Pepe Today: Current Price and Market Data

As of today (September 23, 2025), PEPE trades around $0.00001 per token with a market cap near $4B, according to large venues that track live prices such as CoinMarketCap, Binance, and Coinbase. All three place PEPE in the top tier of meme tokens by market value, with deep daily trading volumes that can swing into the hundreds of millions of dollars.

For context on the sector, CoinDesk has highlighted short bursts of momentum—PEPE rallied roughly 10% over a week in early September—followed by quick shakeouts, a hallmark of memecoin trading.

Supply: PEPE launched with a meme-themed fixed supply of 420,690,000,000,000 tokens; circulating supply sits near that figure, which is relevant when you sanity-check long-shot price targets.

Historical Price Trends

Source: Coinmarketcap

PEPE’s history is short but intense: a viral launch, a blow-off top, and then cyclical runs aligned with broader crypto liquidity. In September 2025, CoinDesk reported notable resistance/support areas (roughly $0.0000102–$0.0000108) around which liquidity concentrates—useful landmarks for traders watching breakouts or failures. Meanwhile, sharp dips (e.g., a 6% drop on Sept. 15) show how quickly sentiment can flip.

If you’re comparing data series, TradingView and Coinmarketcap also offer intraday charts and return tables; the takeaway is consistent: PEPE’s volatility remains elevated compared with large-cap crypto.

Key Drivers That Impact Pepe Price

Technology & Use Cases

PEPE is an ERC-20 memecoin with no core “utility” beyond community, speculation, and integrations across exchanges and DeFi. That doesn’t make it trivial: liquidity venues, listings, and derivative markets can amplify moves and deepen order books. But unlike smart-contract platforms, PEPE’s value proposition is primarily narrative and community. Reference pages from Coinbase and Binance frame it as a high-risk meme asset rather than a platform token.

Adoption & Demand

Adoption looks like listings + volume + community activity, not enterprise partnerships. Sector data (e.g., CoinGecko’s memecoin category) shows meme tokens ebb and flow with risk appetite; when liquidity chases beta, PEPE often benefits disproportionately.

Regulations & Market Trends

Macro policy and regulatory news still sway crypto beta. When risk appetite is strong and policy headlines are calm, memecoins can outperform for weeks at a time (as CoinDesk’s memecoin index pieces suggest). Conversely, risk-off days can erase gains quickly.

Short-Term Pepe Forecast (2025–2026)

What credible sources predict right now

- Changelly: For late 2025 monthly windows, the team lists ranges near $0.00000753–$0.0000116, implying consolidation around today’s price with downside wicks possible.

- CoinCodex: For 2026, the site projects a band around $0.000006683–$0.000009563—again suggesting rangebound action unless the narrative shifts materially. Their near-term call also flags the possibility of a ~25% drawdown into autumn 2025.

Interpretation: Short-term, published models cluster around $0.000007–$0.000012. That lines up with recent support/resistance zones shown in CoinDesk’s market notes. Upside spikes tend to meet heavy supply near prior highs; downside moves find liquidity where whales reload.

Key short-run swing variables

- Liquidity pulses (ETF news for majors, risk appetite)

- Exchange listings/derivative market depth

- Whale flows and on-chain positioning (often referenced in CoinDesk’s updates)

Long-Term Pepe Forecast (2027–2030)

- CoinCodex: Projects $0.00001221–$0.00002015 as a model band; they explicitly deem $0.01, $0.10, or $1 as mathematically out of reach without astronomical percentage gains.

- Many mainstream outlets avoid long-horizon targets for memecoins due to uncertainty. Where numbers exist, they remain incremental, not exponential. That aligns with simple math: with a ~420T supply, hitting $0.01 would imply a multi-trillion-dollar PEPE valuation—larger than most blue-chip cryptos—so sites that model supply mechanics label such targets as very unlikely.

If crypto’s overall market cap grows and PEPE retains community mindshare, a realistic long-run band is low five-digits of a cent (roughly today’s zone up to ~$0.00002 as per CoinCodex). If liquidity rotates to new memes or regulation chills risk, revisiting sub-$0.000007 levels is plausible.

Expert Opinions on Pepe

- Momentum snapshots: CoinDesk reported a ~10% weekly rise in early September and, a week later, a 6% daily drop tied to broader risk-off—illustrating how PEPE trades like a levered bet on market tone. Their analyses also mention whale accumulation on down days.

- Price landmarks: The same coverage has highlighted intraday supply near $0.0000107–$0.0000108 and demand near $0.0000102, levels active traders watch for breakouts or failed rallies.

