In one step, you can swap ETH to BTC and you’ll see right away how much the network and service fees add up, aka crypto fees that nibble at every move. This guide explains what drives crypto transaction fees on-chain and on exchanges, then gives you a practical, beginner-friendly framework to keep more of your money on every trade.

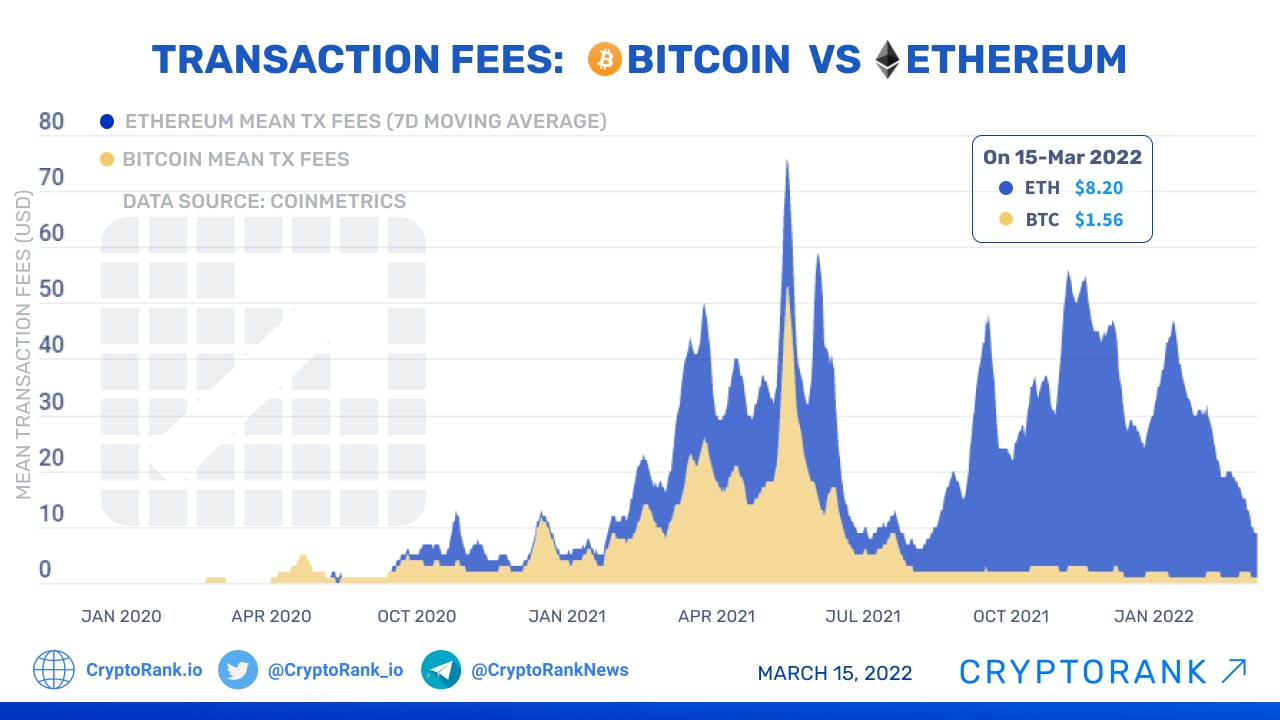

Graph of Bitcoin vs Ethereum mean transaction fees, 2020–2022. Source: Cryptorank

Why Fees Happen

Every crypto trade can include two layers of costs: the network fee paid to miners/validators and the platform fee for executing the swap. On top of that, spreads and slippage silently take a bite out of your result. If you’re moving funds between chains or venues, withdrawal and deposit fees can stack up fast. In other words, cryptocurrency transaction fees arise both from base-layer demand and from the economics of the venue you use.

Quick rule of thumb: treat fees like “friction.” Your job is to reduce friction at each step, network, venue, and timing.

Step 1: Pick the Right Chain and Timing

Not all blockchains are equal during peak hours. When activity spikes, base layer fees rise. Two simple wins:

- Avoid rush hour. Fees often cool down at off-peak times. If you don’t need instant settlement, wait for quieter periods.

- Use efficient rails for transfers. Stablecoins on lower-cost networks can be a smart “bridge” compared to moving a volatile coin directly.

- If you track Bitcoin price today, you’ll notice that price moves can correlate with network congestion, another reason to time your on-chain actions.

