Thinking about an exchange TRX without verification? Privacy‑minded traders often look for ways to move their TRX quickly, without handing over passports or selfies. Before you jump in, remember that even widely used instant services (allow you to swap BTC to TRX in a matter of minutes) still follow regional rules. Let’s unpack what “no KYC crypto exchange” really means in 2025.

Source: https://crypto.ru/tron/

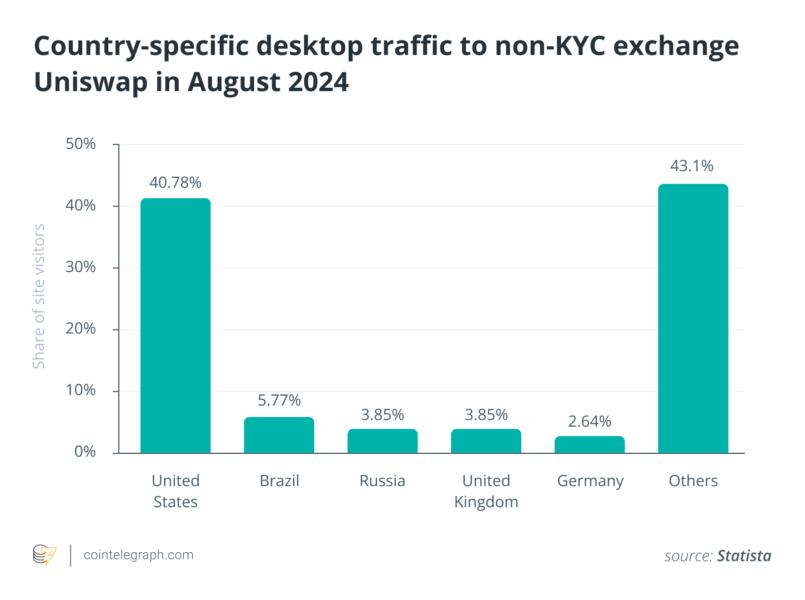

Chart showing TRON (TRX) price in USD from 2020 to 2025, with a significant rise in 2021 and fluctuations since, currently at $0.08695 with a 0.62% decrease.

What Is KYC and Why It’s Required

Know‑Your‑Customer (KYC) rules ask exchanges to collect:

- A government‑issued ID

- Proof of address

- Sometimes a short video selfie to match the documents

Regulators push these checks to stop money laundering, terrorism financing, and tax evasion. In most jurisdictions, a licensed platform that holds user funds must perform KYC once deposits cross a modest threshold (often USD 1,000–2,000). Non‑compliance can lead to fines or loss of a license, so mainstream platforms do not chance it.

Can You Really Exchange TRX Anonymously?

Short answer: yes, but only under strictly defined conditions and modest limits. The next section reveals which services still allow anonymity — and the trade‑offs involved.

Anonymous Platforms

Purely code‑based services that never touch fiat, custody, or order books offer the best shot at an anonymous TRX exchange. The main classes are:

- Decentralized exchanges (DEXs) – Platforms such as SunSwap or Uniswap (via a TRX‑wrapped token) run on smart contracts. They ask for no account and keep only on‑chain data.

- Liquidity aggregator bridges – Tools like THORChain allow you to move TRX in and out by matching native routes on the backend. Deposits and withdrawals happen at one‑time addresses.

- Peer‑to‑peer (P2P) marketplaces – You post an offer and negotiate directly with another user over an escrow smart contract. Some P2P sites now cap daily limits for non‑verified users at 1,000 USDT to stay under regulators’ radar.

Below those limits, swapping TRX no KYC remains feasible. The moment you touch fiat — bank transfer, card refill, or cash pickup — the counterparty will likely request at least a proof of identity.

Tip: Check the TRX price today before you trade. On low‑liquidity DEX pairs, thin order books can widen slippage quickly.

Legal Risks

Local law might treat anonymous conversions differently from anonymous holding. Here are common pitfalls:

- Reporting rules – In Germany and many EU states, every crypto‑to‑crypto trade must be logged for tax even if KYC was not performed.

