August 7, 2025

~4 min read

The cryptocurrency sector has welcomed a significant development regarding the legal status of liquid staking tokens (LSTs) in the United States, as outlined in a recent study by the Proof of Stake Alliance (POSA), a nonprofit advocating for blockchain innovation. Released on February 22, 2023, the research argues that LSTs—tokens representing staked digital assets with added liquidity—should not be deemed securities, swaps, or taxable events under existing U.S. laws. This shift could reshape the regulatory landscape for decentralized finance (DeFi) and create new opportunities for platforms like SwapGate, an exchanger dedicated to seamless crypto swaps.

Background and Research Insights

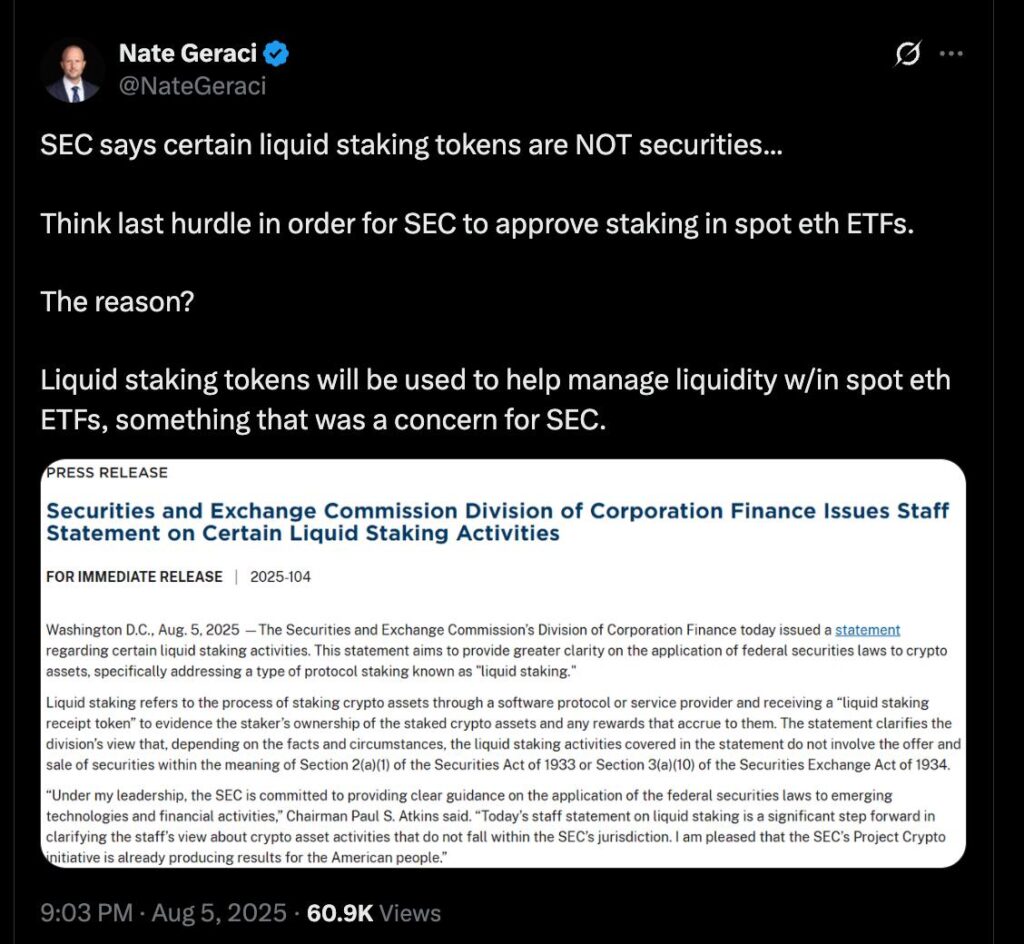

The POSA’s findings, detailed in two white papers, were crafted by experts from over a dozen blockchain projects, including Alluvial, Lido, and the legal firm Willkie Farr & Gallagher. The study challenges the traditional classification of LSTs as derivative instruments, asserting that their value stems directly from underlying staked assets rather than entrepreneurial efforts by third parties. This positions LSTs as digital commodities rather than securities, a distinction that could simplify compliance for DeFi protocols and staking platforms.This perspective aligns with more recent developments, as the U.S. Securities and Exchange Commission (SEC) has issued clarifications in 2025 suggesting that certain liquid staking activities may not fall under securities laws. These statements, while non-binding, indicate a potential softening of regulatory stances, offering a lifeline to crypto firms seeking operational clarity.

Implications for the Crypto Industry

The reclassification of LSTs as non-securities could unlock significant growth in the DeFi space, where liquid staking has become a cornerstone. With over $67 billion in total value locked (TVL) across blockchains, as noted in recent market analyses, the ability to use LSTs like stETH and rETH in trading, lending, and collateralization without securities oversight could drive adoption. This is particularly relevant for networks like Ethereum and Solana, where staking protocols such as Lido and Jito thrive. For exchangers, this regulatory clarity presents a chance to expand offerings, such as facilitating trades involving LSTs or providing liquidity pools that incorporate staking rewards.

The move could also pave the way for innovative financial products, including staking-enabled exchange-traded funds (ETFs), which have been under consideration by asset managers lobbying for Solana ETFs. However, the SEC’s guidance remains conditional, requiring providers to avoid managerial control or profit guarantees, a nuance that demands careful navigation.

Community and Market Reactions

The crypto community has responded with cautious optimism. Industry leaders, including representatives from Lido Labs, have hailed the SEC’s 2025 clarifications as a breakthrough, potentially encouraging institutional participation. The removal of legal ambiguity could attract centralized exchanges and fintech platforms, boosting liquidity and market confidence. Yet, the SEC’s internal debates and the non-binding nature of these statements suggest that future adjustments are possible, keeping the sector on edge.For SwapGate, staying attuned to these shifts is vital. The platform could leverage this momentum to educate users about liquid staking benefits, such as earning yields while maintaining asset flexibility, thereby strengthening its position in a competitive market. The ongoing dialogue between regulators and industry players, including planned “crypto roundtables,” indicates a collaborative approach that could further shape the future of staking regulations.

Future Outlook and Challenges

Looking ahead, the Solana adoption forecast and long-term outlook for liquid staking hinge on sustained regulatory support and market stability. Analysts predict increased TVL and innovation if the SEC’s stance holds, potentially pushing LST-related activities into mainstream finance. However, risks remain, including potential reversals if staking models evolve to resemble investment contracts under the Howey Test.Exchangers like SwapGate must balance these opportunities with compliance challenges, ensuring their operations align with evolving standards. The integration of LSTs could enhance transaction efficiency and user engagement, aligning with SwapGate’s mission to facilitate fast, secure crypto exchanges. As the industry watches for further SEC decisions, particularly on ETF approvals, the liquid staking sector stands at a crossroads, with potential to redefine decentralized finance in the U.S.