Most lending protocols list a few dozen assets; the rest of the long tail is left out. UniLend Finance was built to fix that by making lending/borrowing permissionless for any ERC-20—and by pairing money markets with spot trading in one stack. In February 2024 the team rolled out UniLend Swap V2 on Ethereum mainnet with a new dual-asset, isolated-risk design: anyone can spin up a pool for a pair of tokens and set markets without exposing the rest of the protocol to contagion.

The official site still leads with that core vision—“every asset is welcome”—and emphasizes permissionless listing plus isolated dual-asset pools so lenders choose exactly which asset they want exposure to.

What is UniLend?

UniLend is a multichain DeFi protocol that enables permissionless lending and borrowing across Ethereum, BNB Chain, and Polygon, with add-ons like flash loans and on-chain price feeds. Its token, UFT, is used for governance and various protocol incentives. Think of UniLend as “bring-your-own-asset” money markets, designed for the long tail as well as majors.

How UniLend V2 works?

Dual-asset, isolated pools

Instead of one giant pool where risks can bleed across assets, UniLend V2 uses isolated pools—one lending/borrowing market per pair (e.g., WETH/DAI, or any ERC-20 pair you choose). If a risky token goes sideways, it doesn’t contaminate unrelated markets. This is central to the project’s permissionless listing promise.

Permissionless listing

Anyone can list any ERC-20 token and immediately enable borrowing/lending for it, subject to the pool’s parameters. That’s the “every token welcome” thesis you’ll see on the homepage and docs. It’s a real differentiator for long-tail assets that rarely get attention on larger money markets.

Price feeds, flexible rates, flash loans

The protocol’s public materials and research pages highlight on-chain oracle feeds, dynamic interest models, and flash loans (an advanced tool, but a must-have in DeFi). These are foundational for keeping permissionless markets orderly.

Multichain access

UniLend operates across Ethereum, Polygon, and BNB Chain, which broadens the audience for both lenders and borrowers and makes it easier to route liquidity from ecosystems you already use.

