Want your Bitcoin spending-ready on a Revolut card in minutes? The shortest path isn’t “send BTC straight to the card” (payment cards run on fiat rails). Instead, you sell BTC for fiat on a regulated platform and push that cash out to your Revolut Visa/Mastercard using instant payout rails (Visa Fast Funds/Mastercard Send) or fall back to a regular bank transfer to your IBAN. Below is a clear, source-backed guide that shows you exactly how to do an instant BTC withdrawal to Revolut, how to minimize fees, and what to watch for in 2025.

Why Withdraw BTC to Revolut?

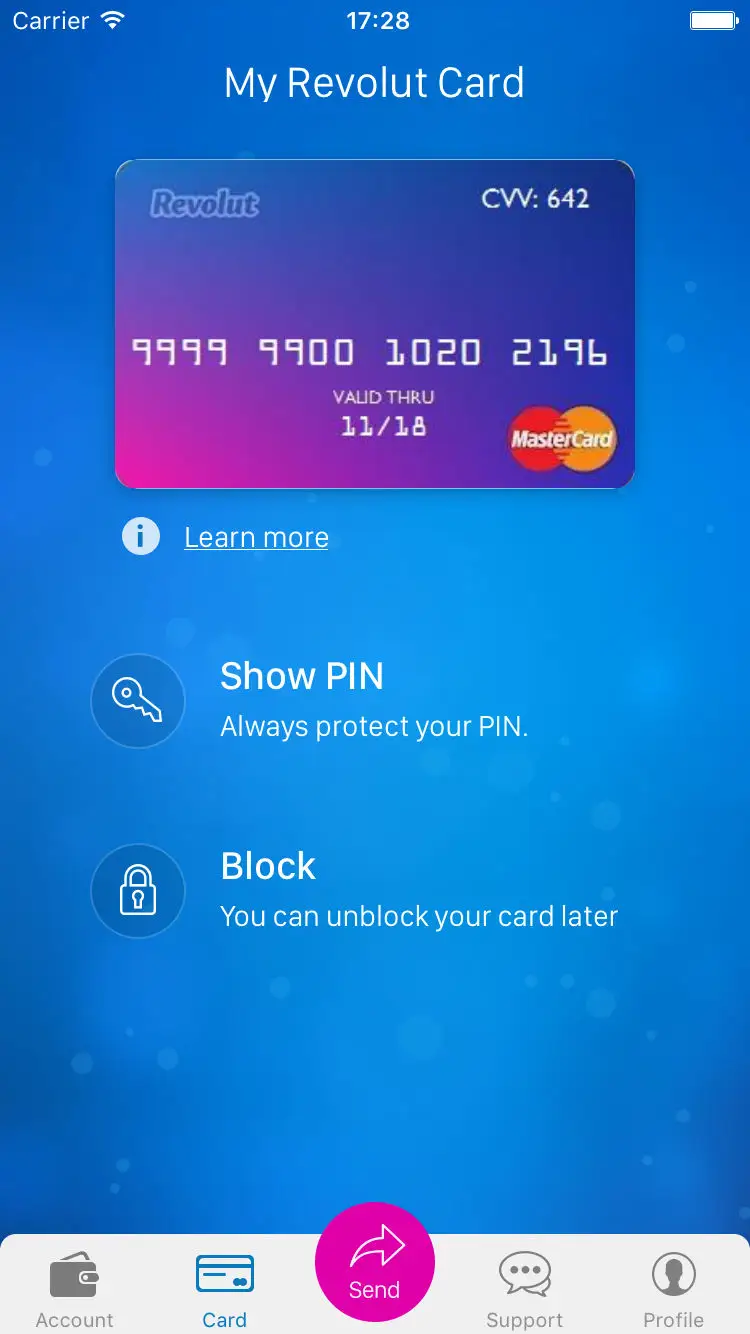

- Spend anywhere: Once cash lands in your Revolut balance, you can tap the card online/in-store, pay bills, or send bank transfers. Revolut also supports incoming transfers to your card number (card-to-card disbursements), which is precisely what instant exchange cashouts use.

- Fast settlement options: Many major exchanges now support push-to-card payouts via Visa Fast Funds/Mastercard Send, enabling near-real-time cashouts to eligible cards—exactly the thing you need for a BTC to Revolut transfer in minutes.

- Fallback rails: Even if a payout isn’t available in your region, you can always sell BTC → EUR and send the money to your IBAN via SEPA. Revolut’s help center documents standard bank transfers into your account.

Bottom line: to exchange BTC to Revolut card, you first convert BTC to fiat on an exchange, then use instant payouts (if your card is eligible) or a bank transfer to your Revolut account.

