If you’ve watched Chainlink (LINK) ride big crypto cycles, you know the question never changes: will LINK rise from here, or drift? Below is a balanced, research-backed LINK forecast for 2025–2030—summarizing current market context, real utility drivers (CCIP, staking, tokenization), what reputable model sites predict, and practical tips if you’re considering a position.

Chainlink (LINK) Today: Current Price and Market Data

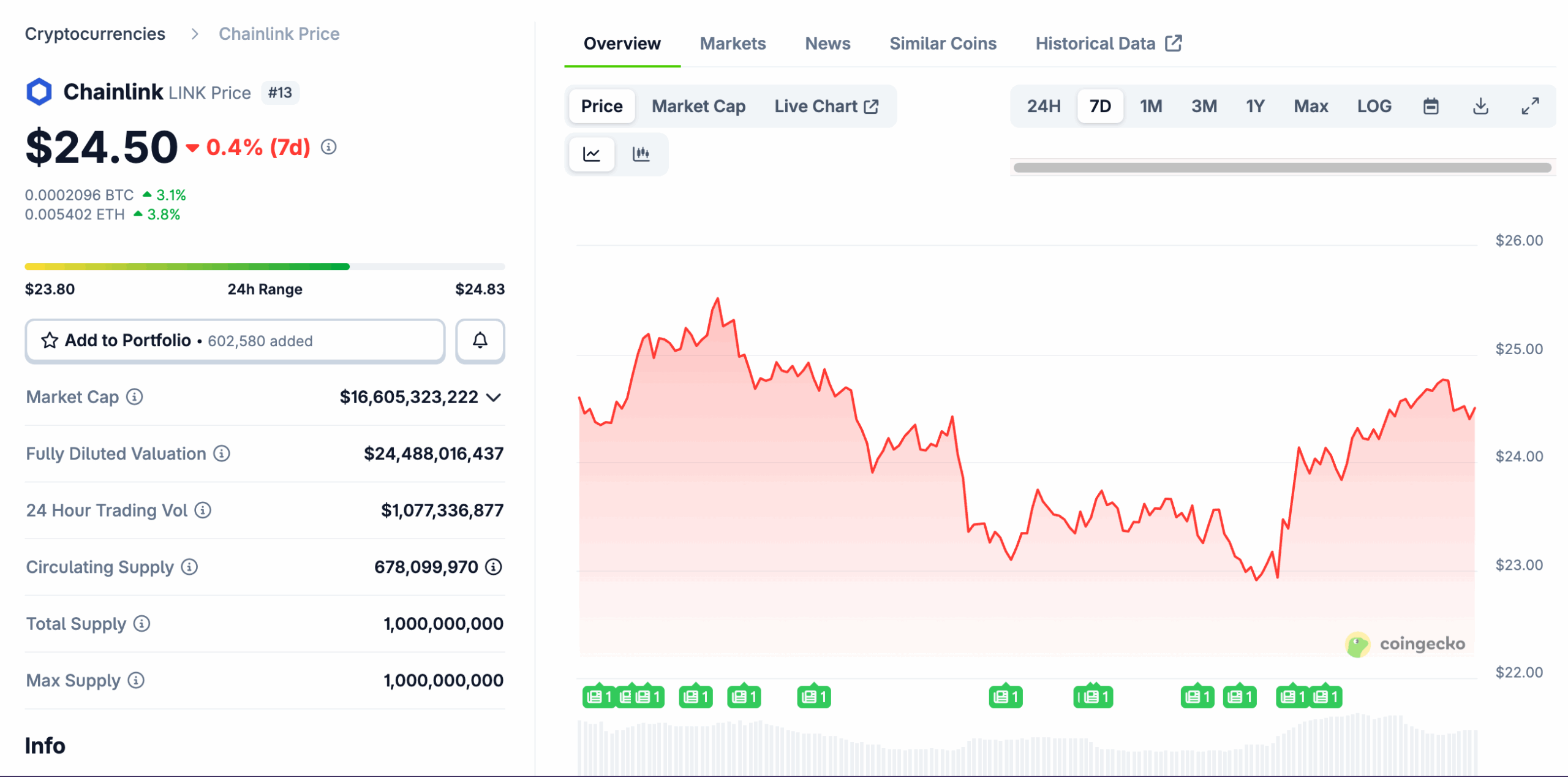

Source: Coingecko

LINK trades in the mid-$20s with a top-15 market cap and an all-time high near $52.70 (May 2021). Recent tracker snapshots place the price around the mid-$20 range; CoinGecko confirms the ATH, while CoinCodex’s dashboard shows LINK hovering in the mid-$20s in September 2025.

Why that matters: the current quote sits far below the prior peak, but well above bear-market lows—classic “prove-it” territory that leaves room for both bull and bear narratives.

Historical Price Trends of Chainlink

LINK price trends tend to echo crypto’s broad risk cycle: strong outperformance during 2019–2021 as oracles became DeFi plumbing, deep retrace in 2022, and multiple recovery waves since 2023. That long arc explains why many LINK outlook dashboards model modest step-ups rather than sudden retests of the ATH. It’s also why fundamentals (below) matter so much for the LINK crypto forecast.