Unilend swap explained

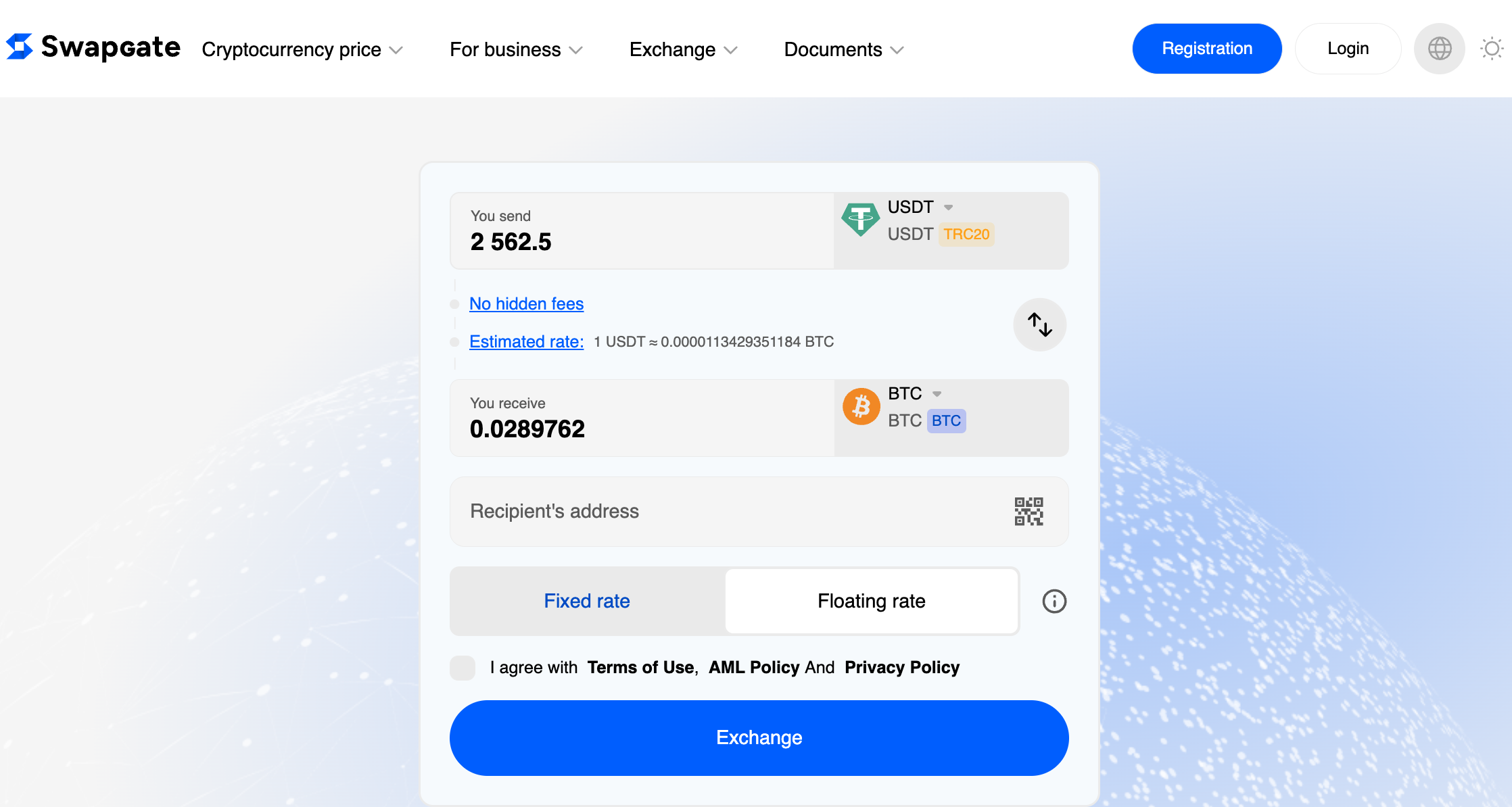

You’ll see people search for “unilend swap”—often meaning “how do I trade into or out of UFT or assets near UniLend’s ecosystem?” There are two angles:

- Inside UniLend’s design: the project historically combined spot trading with money markets so that tokens listed for lending could also be traded in-protocol. That design goal still underpins V2’s permissionless, pair-based approach.

- Outside, at an exchange/aggregator: if you want to exchange UFT or route into UFT pairs (e.g., exchange Bitcoin for USDT or vice versa), you’ll usually use an exchange crypto aggregator that supports such pairs.

Either way, confirm the chain (ERC-20 on Ethereum vs. other networks) and contracts before you press swap—long-tail tokens often have impostors.

UFT coin: role, supply, and how it’s used

- Ticker: UFT

- Role: governance and protocol utility; appears across supported chains in the UniLend stack and is referenced by research portals as the governance token for UniLend Finance.

- Supply & token history: Listings and exchange help pages indicate a 100,000,000 max supply, with early distribution dating back to 2020–2021. If you’re researching circulating/FDV figures, always pull a live market page rather than memorizing old snapshots.

Where UniLend fits in the DeFi map

- If you’re a lender: UniLend lets you pick your counterpart by choosing the pool. Conservative users can lend only against majors; adventurous users can lend into long-tail markets with more yield but more risk.

- If you’re a project/community lead: you can bootstrap a market for your token without waiting for a central listing committee. This is the permissionless value prop in one sentence.

- If you’re a trader/arb user: V2’s isolated pools and available flash-loan tooling (where active) create basis and arbitrage edges, especially in smaller pools that drift from fair value.

UniLend (UFT) at a glance

| Topic | What to know | Why it matters |

| Core design | Permissionless money markets with dual-asset, isolated pools | Contain risk to a pair; list any ERC-20 without waiting for approval. |

| Launch milestone | V2 live on Ethereum mainnet (Feb 13, 2024) | Confirms the production rollout of the isolated-pool model. |

| Chains | Ethereum, Polygon, BNB Chain | Meet users where they already hold assets and liquidity. |

| Token (UFT) | Governance & utility across the stack; max supply commonly cited as 100M | Aligns incentives; check live market data before acting. |

| Feature set | Permissionless listing, on-chain feeds, dynamic rates, flash loans | The “complete” DeFi toolbox for long-tail assets. |

| Unilend swap | Trade UFT on CEX/DEX/aggregators; UniLend’s own model historically paired trading + lending | Mind the network (ERC-20 etc.) and verify contract addresses. |

How to access UFT and UniLend markets

- Start from official links. Visit the homepage and docs to avoid spoofed interfaces. From there, you can reach the V2 dApp and check supported chains.

- If you need UFT exposure: use reputable venues/aggregators to exchange UFT (or exchange Bitcoin to UFT) and double-check you’re selecting UFT (ERC-20) or the intended chain.

- Kick the tires with small sizes. Long-tail pools can be thin. Test deposits/borrows in modest amounts before you scale.

- Price-feed sanity check. Because pools are permissionless, validate that the oracle feed and collateral parameters look sensible for the pair you’re using.

Risks you shouldn’t ignore

- Oracle/parameter risk in new pools. Permissionless is a superpower—and a responsibility. Poorly configured pools can be gamed. Always confirm parameters (LT, LTV, liquidation bonuses, oracle source) before lending.

- Long-tail liquidity. If a token barely trades, a sudden UFT price swing can liquidate borrowers or maroon lenders. That’s not unique to UniLend, but permissionless markets make it easier to stumble into illiquid assets.

- Cross-chain confusion. Because UFT (and many ERC-20s) exist on multiple networks, swaps sometimes land on the wrong chain. Verify chain + contract every time.

Conclusion

If you’ve been hunting for a permissionless money market where any ERC-20 can get a lending market—and where you can guide your own risk—UniLend is worth a look. V2’s dual-asset, isolated-risk architecture makes “every token welcome” more than a slogan, and the UFT coin provides governance/utility hooks across Ethereum, BNB Chain, and Polygon. For traders and builders, that means you can create or join markets aligned to your thesis; for token communities, it means you can activate utility without a gatekeeper.

When you’re ready to try unilend swap or exchange UFT, keep it boring and safe: start from official links, verify the chain and contract, and test with small amounts. Permissionless power rewards careful execution—and UniLend’s design gives you the tools to do it right.