Top Methods for Conversion

Centralized Exchanges (fastest & simplest)

Coinbase – Instant Card Cashouts

Coinbase supports Instant Cashouts to Visa Fast Funds/Mastercard Send for customers in the US, UK and EU. Choose “cash out” to your card and the funds are pushed to the card number—perfect for a how to send BTC to Revolut workflow if your Revolut accepts fast-funds.

Binance – Sell/Withdraw to Mastercard (EEA)

In August 2025, Binance rolled out a sell-to-card / withdraw-to-card service across Europe using Mastercard Send, with near real-time availability. If your Revolut is a Mastercard and eligible for pushes, this route makes a BNB/BTC → EUR → card cashout effectively instant.

SEPA to Revolut (any exchange with EUR off-ramp)

If your card isn’t eligible for push payouts or you want lower fees on bigger sums, sell BTC for EUR and withdraw via SEPA to your Revolut IBAN (available on Coinbase, Kraken, OKX, Bitstamp, etc.). SEPA usually takes 1 business day. Revolut explains bank top-ups in its help center.

Compatibility tip: Revolut confirms it can receive inbound transfers to your card number—many remittance and payout services use the same rail. If your exchange supports card withdrawals, your Revolut card can usually accept them.

P2P Services (flexible, but use escrow carefully)

OKX P2P / Binance P2P

These marketplaces let you sell BTC to verified buyers who pay you by your chosen method—bank transfer to your Revolut IBAN is common. Always trade with high-rated merchants inside the escrow flow and release crypto only after funds hit your Revolut account. OKX’s help center walks through listing & adding payment methods.

OTC Desks (best for large tickets)

Institutional-style OTC desks at Kraken, Binance and Coinbase execute large orders privately with tailored settlement (wire/SEPA). Ideal if you’re moving five to seven figures where slippage matters more than speed; most desks won’t push to card, so expect a bank transfer into Revolut.

