NEAR Protocol Today: Current Price and Market Data

As of September 25, 2025, the NEAR price is around $3.00, with 24-hour volume near $226M and live market context on CoinDesk’s asset page.

For historical bearings, Forbes’ NEAR asset dashboard shows a 5-year high ~$20.24 and a 5-year low around ~$0.53—useful bookends when thinking about the token’s journey and volatility.

Historical Price Trends

Source: Coindesk

NEAR Protocol’s chart has been classic “boom→reset→rebuild”: a strong 2021–2022 run culminating near $20, a deep 2022–2023 drawdown, and then a series of range-bound recoveries through 2024–2025. Recent CoinDesk market notes highlight sharp intraday whipsaws in August 2025, reflecting how liquidity and sentiment can flip within hours. This is par for an L1 in a macro-sensitive market and a reminder to size any positions prudently.

Key Drivers That Impact NEAR Price

Technology & Use Cases

NEAR’s core technical edge is Nightshade sharding, a design that parallelizes execution across shards to scale throughput while staying developer-friendly (EVM-compatible tooling and straightforward account model). If you want the canonical technical reference, the Nightshade paper lays out the approach to state validity, data availability, and sharded execution. In short: scaling without forcing dApp teams to re-architect entirely.

On the ground, Messari’s project page consolidates network fundamentals and quarterly reports—handy for tracking how platform usage translates into fees and attention. Developer-ecosystem health is also captured by the Electric Capital Developer Report, which tracks active contributors across chains; a resilient builder base is often a leading indicator for app launches and, eventually, demand for blockspace.

Adoption & Demand

User and developer momentum matter more than slogans. Dashboards such as The Block and Token Terminal track active addresses and other activity metrics; upticks here often precede better NEAR price trends if liquidity cooperates. Combine those with live price/volume on CoinDesk for a fuller picture.

On the token-economics side, it uses inflationary issuance (commonly referenced as ~5% per year) offset by fee burns—a balance between rewarding validators and limiting net supply growth when activity rises. Review independent tokenomics summaries and the project’s own materials to understand how issuance and burns interact over time.

Regulations & Market Trends

Policy isn’t price, but it sets the rails. In the EU, the MiCA regime for crypto-assets and service providers is now in force, giving clearer rules for custody, disclosures, and token operations. Law-firm explainers are a good way to track what this means for exchanges and projects interfacing with European users. More clarity generally reduces risk premia—supportive for a constructive NEAR crypto forecast when sentiment is neutral.

Short-Term NEAR Forecast (2025–2026)

Mainstream financial outlets rarely publish precise NEAR targets, so credible numbers typically come from model-based or editorial sources that disclose methods:

- CoinCodex (algorithmic model):

• 2025: range $2.92–$4.89 (upper bound implies ~70% above today’s level).

• 2026: range $2.92–$5.01 (slightly higher upper band than 2025).

These are technically-driven projections that update with trend/volatility.

How to use these: treat 2025–2026 as a range-trading regime unless a real adoption shock hits (e.g., a breakout dApp, major partnership, or clear macro risk-on). CoinDesk’s frequent notes on its intraday reversals underscore that momentum can fade quickly without follow-through in users and fees.

Long-Term NEAR Forecast (2027–2030)

By 2030, published numbers diverge widely:

- CoinCodex (model): $5.5–$8.2 by 2030 (upper end ≈ +185% vs. today), assuming sustained but measured adoption.

- InvestingHaven (editorial research): Peak scenario – $24 by 2030 (a bullish case tied to institutional interest and strong execution). Consider this an upside scenario if NEAR captures disproportionate developer and user mindshare.

Because trustworthy institutions seldom set coin-specific 2030 targets, a sober NEAR future prediction blends fundamentals with scenario bands. A cautious planning range many investors use is “mid-single-digits base, high-teens bull” into 2030—roughly consistent with the model/editorial span above, and explicitly contingent on execution and macro liquidity.

Expert Opinions on NEAR Protocol

- Technology stance (sharding at the core): The Nightshade paper remains the best canonical source for why NEAR claims linear scalability via sharding—an architectural bet that, if validated by usage, underpins any long-run NEAR forecast.

- Ecosystem health: Messari’s coverage aggregates quarterly “State of NEAR” reports and relevant news; pair that with Electric Capital’s developer dashboards to gauge whether devs are shipping through cycles—often a tell for future fee demand.

- Market tape: CoinDesk’s daily market briefs on NEAR (July–August 2025) highlight the asset’s sensitivity to flows; sustained upside typically needs both on-chain activity and macro risk-on.