Key Drivers That Impact LINK Price

Technology & Use Cases

Chainlink is best known for secure data feeds (price oracles), but the roadmap now leans heavily into interoperability:

- CCIP (Cross-Chain Interoperability Protocol): Used in high-profile experiments with Swift to move tokenized assets across blockchains—work that positions Chainlink as a neutral messaging layer for traditional finance exploring tokenization. Swift’s own releases described successful multi-chain experiments and outlined next steps.

- Tokenization pilots: In May 2024, the DTCC (the U.S. post-trade giant) published results from its Smart NAV pilot, distributing mutual-fund data on-chain with help from Chainlink tech; CoinDesk’s report noted participation from major institutions. These efforts don’t set price, but they strengthen the “real-world finance” use case investors watch.

- Staking v0.2: Launched in late 2023, the upgrade expanded staking and revamped mechanics to secure oracle networks—part of “Chainlink Economics 2.0,” aiming to align incentives as usage grows.

Put simply: more secure data, more cross-chain transactions, and more institutional pilots all point to durable demand for Chainlink services—inputs many investors consider in any LINK future prediction.

Adoption & Demand

Adoption is visible on two fronts:

- Crypto-native: DeFi apps, lending protocols, and derivatives platforms rely on Chainlink feeds for reliable prices and automation.

- TradFi bridges: Swift and DTCC explorations show traditional rails testing Chainlink to move or publish data across chains—precisely the kind of sticky, B2B plumbing that can outlive hype cycles.

If those pilots translate into production workflows and fees, the LINK outlook improves.

Regulations & Market Trends

Macro and policy still set the weather. Liquidity cycles, ETF flows in broader crypto, and evolving rules for tokenization and on-chain data can amplify or mute Chainlink-specific wins. Swift’s experiment recap explicitly flagged the need for regulatory clarity as tokenization scales—worth tracking because enterprise adoption depends on it.

Short-Term LINK Forecast (2025–2026)

“What do people actually predict?” Most reputable, public dashboards publish model-based ranges:

- CoinPriceForecast: End-2025 around $25, stepping toward $50 by mid-2026 on its curve (conservative, gradual rebuild).

- CoinCodex: 2025 monthly bands cluster in the mid-$20s; its long table places 2030 in a ~$49–$77 range (helpful as a sentiment barometer).

- Changelly Research: A cautious 2025 path with min/avg/max near $19.94 / $26.01 / $22.98 (note the table’s average sits slightly above the max—it’s a rolling blog; treat it as a directional snapshot, not gospel).

The 2025–2026 LINK price forecast from these trackers clusters in the $20–$30 zone, with upside toward $50 on more optimistic curves. None of these are guarantees; they refresh with market conditions, but they’re transparent about methods and timing.

Long-Term LINK Forecast (2027–2030)

- CoinPriceForecast: Projects $75 in 2028 and $100 in 2031, implying a slow-grind path for out-years. If you interpolate 2030 from that curve, it suggests high-two-digit prints before triple-digits arrive.

- DigitalCoinPrice: More bullish long-frame scenarios (e.g., high double-digits by 2027–2028)—useful to see the range of algorithmic optimism, but verify refresh dates.

Long-dated LINK crypto forecasts diverge widely. Treat them as scenario maps. The variables that actually move outcomes: (1) CCIP adoption beyond pilots, (2) growth in tokenized assets/real-world data on-chain, and (3) sustained DeFi demand.

Expert Opinions on Chainlink Price

Strict “street” price targets for LINK are uncommon, but institutional pilots speak louder than hot takes. When DTCC says it piloted on-chain fund data dissemination with Chainlink, and Swift releases public reports on tokenization experiments using Chainlink tech, that’s the kind of real-economy validation sophisticated allocators watch. Media coverage by CoinDesk and official write-ups by DTCC and Swift anchor those claims.

How to Buy or Swap LINK Easily

- Pick your route.

- Regulated exchange: On-ramp with fiat, then buy LINK spot.

- Instant swap: If you already hold crypto, use a reputable swapper to convert into LINK (watch rates/slippage).

- Verify the asset. Always check the contract and ticker (LINK, ERC-677/20 on Ethereum and supported chains) on a trusted explorer or a major listing page.

- Use limit orders for size. Reduce slippage and avoid chasing wicks.

- Store safely. For longer holds, consider self-custody (hardware wallet) and revoke unused token approvals periodically.

- Keep records. Save transaction IDs and confirmations for tax and support.

What’s Next for Chainlink?

If your core question is “will LINK rise?” the fair answer is: it can—if adoption clears two hurdles:

- From pilots to production: DTCC/Swift-style experiments must become live, revenue-generating flows. If tokenized funds, on-chain NAVs, and cross-chain messaging move beyond sandbox mode, the LINK price outlook improves.

- Sustained DeFi demand: Oracles are critical infrastructure; steady usage (and fees) through cycles is the healthiest support for any LINK future prediction.

Add macro to the mix: a friendlier risk backdrop can pull all large-caps higher; a risk-off turn can pin even strong fundamentals. That’s why most public dashboards keep 2025 conservative (mid-$20s) and pencil in gradual gains into the late 2020s.