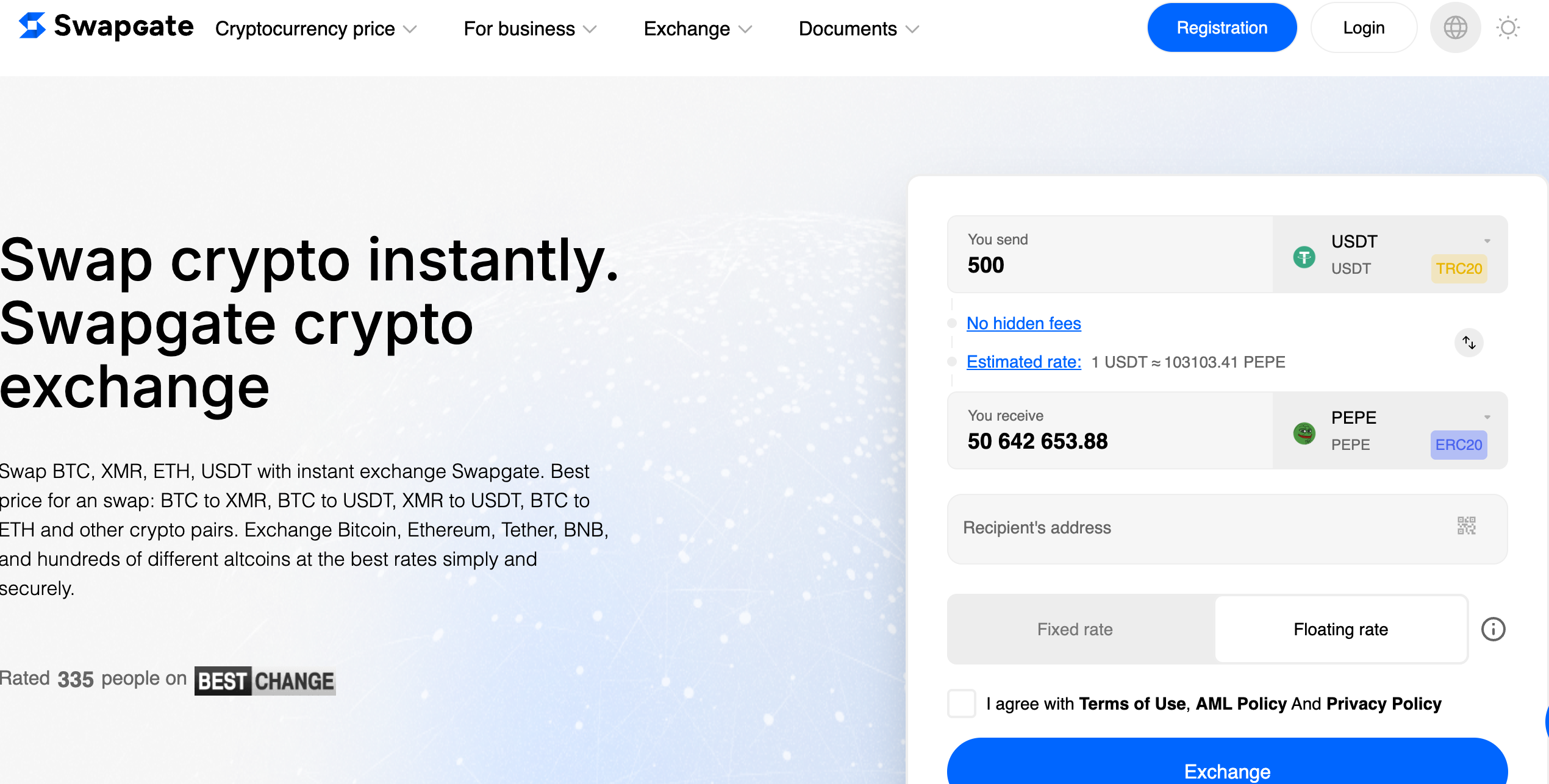

How to Buy or Swap Pepe Easily

- Pick a major venue with strong liquidity and disclosures (KYC required in most regions). Asset pages on Coinbase and Binance confirm ticker details, charts, and pairs.

- Fund your account (bank transfer or card) or send crypto to swap.

- Double-check the contract (ERC-20 “PEPE”) before buying; copy from a trusted source (e.g., CMC asset page) to avoid impostors.

- Consider self-custody if you plan to hold—memecoins are targets for scams; hardware wallets reduce counterparty risk.

- Mind fees & slippage: Use limit orders when volatility spikes; avoid chasing green candles.

What’s Next for Pepe?

Pepe forecast scenarios hinge on two things: liquidity and mindshare. When crypto beta is strong, PEPE can sprint; when macro tightens, it tends to retrace swiftly. Published projections from Changelly and CoinCodex suggest range-trading near current levels in 2025–2026, with 2030 targets topping out near $0.00002 under constructive assumptions. That’s aligned with basic supply math and the asset’s meme-driven nature rather than utility-driven cash flows.

Will Pepe rise—or will Pepe fall? In the very short term, both are likely at some point. If you’re considering exposure, size positions so you can survive volatility, and anchor expectations to realistic bands rather than viral hopium. The Pepe price forecast 2025 looks like a tug-of-war around $0.00001; the Pepe future prediction into 2030—per models willing to publish numbers—tops out a few multiples above today, not orders of magnitude.

This article is educational, not financial advice. Crypto is volatile—never invest more than you can afford to lose.