic Screeners and Trackers

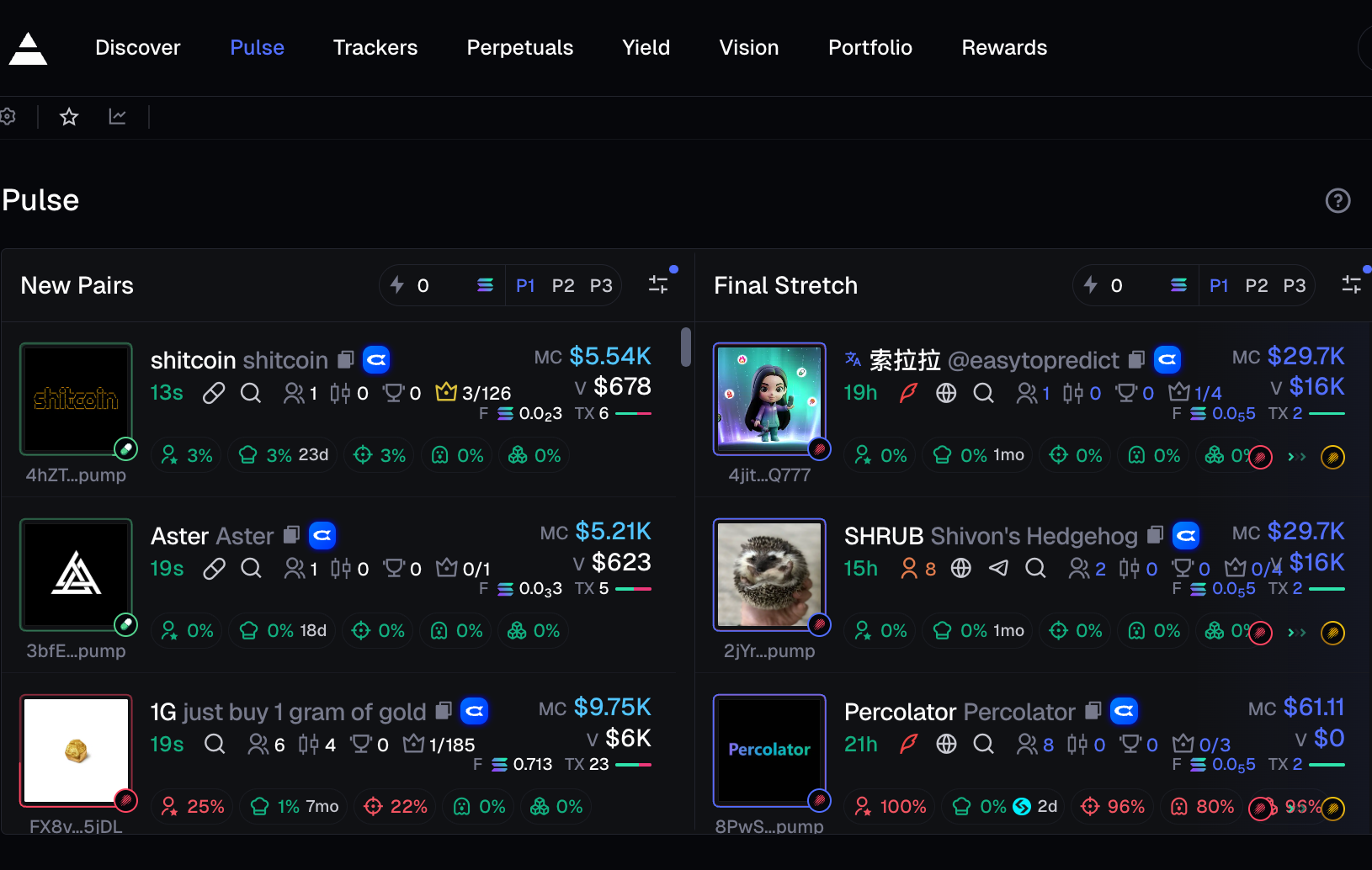

Source: Axiom

- DexScreener and Axiom show real-time DEX pairs and a dedicated New Pairs feed so you can spot fresh launches minutes after liquidity appears. Use it to sort by chain, volume, and age to find trending memecoins at birth.

- DEXTools aggregates pair explorers, charts, and token info across DeFi—handy when you want fast candles, basic liquidity checks, and quick links to contract pages.

- CoinMarketCap keeps Recently Added and Upcoming sections—a quick way to find new memecoins today and monitor which ones graduate from microcaps to exchanges with deeper books.

