Every self-respecting member of the crypto community knows that Bitcoin’s supply is capped — only 21 million BTC will ever be mined, not a coin more. But how many Bitcoins are actually available, and how much Bitcoin is in circulation right now? In reality, things aren’t quite as investors imagine. While Bitcoin is famous for its limited supply, Bitcoin scarcity is increasing for reasons that have nothing to do with mining itself. Understanding who controls Bitcoin supply — and why there won’t be 21 million BTC — is vital for anyone trying to grasp the asset’s long-term dynamics.

Here’s why the “21 million Bitcoins” idea is a myth you shouldn’t believe, and how many BTC will actually reach the market.

What’s wrong with Bitcoin’s Issuance

Technically, Bitcoin is code. It does hard-code a maximum issuance of 21 million coins, but that amount of BTC will never circulate, making the real Bitcoin limited supply smaller than most people think.

1. Lost coins and inactive Bitcoins

Unfortunately, some investors have been unlucky — they lost access to their cryptocurrency. Some forgot their passwords; others misplaced the recovery information for their cold wallets. These lost Bitcoins sit forever in addresses that no one can unlock; BTC cannot be recovered from them. Analysts periodically try to estimate how many coins are lost and how many of them are held in cold wallets that may never move again.

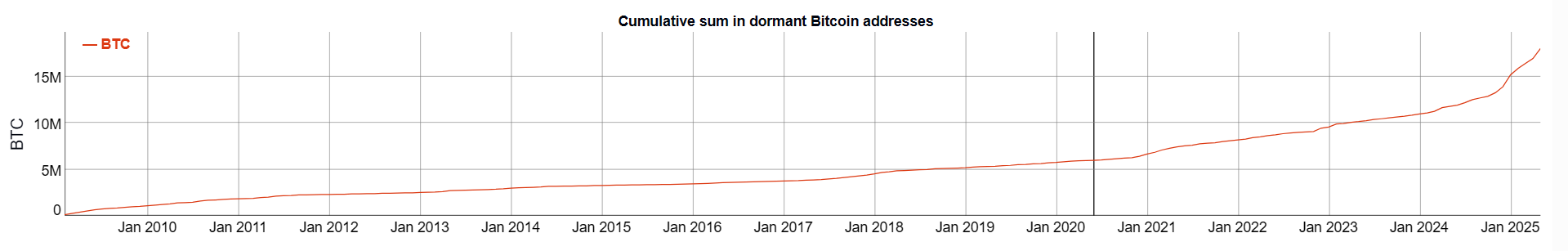

It’s impossible to determine exactly how many Bitcoins are lost, yet we can assess the pool of inactive Bitcoins by looking at coins that haven’t moved for years. For example, here’s a chart showing the number of BTC that haven’t been transferred for five years:

Bitcoins unmoved for five years. Source: bitinfocharts

The five-year-dormant metric began to rise sharply at the end of 2024. At the time of writing, it stands at 18.04 million. Miners have already extracted 19.8 million coins. That means 91% of all mined BTC have been motionless for five years — held by long-term Bitcoin holders or simply lost. How many Bitcoins are gone forever remains an open question, but the share is clearly large.

2. Owners who are no longer with us

Sadly, death can also immobilize coins. Sometimes the stories are particularly tragic. In 2019, for example, Quadriga CX exchange founder Gerald Cotten died, taking $137 million in crypto to the grave. No one but Cotten knew the password to his work computer. As a result, those Bitcoins are lost, and investors learned the hard way that Bitcoin cannot be recovered once the keys are gone.

3. Blocked coins, burns, and whale concentration

The crypto community has repeatedly recorded deliberate acts of relinquishing control over coins. Some enthusiasts have sent their Bitcoins to wallets belonging to Bitcoin’s creator, Satoshi Nakamoto — effectively performing a form of Bitcoin burn by choice. Recall that the developer vanished from the internet in 2011, and nothing has been known of his whereabouts since. Many believe Satoshi has died, a theory supported by the absence of any activity in his wallets.

Large unspent balances in a handful of addresses also highlight Bitcoin concentration among whales, a point often raised in debates over Bitcoin centralization and who truly controls Bitcoin supply.

Interesting! In 2025, the value of the Bitcoins in Satoshi Nakamoto’s wallets briefly pushed him past Microsoft founder Bill Gates in the ranking of the world’s richest people.

4. Intentional errors and Bitcoin empty blocks

In June 2025, community member Billy Boone pointed out that miners don’t always receive a reward for every block they mine. Empty blocks, he argues, subtly change the emission curve and illustrate again why there won’t be 21 million BTC.

