Curious where MATIC might go next? Below you’ll find a clear, research-backed Polygon forecast that blends today’s market context, technology catalysts, risk factors, and what reputable tracker sites are modeling for 2025–2030. Throughout, remember: outputs are scenario tools—not guarantees.

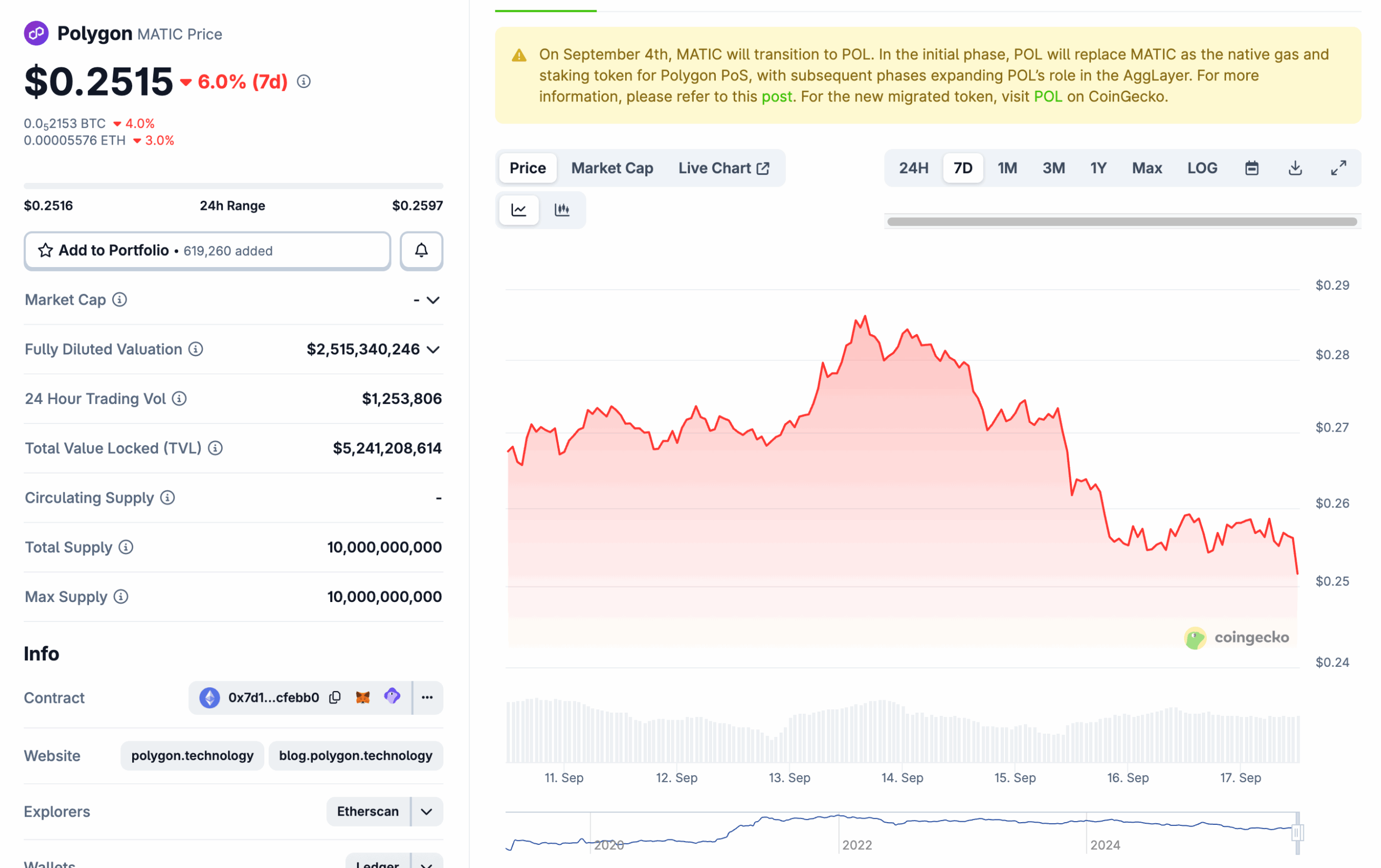

Polygon (MATIC) Today: Current Price and Market Data

Source: Coingecko

For live market data, CoinGecko remains a high-trust reference. It records Polygon’s all-time high (ATH) at $2.92 and an all-time low near $0.0031, giving you a quick sense of where today’s price sits in the long arc.

One important context point for any MATIC price outlook: the project’s multi-year transition from MATIC → POL within “Polygon 2.0,” where POL is positioned as the utility token for both the AggLayer (Polygon’s cross-chain settlement layer) and the Polygon PoS ecosystem. That design is part of Polygon’s value-accrual story going forward.

In mid-2025, Polygon also announced a Heimdall v2 upgrade targeting ~5-second fast finality on Polygon PoS—an example of performance work that can influence developer and user demand over time.

Historical Price Trends of Polygon

Like most large-cap crypto assets, MATIC’s price action has tracked broader crypto cycles: a surge into the 2021–2022 peak (culminating in the $2.92 ATH), followed by a deep bear-market retrace, and intermittent recoveries throughout 2023–2025. The ATH/ATL anchors from CoinGecko are useful mileposts when you’re assessing long-term upside and drawdown risk.