- CoinGecko highlights Trending searches and New Crypto lists. It also exposes “Highlights” and category views, great for narrative hunting.

Social and News Aggregators

- On X (Twitter), use Advanced Search to filter by hashtags (#memecoin, #airdrop, #degens), language, or date ranges to catch projects before they’re everywhere.

- Telegram is where many communities live. Remember bots are third-party services with separate terms—use caution. Security researchers have also warned that Telegram bot traffic uses standard HTTPS (not MTProto end-to-end), so avoid oversharing in bot chats.

Technical Analysis

- TradingView supports alerts on prices, indicators, and drawing objects—use it to get pinged when your level breaks instead of doomscrolling.

- Dune Analytics lets you build on-chain dashboards and set query alerts (e.g., “new holders > 200 in 1h” or “LP added > $50k”). This is a powerful way to automate “early signal” monitoring.

Tactics for Spotting Early Gems

Community Analysis

You’re buying energy as much as a ticker. Check:

- Consistency vs. spikes: Are posts and engagement steady or just a one-day raid? Use X’s advanced filters to examine account age, tweet frequency, and who’s amplifying.

- Real builders: Is the Telegram pinned message a roadmap or just memes? Who are the moderators? Are there meaningful updates or only price talk? (Remember bots are third-party; be conservative with personal info.)

- External validation: Has the project been listed on CMC/CG (even as “recently added”)? Early inclusion doesn’t guarantee safety, but it raises the bar for outright fakes.

On-Chain Metrics

A few fast checks can filter 80% of landmines:

- Contract verification: On Etherscan, verified code boosts transparency, and ownership status (renounced or not) is visible. Verification is a prerequisite for owners to update token info; it also lets the public read the code.

- Liquidity health: How much LP is added? Is it locked (and where)? Rug pulls often hinge on removable liquidity or mint functions.

- Holder distribution: Are a few wallets sitting on 40%+ of supply? Sudden top-holder inflows to CEX/DEX are exit-liquidity alarms.

- Mint/blacklist controls: Scan contract functions for unrestricted minting, blacklist, or high tax modules. (If unsure, assume the worst.)

Early Signals

- Fresh liquidity + organic volume: DexScreener’s and Axiom’s New Pairs plus abnormal 5- to 15-minute volumes is the classic early gem combo. Watch for non-bot-like trades across multiple wallets.

- Trending lists and categories: If a token appears in CoinGecko Trending or CMC Recently Added, interest is rising. Pair that with category dashboards to surf narratives (AI, SocialFi, dog-coin rotations).

- Event catalysts: Ship dates, CEX listings, or game/airdrop milestones. CoinMarketCal centralizes these across projects—use it to avoid buying 5 minutes before a “sell-the-news.”

- Data-driven alerts: Automate rules on Dune (holders, LP adds) and TradingView (price/volume levels) to get notified rather than chase.

Risks and Best Practices

- Rug pulls & liquidity drains: This is the #1 memecoin risk. Red flags include unaudited code, upgradable proxies with god-mode permissions, unlocked LP, and anonymous teams promising “CEX tomorrow.”

- Scams rising with hype: Independent reporting shows crypto scams surged in 2024, helped by AI and social engineering. In hype cycles, fake presales and impostor accounts spike—double-check handles, domains, and contracts.

- Telegram bot caution: Bots are third-party services under separate terms. Some investigations warn bot traffic lacks Telegram’s end-to-end encryption—don’t share keys or sensitive data, and don’t click random “claim” links.

- Position sizing & exits: Microcaps can move 30–50% in minutes. Size positions small, scale in/out, and prefer limit orders on thin books.

- Recordkeeping: Keep a short pre-trade checklist (contract verified, LP locked, top-holder distribution, social health, alert conditions). If one item is red, skip it.

- Narratives fade: Trending memecoins rotate weekly. Lock in process, not predictions.

Conclusion

There’s no secret Discord where every upcoming memecoin is whispered. The edge comes from a consistent, boring routine:

- Find new launches fast (DexScreener New Pairs, DEXTools explorers).

- Gauge attention (X advanced search, Telegram community health).

- Verify on-chain (Etherscan verification, LP lock, holder distribution).

- Track catalysts (CoinMarketCal, CMC/CG trending & categories).

- Automate alerts (TradingView for price; Dune for on-chain).

- Respect risk (scam surge context; bot caution; small sizing).

Do that, and you’ll stop chasing and start arriving early—not by guessing which low market cap memecoins moon next, but by letting the right tools and tactics surface credible candidates while you protect your downside.