Paxos Trust Company, the crypto infrastructure firm behind PayPal’s PYUSD and the Pax Dollar, has reinitiated its pursuit of a national trust bank charter in the United States, signaling another step toward federal oversight. The company is seeking to convert its existing New York state-issued trust charter into one granted by the Office of the Comptroller of the Currency (OCC), a move that would elevate its jurisdictional status and institutional credibility.

Why This Matters?

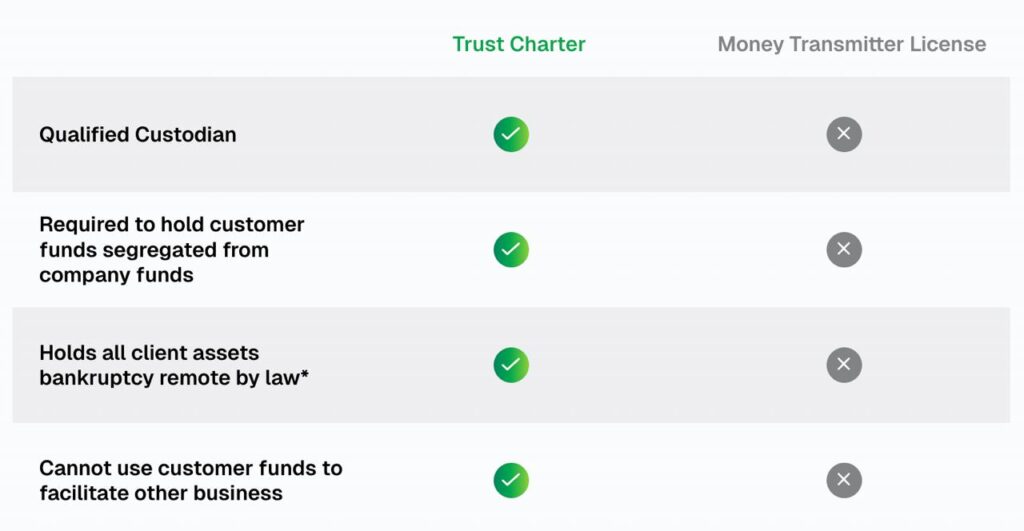

A federal trust bank license would allow Paxos to custody customer assets and settle payments nationwide under the watchful eye of the OCC. Though it would not permit the company to accept deposits or issue loans like traditional banks, proponents argue this charter provides a stronger regulatory foundation and greater confidence for institutional partners.

CEO Charles Cascarilla put it plainly: “OCC oversight will help build on our historic commitment to maintaining the highest standards of safety and transparency”.

A Second Attempt After the Clock Ran Out

This isn’t Paxos’s first shot. In 2020, they applied for the charter and received conditional approval in April 2021, allowing the company time to meet compliance, capital, and operational requirements. But because they didn’t fully meet launch conditions within 18 months, the approval expired in March 2023. Since then, they’ve continued operating under their original 2015 trust charter from the New York Department of Financial Services.

Fresh Push Against a Shifting Regulatory Backdrop

Paxos’s renewed application arrives at a pivotal moment. The recent passage of the GENIUS Act, which lays the groundwork for a federal stablecoin framework, has energized the industry. Paxos, along with peers like Circle and Ripple, now joins a growing list of stablecoin issuers seeking OCC charters. Anchorage Digital remains the only crypto firm currently operating under such a license.

Cleaning Up, Moving Forward

Regulatory scrutiny likely contributed to Paxos missing its initial deadline. In early 2023, New York regulators ordered Paxos to cease issuing Binance USD on compliance grounds, prompting an end to that partnership. More recently, Paxos agreed to a $48.5 million settlement with the NYDFS for alleged lapses in anti-money laundering oversight—$26.5 million paid as fines and $22 million directed toward enhancing its compliance systems.

If approved, the OCC charter could significantly broaden Paxos’s institutional appeal—especially as stablecoins gain acceptance as mainstream financial tools, from everyday payments to asset transfers. As PayPal’s partner for PYUSD and a provider of blockchain infrastructure to firms like Mastercard, Paxos stands to gain from a robust regulatory framework.

Looking Ahead: Regulatory Certainty versus Business Complexity

Securing OCC approval would be a major win for Paxos but also a clear sign of the crypto industry’s shift toward institutional regulation. Yet challenges remain. The OCC will closely review their systems, especially around compliance and anti-money laundering. Even with the new stablecoin law in place, the industry watching remains cautious, recognizing that charters don’t easily come through without meeting exacting standards.

Still, Paxos’s renewed pursuit reveals a broader narrative: crypto infrastructure firms are ready to bridge with traditional finance—but on official, regulated terms.