Cardano has weathered multiple crypto cycles and keeps shipping technical upgrades, which is why ADA remains a top-watched L1. This guide pulls together current market data, real technology milestones, and research-backed views to sketch a sober ADA price prediction—from 2025–2026 (near term) to 2027–2030 (long term). It’s not hype; it’s what the data suggests.

Cardano Today: Current Price and Market Data

Source: Binance

As of October 13, 2025, ADA trades around $0.70–$0.72, with a circulating supply near 35–37 billion ADA and a market cap in the mid-$20 billions, keeping Cardano within the top layer-1s by size. Live trackers like CoinGecko and CoinMarketCap show intraday moves, market cap, and 24-hour volume if you want the latest tick.

All-time high: ADA’s ATH sits near $3.09 from September 2, 2021. That’s the historical anchor many traders reference when evaluating upside versus previous cycle peaks.

Historical Price Trends of Cardano

Cardano’s ADA price trends have been cyclical: multi-month advances around major roadmap moments (Shelley staking, smart contracts in Goguen, and later governance milestones), followed by broader market drawdowns. Since the 2021 ATH, ADA has retraced heavily like most altcoins, then stabilized, with rallies tending to cluster around ecosystem shipping milestones and risk-on phases in crypto. If you’re comparing cycles, remember that supply expands gradually toward a max of 45B ADA—so market cap, not just unit price, is the true yardstick.

Key Drivers That Impact ADA Price

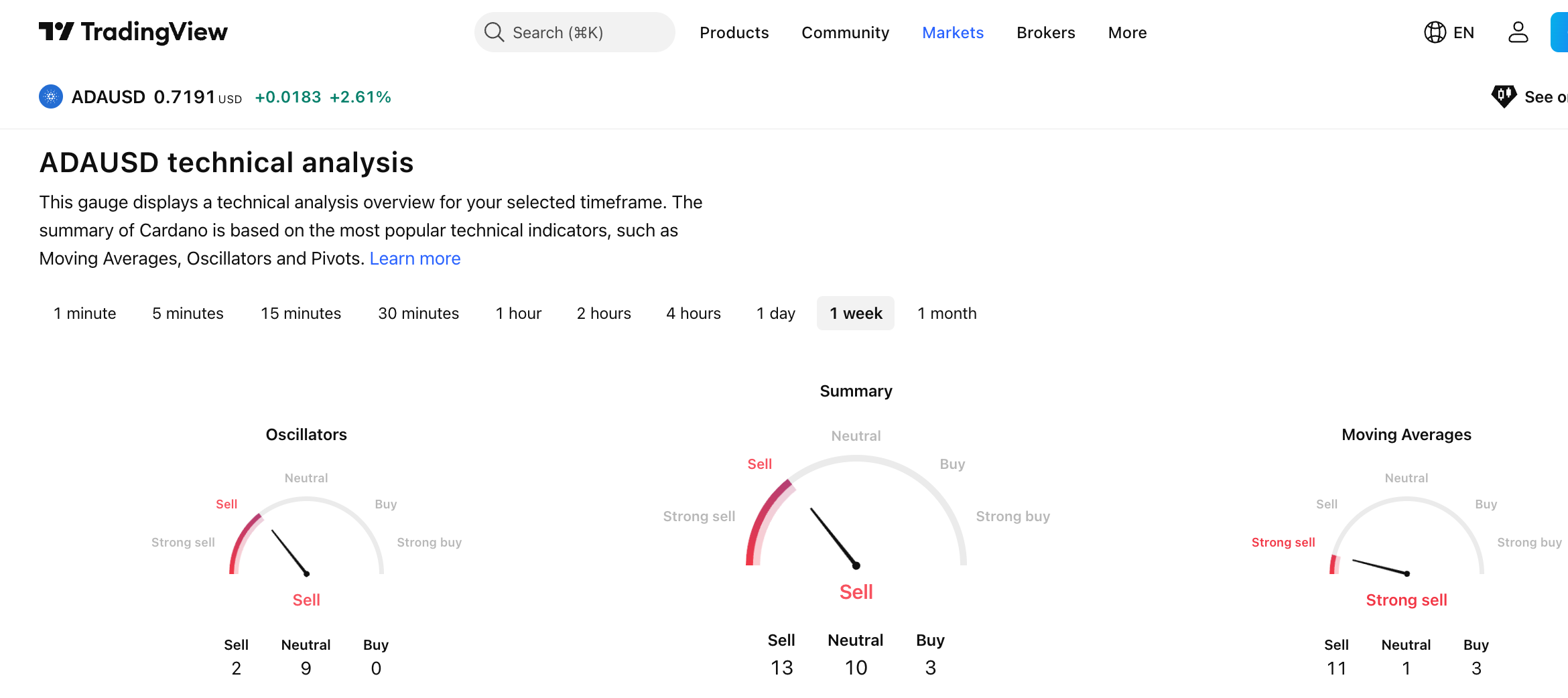

Source: TradingView

Technology & Use Cases

2024–2025 marked a shift from “ship smart contracts” to scaling and governance:

- Chang hard fork & Voltaire governance. Cardano’s governance era formally arrived with Chang and CIP-1694—introducing constitutional committees, DReps, and on-chain voting mechanics meant to steer the treasury and protocol parameters. This increases policy clarity and can de-risk long-term builder commitments.

- Hydra and Layer-2 work. Cardano’s Hydra heads and broader L2 roadmap target throughput and latency improvements for high-frequency dApps, payments, and gaming use cases. IOG has been explicit in 2025 about expanding beyond Hydra with a set of L2 innovations.

- Mithril. This stake-based snapshot protocol lets users/apps verify chain state quickly without downloading the full history, improving sync times and enabling lighter clients—useful for Cardano wallets, dApps, and exchanges.

