Curious about a realistic Polkadot forecast? Below you’ll find today’s live Polkadot price, a quick history lesson, the fundamentals that really move DOT, and a balanced look at what different forecasters expect from 2025 through 2030. Along the way, we’ll keep the language plain and the takeaways practical.

Polkadot (DOT) Today: Current Price and Market Data

Source: Coinmarketcap

As of September 15, 2025, DOT trades around the mid-$4s. For broader context, market trackers like CoinMarketCap put Polkadot’s all-time high near $55 on Nov 4, 2021, and the all-time low in 2020 around the upper-$2s.

Historical Price Trends of Polkadot

Polkadot’s price trends rhyme with crypto’s big cycles. The 2021 bull run sent DOT above $50 on parachain-auction hype; the 2022–2023 bear unwound most of that move; 2024–2025 saw choppy recovery with occasional rallies and drawdowns. Sources tracking DOT’s history consistently show the same arc: ATH near $55 (Nov 2021) and long stretches in the single digits afterward.

Key Drivers That Impact Polkadot Price

Technology & Use Cases

Polkadot’s roadmap is central to any Polkadot outlook. In 2024–2025, the project rolled out “Polkadot 2.0” themes such as Agile Coretime, Async Backing, and Elastic Scaling—all aimed at making blockspace more flexible and cheaper to rent. In simple terms: projects can buy “time on the network” as needed, rather than locking a full parachain slot for years.

Looking further out, JAM (Join-Accumulate Machine)—a proposed successor to the relay chain—targets richer smart-contract functionality and more decentralized client implementations. If shipped and adopted, JAM could broaden use cases and developer interest.

Independent research has repeatedly flagged Polkadot’s deep developer bench as a strength: reports from Messari (drawing on Electric Capital data) show the ecosystem among the industry’s top cohorts by active developers through 2024 and into early 2025. More builders typically means more apps, which tends to support long-term network value.

Adoption & Demand

Adoption is visible in user activity on parachains and cross-chain messaging (XCM). Messari tracked YoY transaction growth across the ecosystem into early 2025, even with a QoQ slowdown in Q1’25 as certain parachains optimized throughput—proof that activity can be lumpy quarter to quarter.

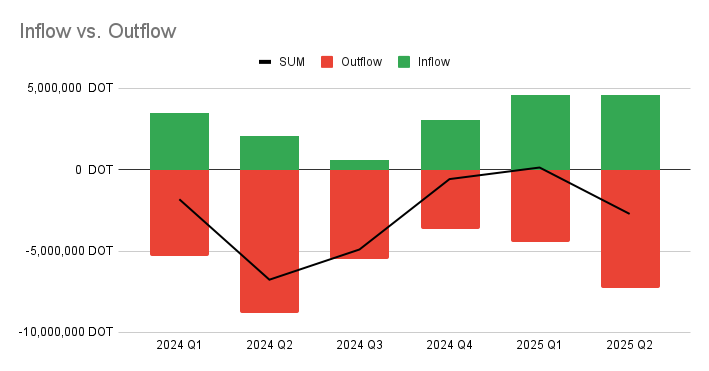

On governance and incentives, Polkadot OpenGov and the on-chain Treasury fund ecosystem workstreams (dev grants, outreach, UX). Quarterly Treasury reports outline tens of millions of dollars equivalent spent in 2025 across development and growth categories—signal that the protocol continues to invest in its own flywheel.

Regulations & Market Trends

Source: Polkadot Forum

DOT does not live in a vacuum. The entire crypto complex still swings with macro liquidity, Bitcoin cycles, and regulatory clarity. Global crypto market cap and flows can amplify or mute idiosyncratic Polkadot news. Keeping an eye on top-down market trend gauges (e.g., total market cap dominance and liquidity) helps frame the DOT crypto forecast day to day.

Short-Term DOT Forecast (2025–2026)

What do popular forecasting sites say today?

- CoinPriceForecast (a long-running quant site) is cautious: ~$5 by end-2025 and ~$5–6 by 2027, implying mild upside from current levels.

- WalletInvestor leans bearish near term, modeling a drop toward the mid-$3s within a year.

- Changelly Research recently published month-by-month ranges clustering around $3.9–$4.1 for late-2025, i.e., flat to slightly negative.

Most algorithmic models keep 2025–2026 in a broad $3.5–$6 channel unless a strong market-wide uptrend returns. For traders asking will Polkadot rise? The honest near-term answer is: it likely tracks the broader market unless a clear Polkadot-specific catalyst (e.g., sticky demand for Coretime or a breakout app) emerges.

Long-Term Polkadot forecast (2027–2030)

Long-range calls diverge a lot:

- CoinCodex sketches a conservative path, with 2030 near ~$5–$6.

- CoinPriceForecast shows ~$6 in 2030 in its more recent updates.

- On the higher side, InvestingHaven outlines a 2030 scenario around ~$36 if adoption and market tailwinds align.

- Coinpedia compiles third-party targets with a very wide band (e.g., $26–$79 by 2030), underscoring the uncertainty of long-dated crypto predictions.

What to do with that range? Treat long-term Polkadot future prediction numbers as scenarios, not certainties. The key swing variables are:

- Whether Polkadot 2.0 economics (Coretime markets) drive sustainable demand for blockspace

- Whether JAM arrives and is adopted

- How big crypto itself is by 2030

Expert Opinions on Polkadot Forecast

While many outlets publish models, a few research sources offer useful context:

- Messari’s State of Polkadot highlights developer resilience and evolving network economics into 2025—factors supportive of a constructive Polkadot outlook if user growth follows. (They don’t set price targets.)

- Media roundups vary: some (e.g., Benzinga) share bearish composites for 2030 (low single-digits), while others (e.g., InvestingHaven) argue the opposite based on technical and cycle analysis. The spread itself is the story—uncertainty is high.

Expert sentiment is mixed, and in crypto it usually tracks adoption and liquidity more than neat calendar dates.

How to Buy or Swap Polkadot Easily

- Choose a venue. For newcomers, a centralized exchange (e.g., major global platforms, such as Swapgate) offers simple coin-to-coin exchanges.

- Fund your account/wallet. Deposit fiat or stablecoins.

- Place an order for DOT. Market orders fill instantly; limit orders let you pick your price.

- Secure your assets. For longer holds, consider self-custody (hardware wallet) and keep your seed phrase offline.

- Swapping DOT. On-chain, you’ll pay network fees and may need the right parachain wallet; double-check slippage and contract addresses before confirming.

Tip: however bullish your DOT price forecast 2025 may be, size positions so you can live through volatility. Crypto can move 10–30% in a week—sometimes a day.

Conclusion: What’s Next for Polkadot?

If your question is simply will Polkadot rise? The fair answer is: it can—if Polkadot 2.0’s economics actually translate to durable demand for Coretime and if the broader market provides a tailwind. The difference between cautious and optimistic forecasts for 2027–2030 boils down to execution (Agile Coretime/JAM), real user growth on parachains, and macro crypto cycles.

Here’s a pragmatic DOT crypto forecast you can carry with you:

- Base case (most models): DOT oscillates in a wide range over 2025–2026 ($3.5–$6), with upside capped unless network demand accelerates.

- Bull case: successful Polkadot 2.0 adoption, improving developer + user metrics, and a risk-on crypto cycle could pull DOT into the teens later in the decade, with some forecasters sketching paths to the $20–$40 zone by 2030.

- Bear case: muted adoption and tighter liquidity keep DOT near mid-single digits through 2030 (or lower, per the most bearish composites).