Key Drivers That Impact Polygon Price

Technology & Use Cases

Source: Pickacrypto

Polygon’s roadmap today centers on Polygon 2.0 and AggLayer—a framework intended to unify liquidity and security across many chains. In Polygon’s words, POL is the utility token for both AggLayer and the Polygon PoS network, potentially tying value to cross-chain settlement and blockspace demand.

On the scaling front, zk-powered infrastructure remains a hallmark. Polygon’s zkEVM documentation outlines the protocol components behind zero-knowledge rollup verification (sequencer, aggregator, L1 contract), even as the network’s architecture evolves in step with Polygon 2.0 plans.

Performance-wise, the fast-finality upgrade (~5 seconds) aims to improve user experience for payments and DeFi on Polygon PoS. If it leads to stickier activity, that can support MATIC price trends (or POL, as migration advances).

Adoption & Demand

Beyond retail and developers, Polygon has drawn institutional interest. In March 2024, Nomura’s crypto arm Laser Digital launched an institutional fund for exposure to Polygon’s token (including staking), underscoring that some professional allocators see a thesis for the network. Institutional vehicles don’t set price by themselves, but they can expand the buyer base.

Regulations & Market Trends

Macro liquidity, Bitcoin cycles, and regulation still set the backdrop for MATIC crypto forecasts. During risk-off periods, correlations rise across crypto assets; during risk-on phases, funds often rotate toward high-beta names. Meanwhile, the MATIC→POL transition adds a token-specific variable that models must interpret carefully. (Official updates from Polygon remain your best source on migration timing and mechanics.)

Short-Term MATIC Forecast (2025–2026)

Here’s what price reputable web sources with public methodologies are currently showing:

- CoinCodex: Near-term monthly snapshots for late 2025 center around the low-$0.30s (example: November 2025 band around ~$0.313–$0.320). These are rolling, model-driven ranges rather than analyst calls.

- CoinPriceForecast: Puts end-2025 in the low-$0.30s as well, with a gradual climb path into the out-years.

- Changelly Research: A conservative 2025 snapshot with December 2025 ≈ $0.25 shown in its table.

- WalletInvestor: Much more bearish in tone, classifying MATIC as a “high-risk 1-year investment” and showing depressed levels in 2025 on its forecast page. This underscores how wide prediction spreads can be.

Short-term MATIC price forecast 2025–2026 from these trackers clusters between ~$0.25 and $0.35 with at least one notably bearish outlier. Treat them as scenario markers, not certainties; methodology and refresh cadence differ by site.

Long-Term MATIC Forecast (2027–2030)

Long-dated calls get fuzzier, but the most transparent sites still publish directional views:

- CoinPriceForecast: Projects $0.40 by 2027, $0.50 within 2029, and roughly $1 by 2035 on its long-run curve (implying slow compounding rather than a moonshot). While it doesn’t pin one number to 2030 on the page, the 2029/2031 marks bracket expectations around the ~$0.5–$0.7 zone by that time frame.

- Other roundups exist, but their quality varies. If you compare multiple dashboards, you’ll see some very bullish 2030 calls and some very muted ones. Always check whether a site is modeling MATIC vs. POL (or conflating them), and whether it updates assumptions when major tech shifts (like AggLayer or token migration) are announced.

Expert Opinions on Polygon Price

Strict, bank-style price targets for MATIC are rare. However, institutional actions can signal medium-term confidence. Nomura’s Laser Digital fund targeting institutional exposure to Polygon (with staking) is one example of a traditional firm building Polygon-specific product. Analysts also point to Polygon’s enterprise-friendly brand and tooling as reasons it often wins pilots and partnerships, which can translate to steadier activity and a stronger MATIC outlook over time.

How to Buy or Swap Polygon Easily

- Choose your route. If you want a bank-like interface, use a reputable, regulated exchange with fiat on-ramps. If you just need a quick crypto-to-crypto swap, instant-swap services like Swapgate can convert in minutes—check the counterparty and rates.

- Confirm the asset. Exchanges still list MATIC widely; watch for any migration steps toward POL and always verify the contract/ticker before you trade. Official Polygon channels are your best source on token transitions.

- Mind fees and slippage. Use limit orders when possible; split large orders to reduce price impact.

- Secure storage. For longer holds, consider self-custody (hardware wallet) and keep your seed phrase offline.

- Keep records. Save order confirmations and txids for compliance and support.

Risks & Challenges for Polygon

- Execution risk on Polygon 2.0. Delivering AggLayer at scale, maintaining developer momentum, and smoothing any MATIC→POL migration are non-trivial. Market pricing can drift if timelines slip.

- Competition for blockspace. Alternative L2s and sidechains are shipping fast; user attention is finite.

- Regulatory and macro forces. Policy changes and risk-off macro regimes can swamp project-specific progress in the short run.

Conclusion: What’s Next for MATIC?

If your core question is “will MATIC rise?” the most honest answer is: it can—if technology and adoption align. The short-term Polygon forecast from publicly documented models tends to cluster around ~$0.25–$0.35 for 2025, while long-term views like CoinPriceForecast’s show a gradual glide path (e.g., ~$0.40 by 2027, ~$0.50 by 2029, $1 by 2035). Meanwhile, the fundamental story in 2025 is Polygon 2.0: AggLayer, fast finality, and a POL-centric value-accrual design intended to knit multiple chains together. If those pieces drive sustained user activity—and if institutional access grows—the MATIC outlook improves. If not, researchers that already lean conservative could prove prescient.