How to Buy or Swap NEAR Easily

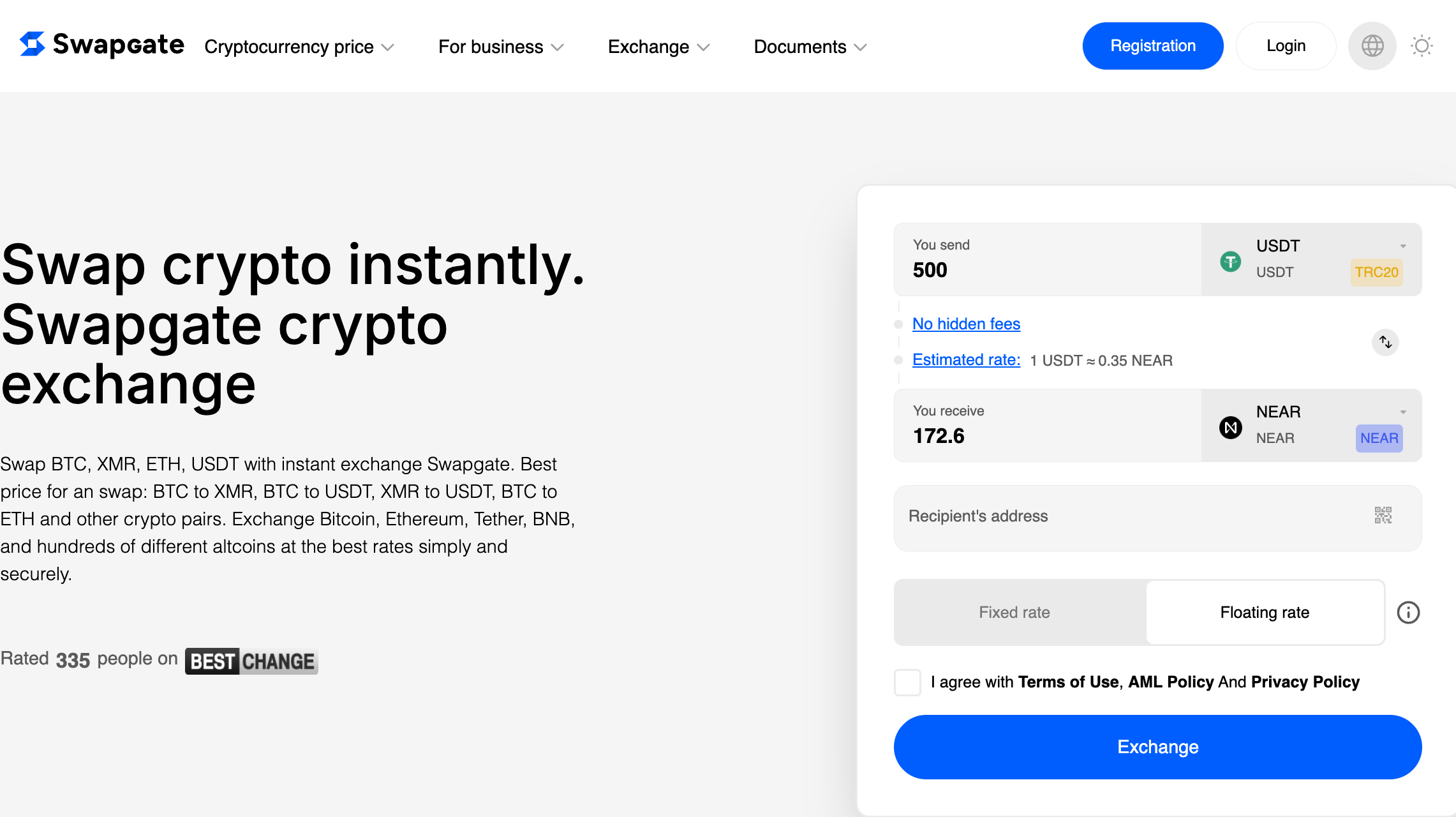

- Centralized exchanges: Check availability and market pairs on reputable venues, such as Swapgate; pages on Forbes and CoinDesk list market data and links to regulated exchanges. Verify fees, funding methods, and withdrawal networks before you trade.

- Self-custody + DEX: If you already hold crypto, you can route through EVM bridges/DEXs that support NEAR pairs, but confirm contract addresses and bridge security.

- Basics to save time and fees: Use limit orders to avoid slippage on thin pairs, compare maker/taker fees, and test small deposits/withdrawals before scaling up.

What’s Next for NEAR Protocol?

Catalysts that could push NEAR higher (will NEAR rise?):

- User growth + dev velocity: More active addresses and sticky apps (measured on The Block or Token Terminal) can widen the fee base and justify higher valuations over time.

- Clearer policy rails: Continued implementation of MiCA in Europe and analogous clarity elsewhere lowers structural frictions for listings and institutional access—constructive for the NEAR outlook if fundamentals keep improving.

Risks that could cap or reverse gains:

- Execution risk: If flagship dApps fail to retain users, token issuance may outpace fee burns—dampening the NEAR price trends story. Review tokenomics carefully.

- Macro/liquidity shocks: As CoinDesk’s recent coverage shows, sharp drawdowns can appear with little warning; treat forecasts as ranges, not promises.

Conclusion

- For 2025–2026, model-based sources suggest NEAR could chop in a $3–$5 band absent a major adoption shock, aligning with CoinCodex’s range and recent price behavior.

- For 2027–2030, credible public numbers span from mid-single-digits (model base case) to mid-teens/low-20s(bullish editorial scenarios). Whether the NEAR future prediction skews high or low depends on sustained dev/user growth, competitive dynamics among L1s, and the macro cycle.

If you decide to allocate, consider dollar-cost averaging, keep position sizing modest, and watch three dashboards: active users, developer activity, and tokenomics (issuance vs. burn). That’s how you turn a headline NEAR price forecast 2025 into an informed, adaptable plan.