- Pro tip: batch actions. Instead of multiple small transfers, one well-planned move typically saves more than it risks, especially when wallets charge per transaction. If your goal is the “cheapest transaction fee crypto” route, confirm that the full path (including bridges and extra swaps) really reduces your total cost.

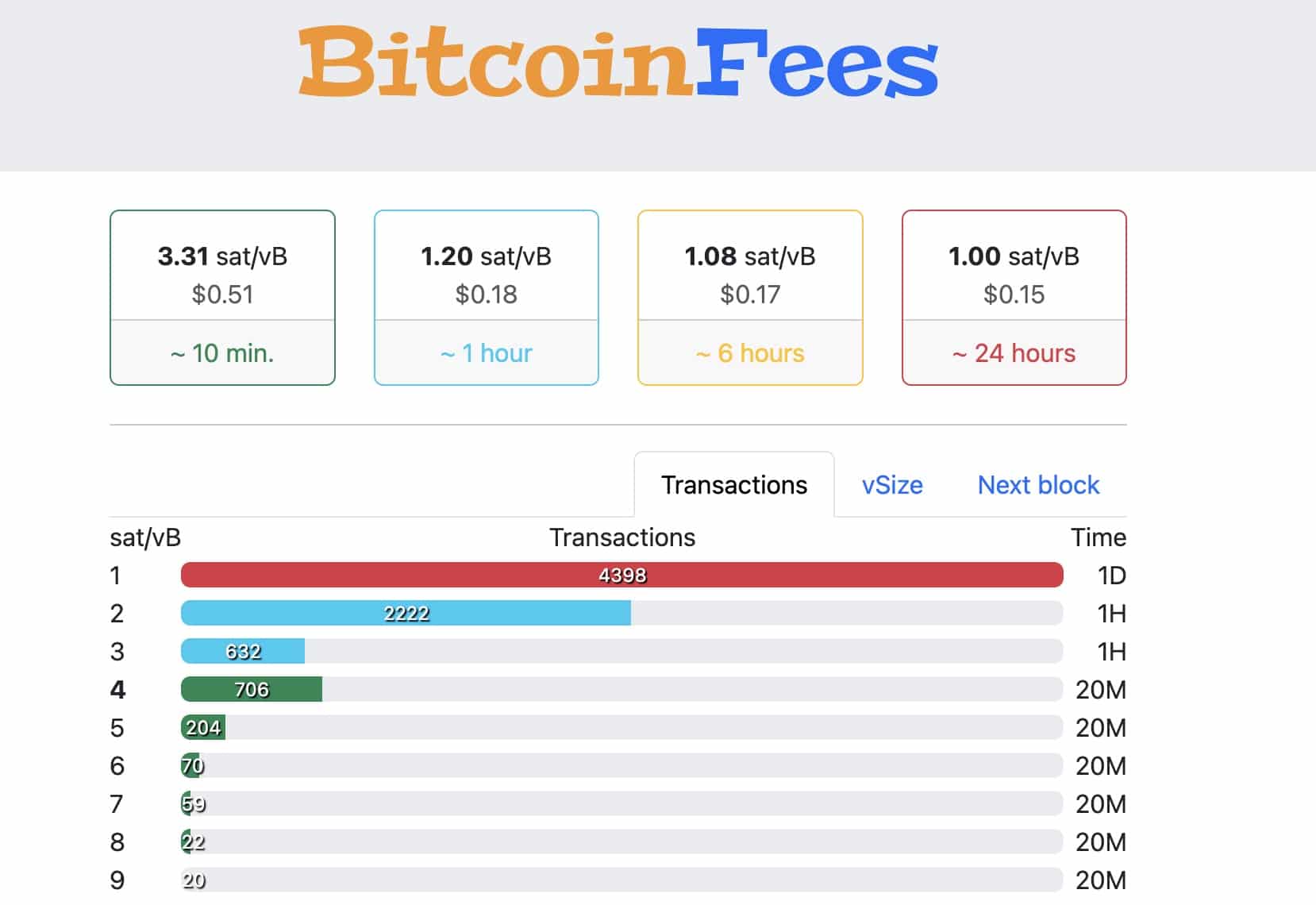

BitcoinFees dashboard showing current sat/vB estimates and confirmation times. Source: 99 Bitcoins

Step 2: Choose Venues With Transparent Pricing

Some platforms advertise 0% trading but recover margins through spreads, withdrawal fees, or slow settlement. Evaluate total cost, not just a single headline number. Look for venues known for the best crypto exchange fees, but always verify the spread and execution quality.

