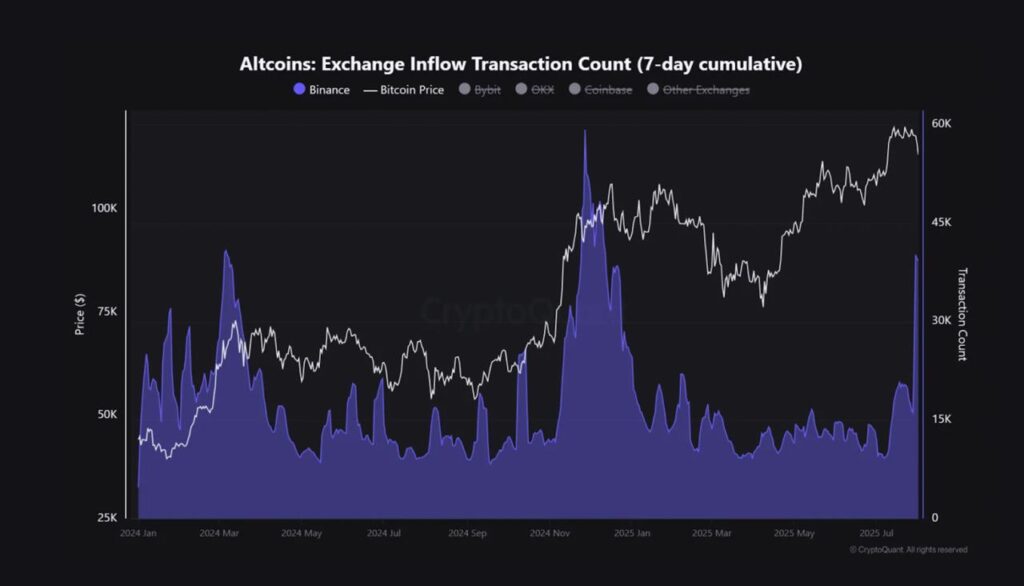

The cryptocurrency market is experiencing a renewed surge in altcoin activity, marking a clear return of altcoin seasonas traders begin diversifying away from Bitcoin. According to CryptoQuant, Binance saw its highest inflows in 18 months, totaling $1.2 billion.

This capital shift reflects growing trader confidence in alternative cryptocurrencies and signals a broader market rotation—one that exchangers can capitalize on through increased trading volume and expanding asset offerings.

Market Shift and Binance Inflows

CryptoQuant’s latest report shows that Binance inflows peaked on August 6, coinciding with a 7% drop in Bitcoin’s dominance since its July highs. This decline has triggered a wave of capital flowing into altcoins, with major players like Ethereum, Solana, and other mid-cap tokens posting strong gains.

The $1.2 billion inflow into Binance also marks the highest exchange reserve level since early 2024. Analysts interpret this as a strategic shift, with traders seeking higher returns across a diversified crypto landscape.

This movement aligns with past altcoin seasons, which typically follow periods of Bitcoin consolidation. Historically, these cycles precede broader bull runs. In the last week alone, altcoin market capitalization has risen by 15%, reinforcing this pattern.

For crypto exchangers, this presents a clear opportunity to expand altcoin support, improve liquidity, and meet growing demand.

Supporting Trends and Altcoin Performance

The current trend mirrors previous surges—most notably the 2021 altcoin boom, where assets like Cardano and Polygon recorded triple-digit gains. Recent CoinGecko data indicates that in just the past 48 hours:

-

Solana has surged by 12%

-

Avalanche has climbed 9%

These price movements are largely fueled by renewed interest in DeFi and NFT ecosystems.

Additionally, Glassnode reported on August 5 a 20% increase in stablecoin inflows to exchanges, suggesting traders are positioning themselves for further upside in altcoins.

Technical developments are also adding fuel to the fire. Solana’s recent upgrade has improved transaction speed, while Ethereum continues to refine its layer-2 scaling solutions. These enhancements are attracting both developers and capital, increasing the attractiveness of the altcoin sector overall.

To keep up, crypto exchangers must ensure:

-

Sufficient liquidity

-

Fast transaction processing

-

Scalable infrastructure for high-demand tokens

Implications for the Crypto Exchange Sector

The re-emergence of altcoin season presents both opportunities and challenges for crypto exchanges.

Opportunities:

-

Increased trading volume

-

Higher fee generation

-

New user acquisition

-

Expanded token offerings

Challenges:

-

Greater market volatility

-

Higher support demand

-

Security risks from new listings

The $1.2 billion inflow into Binance sets a new standard, pressuring competitors to level up. Exchanges that respond quickly with broader listings, better UI/UX, and strong risk management will be well-positioned.

Altcoins also tend to attract retail investors looking for higher growth potential. Historically, altcoin seasons have boosted exchange sign-ups by up to 30%, a trend that could very well repeat.

Exchangers can capitalize by:

-

Promoting educational content

-

Offering competitive fees

-

Supporting popular altcoin ecosystems

Future Outlook and Market Predictions

Looking forward, analysts remain optimistic about the sustainability of this altcoin momentum.

-

If the trend holds, the total altcoin market cap could rise another 25% by the end of the year.

-

The current 7-day altcoin performance index is up 18%, signaling market resilience.

However, key risks remain:

-

Renewed Bitcoin dominance surges

-

Regulatory action targeting smaller or anonymous altcoins

-

Speculative bubbles forming around untested tokens

To thrive in this fast-changing environment, exchanges will need to stay agile, with a focus on:

-

Real-time analytics

-

Deep liquidity pools

-

User-friendly interfaces

-

Robust risk controls

As the altcoin narrative strengthens, the crypto exchange sector is poised for growth—provided it adapts effectively to shifting conditions and continues to build user trust.