- Source‑of‑funds questions – When you eventually cash out to fiat, the bank can freeze funds until you explain where the TRX came from.

- Travel Rule extensions – Global watchdogs are now testing blockchain analytics to flag “self‑hosted wallet” withdrawals over USD 1,000. The receiving exchange can demand KYC later, retroactively.

No KYC today does not guarantee anonymity tomorrow.

Pros and Cons of No‑KYC Exchanges

Before diving in, balance the convenience of skipping verification against the long‑term challenges. The table below maps out the key upsides and drawbacks in one glance.

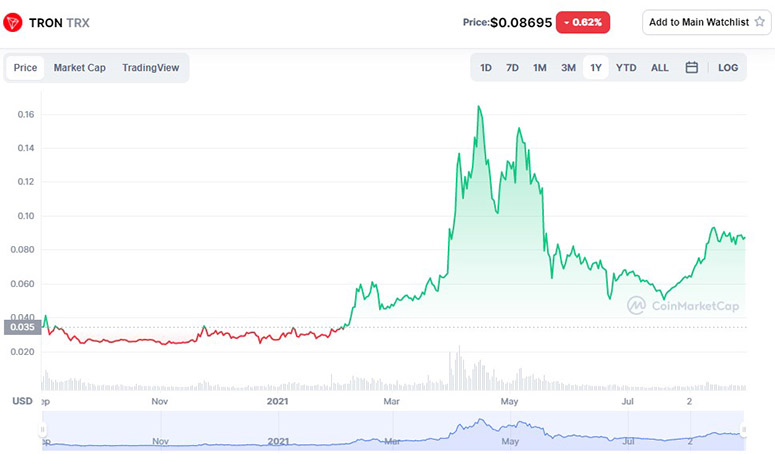

Bar chart showing country-specific desktop traffic to non-KYC Uniswap exchange in August 2024, with United States at 40.78%, Others at 43.1%, and smaller shares from Brazil, Russia, United Kingdom, and Germany.

| Factor | Upside | Trade‑Off |

| Speed | One‑step deposit — swap — withdrawal. No waiting for document review. | Smart‑contract delays, higher network fees. |

| Privacy | No central database storing your passport. | On‑chain data still public; chain analysis can trace origin. |

| Accessibility | Ideal for users in sanctions‑hit or unbanked regions. | Hard limits (typically < 2,000 USD/day) and no fiat ramps. |

| Support | No ticket queues for “document mismatch” rejections. | Limited human support; mistakes on‑chain are final. |

How to Do It Safely

If you choose the no‑KYC path, a few best practices can protect both funds and privacy. Follow the checklist below to minimise risks and keep future paperwork manageable.

- Stick to transparent smart contracts – Read audit reports; trust code you can verify.

- Limit size per swap – Keep each swap TRX without ID below the daily threshold that triggers automatic red flags (e.g., 900 USDT).

- Rotate addresses – Fresh deposit and withdrawal addresses complicate clustering attempts.

- Mind network fees – TRX network costs pennies, but bridging to other chains can be pricey.

- Keep records – Even if you sell TRX anonymously, save transaction hashes and screenshots for future tax filings.

- Check local laws – Rules differ: the US treats unreported gains harshly, while Hong Kong focuses on entities with customer funds.

For a broader look at platforms that still skip verification, skim the guide: “Exchanges That Don’t Require KYC in 2025: What You Need to Know”.

Final Thoughts

Is exchanging TRX without passport control a myth? Not entirely. DEXs, cross‑chain bridges, and low‑volume P2P trades allow you to sell TRX anonymously — within limits. The real question is whether the convenience beats the long‑term complications of tax reporting or future compliance checks.

If privacy matters most, adopt good on‑chain hygiene, keep trades small, and follow local regulations anyway. When you need larger liquidity or fiat off‑ramps, a registered exchange may still serve you better, even if that means a one‑time KYC upload.