How to Choose a Safe Exchange

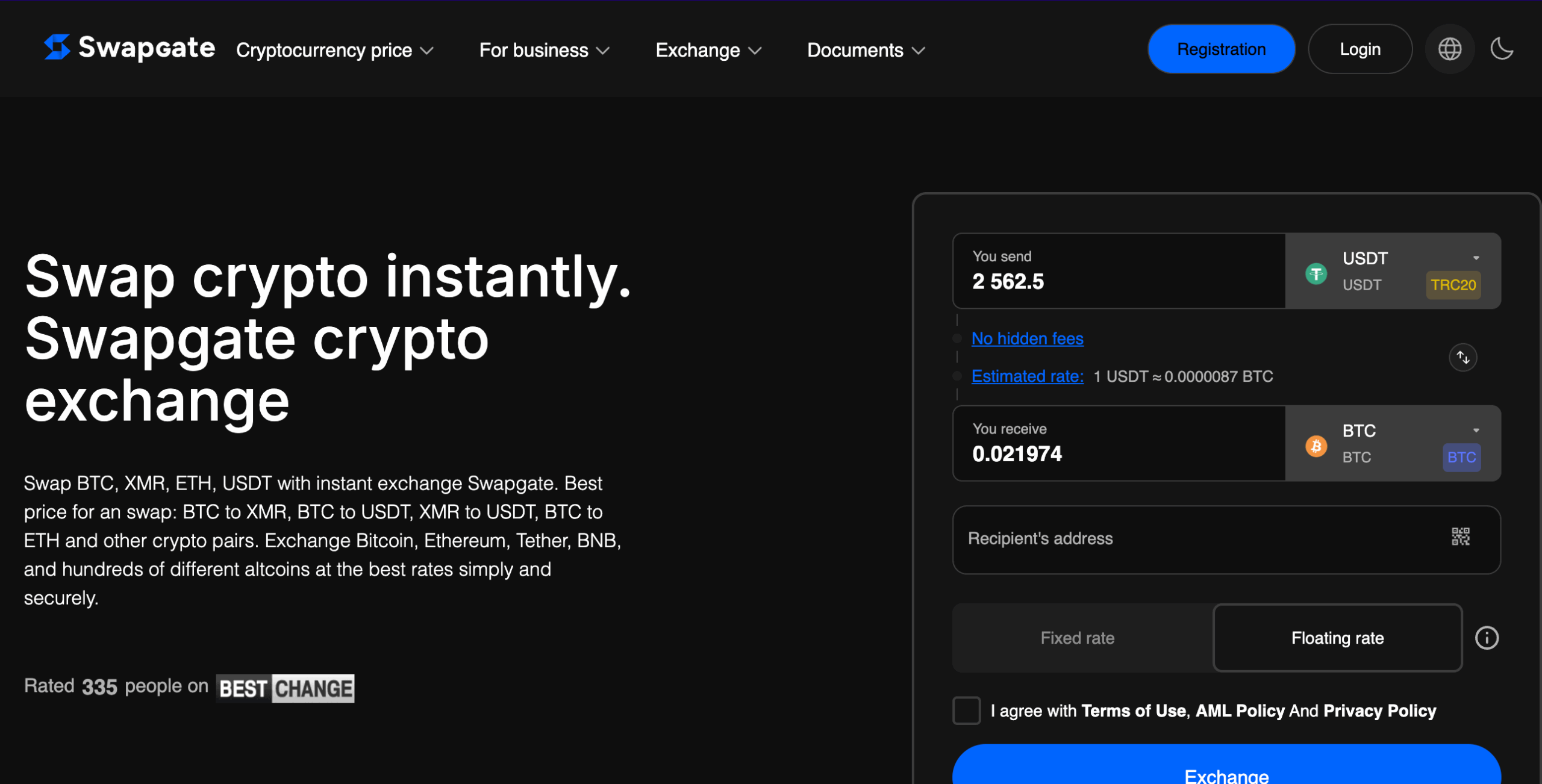

Source: Swapgate’s main page with exchange window

- Payout rail support: Check whether the platform supports card cashouts (Visa Fast Funds/Mastercard Send) in your country. Coinbase and Binance both publish eligibility; Revolut confirms it can receive card transfers.

- Licensing & reputation: Prefer top-tier platforms with clear compliance and support. (Coinbase, Kraken, Bitstamp, OKX all maintain detailed help centers and regulated fiat rails.)

- Fees & limits: Compare trading spreads, cashout fees, and daily/monthly caps. Revolut also has its own plan-based limits and transfer rules—check the current fee page before big moves.

- Card scheme: Visa vs Mastercard matters for which instant rail is used. Exchanges will show you only the cards they can pay out to; if yours isn’t eligible, switch to SEPA.

Step-by-Step Instructions

Register & Verify

Create an account on your chosen platform (e.g., Coinbase or Binance) and complete KYC. You can’t withdraw BTC to Revolut without verification on reputable platforms. (Check each site’s onboarding page.)

Add Card Details (or Revolut IBAN)

- For instant card cashouts: Add your Revolut card as a payout method inside the exchange. Coinbase uses Visa Fast Funds/Mastercard Send; Binance offers sell/withdraw to Mastercard in the EEA. Your Revolut card must accept inbound transfers (it typically does).

- For SEPA: Add your Revolut IBAN (found in your Revolut app) as a bank beneficiary on the exchange for EUR withdrawals.

Complete the Swap

- Sell BTC → EUR (or your card’s currency) on the exchange.

- Choose Withdraw → Card (instant) or Withdraw → Bank (SEPA).

- Confirm the amount and fees; submit. Card payouts usually arrive in minutes; SEPA lands next business day.

If your card payout fails (region or scheme issue), just re-run the withdrawal to your Revolut IBAN instead. Revolut supports standard bank top-ups.

Tips for Lower Fees

- Pick the right rail for the right size: Instant cashouts are great for speed, but larger sums often cost less via SEPA. If you don’t need seconds-level settlement, bank transfer wins on Bitcoin price.

- Watch exchange spreads: Sometimes converting BTC → EUR with a limit/market order on spot can beat “quick sell” spreads. Check the order book. (Each exchange publishes a fee schedule.)

- Know your plan: Revolut’s exchange and transfer fees can vary by plan and day; review the live Personal Fees page before converting currencies inside Revolut.

- Keep it compatible: Visa Fast Funds and Mastercard Send are the exact rails enabling “arrives-in-minutes” payouts; make sure your card and region support them.

Common Mistakes to Avoid

- Trying to send BTC directly to the card: they hold fiat; sending crypto to a card number won’t work. Always sell BTC first, then cash out. (Revolut’s own crypto help covers sending crypto to external wallets—different flow.)

- Releasing P2P escrow too early: On P2P, release crypto only after the money shows in your Revolut balance. Use high-rated merchants and the platform’s chat/appeal tools if anything looks off.

- Ignoring payout eligibility: Some cards aren’t enabled for instant pushes in certain countries. If your BNB/BTC → card withdrawal is rejected, switch to SEPA.

Conclusion

You have two reliable routes for a BNB/BTC → EUR → Revolut cashout:

- Instant card payout (fastest): Sell BTC on a major exchange and cash out to your Revolut via Visa Fast Funds or Mastercard Send. Coinbase supports instant cashouts in the US/UK/EU, and Binance added near real-time Mastercard withdrawals across Europe in 2025. Revolut confirms its cards can receive inbound transfers, so compatibility is usually smooth.

- SEPA to Revolut IBAN (often cheaper for larger amounts): Sell BTC for EUR and withdraw to your Revolut IBAN. Slower than card, but fees are typically lower and limits are higher.

If your goal is to convert BTC to fiat on Revolut card with minimal friction, start with the card-payout option; if your card or region isn’t supported, default to SEPA. Either way, stick to reputable platforms, verify fees up front, and you’ll withdraw BTC to Revolut without worries—often in a few minutes.