Adoption & Demand

Adoption isn’t just TVL; it’s tools, governance, and builder traction:

- Ecosystem/TVL context. Cardano’s DeFi footprint has grown but remains mid-pack by TVL (ranked around the 20s among chains), which caps fee growth but also leaves room for catch-up if L2s and better UX unlock new demand.

- Institutional-facing signals. Independent research houses track Cardano’s steady progress in governance (on-chain elections, budget approvals, foundation roadmap), which helps institutional due diligence even if it doesn’t spark immediate price spikes.

Regulations & Market Trends

Macro liquidity and policy drive crypto beta. Coinbase Institutional’s 2025 market outlook emphasizes broader ETF/derivatives rails and improving compliance clarity—tailwinds for large-cap alts when the tape is risk-on. That doesn’t guarantee ADA outperformance but it improves access for traditional capital.

Short-Term ADA Forecast (2025–2026)

Baseline view: In the near term, ADA price forecast 2025–2026 likely tracks market beta plus delivery on Cardano’s scaling and governance roadmap. A reasonable, data-backed range many analysts discuss for late-2025 into 2026 is consolidation around $0.70–$1.50 with upside tests if liquidity rotates into L1s and Cardano’s dApp throughput improves. We anchor this not on hype but on the combination of: current pricing (~$0.70–$0.72), the chain’s mid-tier TVL status, and credible research describing governance/L2 progress rather than promising moonshots.

For a survey datapoint, Finder’s panel (late-2024) projected ~$1.31 for 2025 and $3.85 by 2030; surveys are opinionated and often lag real-time developments, but they offer a reference point for consensus expectations. Treat them as sentiment, not gospel.

What would push the high end?

- Demonstrable throughput gains (Hydra/L2s in production), rising fees/usage, and voters using governance to accelerate shipping.

What would cap it? - Persistent mid-tier TVL, developer leakage to faster ecosystems, or risk-off macro.

Long-Term ADA Forecast (2027–2030)

From a fundamentals lens, ADA outlook into 2030 hinges on three levers:

- Governance that actually allocates capital well. If Chang/CIP-1694 mechanics drive faster iteration (e.g., parameter updates, treasury funding for infra), Cardano can compound network effects. The Foundation’s roadmap and governance documentation describe the structures now in place.

- Scaling that’s invisible to users. Hydra/L2s/Mithril need to make the chain feel instant to end users. If UX catches up, ADA price trends can decouple from “it’s slow” narratives.

- Sustained builder momentum. Messari’s 2025 reports frame Cardano as moving into a governance-led era; the open question is whether that translates into measurably higher usage and fees by 2027–2030.

Scenario bands (not financial advice):

- Base case (range-bound growth): $1–$2.50 by 2030 if usage rises steadily but Cardano remains a middle-tier DeFi chain. Survey panels like Finder echo this magnitude (mid-single-digit dollars at the top end).

- Bull case (utility ramps): $2.50–$5 if governance accelerates shipping, L2s push real throughput, and TVL + active addresses trend markedly higher versus peers.

- Bear case (stagnation): <$1 if altcoin liquidity thins or rival L1s absorb developer mindshare.

Expert Opinions on Cardano Price

Truly trustworthy sources rarely publish hard targets. Instead, they track fundamentals:

- Messari — State of Cardano (Q1 & Q2 2025): documents the network’s move into on-chain governance (elections, budgets), while noting price and fee softness earlier in 2025. This supports a measured, fundamentals-first ADA crypto forecast.

- Coinbase Institutional — 2025 Outlook: highlights broader structural improvements (ETFs/derivatives, compliance) that can lift high-cap alts when macro improves—useful macro color for any ADA future prediction.

If you see precise year-end numbers, check the source. Surveys (e.g., Finder) and exchange “prediction” pages reflect opinions or models, not guarantees. They can be a sentiment gauge—but fundamentals drive durability.

How to Buy or Swap ADA Easily

You’ve got two broad paths: custodial exchanges (fiat on-ramps with KYC) and non-custodial swaps (crypto-to-crypto, wallet to wallet).

Crypto-to-crypto swaps (wallet → wallet):

- SwapGate: A simple aggregator-style swap interface (no sign-up) that routes crypto-to-crypto exchanges—e.g., AVAX↔ADA—with fixed or floating quotes. It advertises private swaps and requests KYC only if its risk engine flags activity. Just provide your receive address, send from your wallet, and receive ADA directly back to your wallet. You can start with a small test amount and verify the receive network and expected output.

Custodial exchanges (fiat → ADA):

- Coinbase: Clear UX, instant buys in supported regions, robust compliance. Their ADA asset page shows live price and basic info.

- Kraken: Offers ADA spot and conversions (ADA↔USDT and many pairs) with transparent fee schedules.

- Binance: Deep liquidity and live ADA dashboards; availability depends on jurisdiction.

Conclusion: What’s Next for Cardano?

Cardano’s 2025 story is less about guessing a number and more about stacking fundamentals: governance that ships (Chang/CIP-1694), scaling that feels instant (Hydra + L2 push), and lightweight access (Mithril). If those threads convert into higher usage, fees, and a deeper dApp catalog, the ADA outlook improves mechanically. In the short run (2025–2026), a realistic ADA price forecast is range-bound appreciation tracking the broader market and Cardano’s delivery cadence. Longer term (2027–2030), upside depends on real adoption—not just narratives.

So, will ADA rise? It can—if Cardano keeps turning research into products people actually use. Keep your eye on: governance proposals and funding decisions, L2 throughput gains, TVL/user growth, and exchange/liquidity access. Use reputable platforms to buy or swap, self-custody where possible, and let the data, not the discourse, guide your next move.