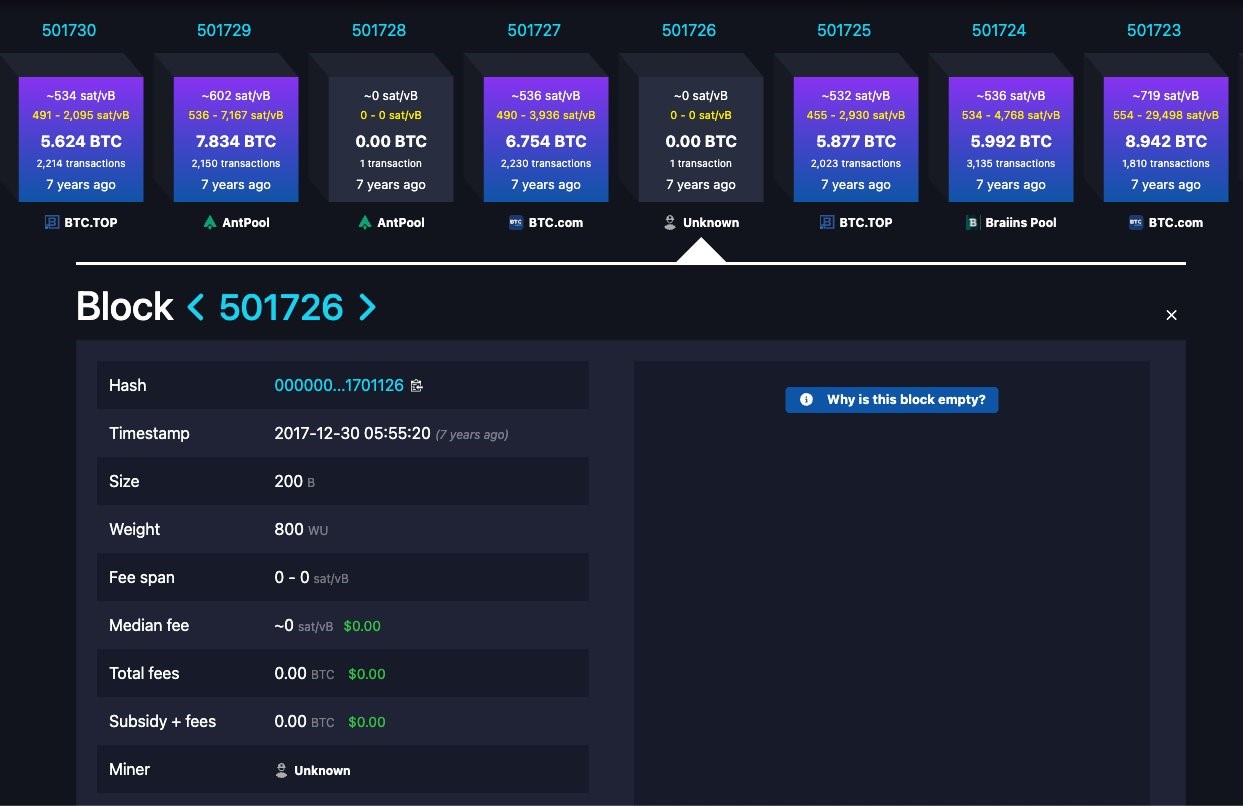

An empty block in the Bitcoin network. Source: x.com/BillyBoone

Boone highlighted block #501 726, mined on 30 December 2017. Here’s what happened:

- The miner who processed the block included no output entries in the transaction;

• The block remained valid;

• Consequently, 12.5 BTC (the block reward at the time) were simply never created — they weren’t burned; they never appeared at all.

Possible causes include:

- A bug in the pool’s software;

- Human error while configuring the block template.

Because of such Bitcoin empty blocks, total issuance will be lower than 21 million. No one knows how many similar blocks have occurred throughout the network’s history.

A new level of scarcity

Bitcoin maximalists often stress that the cryptocurrency’s fixed supply is its greatest asset. Unlike, say, U.S. dollars, no new BTC beyond the limit can be printed, reinforcing the idea of Bitcoin limited supply. Yet practical realities mean the ceiling is even lower than code suggests, so Bitcoin scarcity is increasing faster than many realize.

For investors, the fact that the market will never see 21 million coins — and may have far fewer due to lost Bitcoins, inactive addresses, — is a powerful signal that BTC is already scarce and that further price growth remains possible.

Recall that the Swapgate editorial team previously published a price forecast for five popular cryptocurrencies in 2025, including Bitcoin.