- Check displayed network fee vs a live estimate in your wallet.

- Compare the quoted rate to a reference price; a wide spread can dwarf a “low-fee.”

- Prefer venues that show the full breakdown before you confirm.

A low fee crypto exchange is only “low-fee” if the all-in cost (spread + platform + network) is competitive after your coins land where you need them.

Step 3: Reduce On-Chain Hops

Every extra address you touch is another network fee. Common ways to trim hops:

- Swap directly into the coin you actually need instead of doing A to B to C.

- Use one venue for both swap and withdrawal when possible.

- Pick the right pair to avoid double-fees.

If you simply want to fund a BTC-denominated wallet from ETH, a single routed exchange is almost always cheaper than two separate swaps plus a transfer, and it also avoids paying an extra Bitcoin transfer fee.

Step 4: Calibrate Speed vs Cost

Most wallets let you choose priority. Unless you truly need first-block confirmation, “standard” often clears quickly and costs less. For assets like BTC, paying a premium only makes sense when timing is critical. For BTC specifically, the posted Bitcoin transaction fee (sometimes referred to as the BTC transaction fee) fluctuates with mempool demand and your chosen priority.

- Speed tiers: economy for routine moves, standard for same-hour settlement, priority only for time-sensitive transfers.

- Use RBF (replace-by-fee) when available, start cheaper; bump only if necessary.

Step 5: Mind Spreads, Slippage, and Liquidity

A tight spread and deep liquidity matter as much as posted fees. On volatile pairs, set a limit (or max slippage) instead of market-buying into a thin order book. If your order is large, break it into tranches that the market can absorb.

- Check depth. If a small order moves the price, you’ll pay in slippage.

- Use firm quotes. Prefer quotes that lock for short windows so sudden volatility doesn’t sneak in an extra tax.

Step 6: Keep Custody Costs Low

Moving coins between your own wallets is still subject to network fees. Consolidate UTXOs occasionally on UTXO chains (like Bitcoin) when fees are low, future transactions then cost less because there’s less data to spend. When fees are calm — check the Bitcoin average transaction fee, it’s a good time to consolidate.

Also, decide where to hold assets. If you swap often, parking a portion in a hot wallet can save repeated withdrawals.

Where Your Biggest Savings Usually Come From

Before you start cutting pennies, step back and rank your opportunities. Most traders overspend not because fees are “high,” but because their route and timing are inefficient. Use the checklist below as a quick triage: tackle the highest-impact items first, then fine-tune the rest.

- Timing (off-peak confirmations): medium effort, high impact.

- Route selection (fewer hops): low effort, high impact.

- Venue transparency (spread + fee): medium effort, high impact.

- Priority setting (don’t overpay for speed): low effort, medium impact.

- Order method (limit vs market on thin books): medium effort, medium–high impact.

Practical Walkthrough: ETH to BTC With Fewer Fees

Let’s say you’re rotating part of your portfolio:

- Pick a direct pair. Instead of ETH to USDT to BTC, go straight ETH to BTC to eliminate one network fee and one spread hop.

- Choose standard speed. Unless you’re racing a price spike, standard priority typically clears at a significantly lower cost than “priority.”

- Withdraw once. If you must move to a self-custody wallet, send BTC only after the swap completes to avoid two withdrawals.

FAQ

How do I compare platforms without getting misled by marketing?

Calculate the all-in cost: (quote vs reference price) + platform + network + withdrawal fee. Screenshots and a small spreadsheet help you track.

Is it worth bridging to a cheaper chain first?

Only if the total, including bridge and extra swaps — is lower. Sometimes a single direct on-chain move beats a multi-step “cheap chain” detour.

What if a transfer seems stuck?

Use tools like RBF (where available) to bump the fee instead of overpaying up front. Patience during congested periods often pays.

Learn as You Go

If you’re unsure when to store funds vs when to keep them on an exchange, this guide clarifies the trade-offs: “Crypto Wallet vs Crypto Exchange: What’s the Difference?”. Understanding custody and venue choice is a direct path to fewer mistakes, and lower costs.

Wrap-Up

You don’t need to chase exotic tools to cut costs, timing, route choice, and transparent quotes already deliver most savings. For portfolio rotations, do fewer on-chain hops and avoid paying for speed you don’t need. When you do need to change assets, a direct route like ETH to BTC keeps the fee stack lean.