Tokenized assets are basically a way to put real-world value into a digital package. Imagine owning a tiny slice of a downtown apartment, a piece of a fine-art print, or a share of a private fund — but instead of piles of paperwork and slow settlement, your ownership is tracked by a token on a blockchain. That makes buying, selling and dividing ownership a lot easier. But it’s not just magic: there are legal contracts, custodial arrangements and market rules behind every token, so you can’t treat the blockchain entry as a substitute for the legal paperwork — at least not yet. This guide will walk you through what is tokenization of assets in simple terms, show how asset tokenization works step-by-step, and give practical next steps if you want to exchange crypto for tokenized products or build your own token program.

What are tokenized assets — a plain definition

A tokenized asset is a digital representation — a token — that encodes ownership rights or entitlement to revenues from an underlying real-world asset. The token lives on a blockchain, while legal ownership is usually enforced off-chain through a legal wrapper (a special-purpose vehicle, trust or contract). This separation is deliberate: the token gives you tradability and programmability on-chain, while the legal wrapper makes the claim enforceable in courts and regulated markets. International institutions call this “the next generation of value exchange.”

Why tokenization of real world assets is catching on

Source: Newwebsite

Tokenization promises three big advantages:

- Fractional ownership — expensive assets (commercial real estate, art, private equity) can be split into bite-sized tokens so more investors can participate.

- Faster settlement and lower friction — transfers and corporate actions can execute on-chain, reducing multi-day settlement cycles and reconciliation headaches.

- Programmability and composition — tokens can embed rules (automated payouts, compliance checks, vesting) and integrate with DeFi primitives if allowed.

Central banks, industry groups and big consultancies see tokenization as a serious structural trend — it can increase market access and efficiency if governance, custody, and legal frameworks are solved.

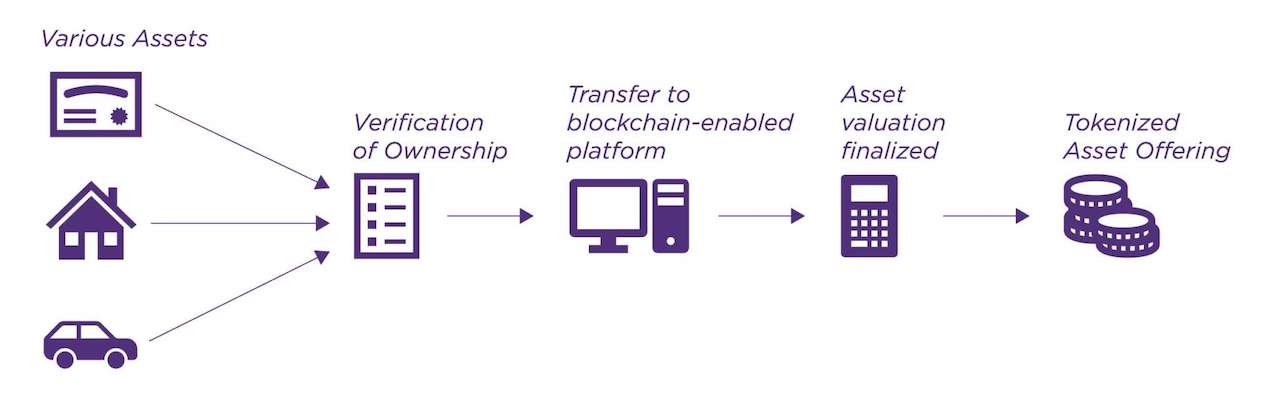

How asset tokenization works — the typical lifecycle

Source: Github

A tokenized asset program usually follows these steps:

- Legal structuring. The issuer creates a legal vehicle that owns or represents the real asset (for example, a SPV holding a building or a fund holding bonds). The legal documents define rights, distributions and redemption mechanics. This is essential because blockchain entries alone don’t replace legal title in most jurisdictions.

- Token issuance on blockchain. The issuer mints tokens (often as security tokens or compliant ERC-20/ERC-1400 variants) that map to ownership stakes. Standards and smart-contract features can add restrictions like whitelisting or transfer limits. Platforms such as Securitize and Tokeny provide turnkey issuance tooling.

- Custody and reserve assurances. For asset-backed tokens (e.g., tokenized debt or fiat instruments), custodians and trustees hold the underlying assets or reserves. Audits and transparency reports are critical to build trust.

- Secondary trading and settlement. Tokens trade on regulated alternative trading systems, token marketplaces, or institutional venues that comply with securities laws. Settlement occurs on-chain almost instantly, while legal settlement remains aligned with the issuer’s documents.

Where tokenized assets trade — and how to buy them

If you want to exchange crypto for tokenized assets or simply buy tokenized products, the usual channels are:

- Licensed token marketplaces (for example, platforms built by tokenization providers and regulated ATSs).

- Specialized exchanges that list compliant tokenized funds or securities.

- Institutional dealers and platforms offering private-placement tokenized shares for accredited investors.

Because tokenized assets are often securities in many jurisdictions, buying them typically requires KYC/AML and compliance checks. Always verify the platform’s legal status and whether the token is freely transferable in your jurisdiction.

Use cases: where tokenization is already useful

- Real estate: Tokenized property shares let investors receive rent distributions on-chain and trade fractional ownership more easily. Industry forecasts suggest major growth in tokenized real estate if the plumbing matures.

- Debt & funds: Tokenized short-term debt, money-market funds and tokenized fund shares can improve liquidity and settlement efficiency for institutional investors. Several pilots from banks and asset managers show practical interest.

- Commodities & collectibles: Tokenizing commodities or expensive collectibles helps fractionalize value and open up markets to smaller investors.

Risks and why adoption is not automatic

Tokenization has real promise, but it’s not frictionless. Key obstacles are:

- Legal and custodial complexity. The token is only as reliable as the legal structure and custodian behind it. Weak legal frameworks create counterparty risk.

- Liquidity fragmentation. If every bank or platform issues its own token, liquidity splinters; market makers and bridges will be needed to keep conversion efficient. Reuters and others have noted that banks’ tokenization rollouts have been slower than early hype suggested.

- Regulatory scrutiny. Securities, AML, and investor-protection rules apply. Regulators are actively studying tokenization, and compliance burdens can be significant.

Practical checklist — how to evaluate a tokenized asset

- Legal docs first. Read the offering memorandum: what exactly does the token represent and what are redemption rights?

- Who holds the asset? Check custody arrangements and the auditor’s reports. Reputable custodians and regular audits matter.

- Where it trades. Is there a regulated secondary market or is liquidity limited to the issuer’s platform?

- Tax and jurisdictional implications. Tokenized ownership can create reporting and tax events—get local advice.

- Smart-contract audits. Ensure the token contracts and any marketplace code are audited and open to review.

The near-term outlook

Think of tokenization like a slow-moving wave: a lot of people see it coming and big firms are getting their surfboards ready. Banks and industry reports expect tokenization to pick up first in straightforward areas like real estate and short-term debt, where the benefits are easy to prove. Consultants are optimistic too — but they’re clear that the real boom depends on a few practical pieces falling into place: solid legal paperwork, trustworthy custody, and systems that actually talk to each other. Adoption won’t be uniform — some asset types and regions will move quickly, others will lag — and for a long time we’ll live in a hybrid world where tokenized rails sit alongside, rather than replace, the old systems.

Final thought

Tokenization feels like a practical remix of old finance with new tech: the speed and flexibility of blockchains married to the legal guardrails of traditional markets. When done right — with a solid legal wrapper, trusted custody and transparent audits — tokenized assets can unlock new investors, speed up settlement, and make illiquid things tradeable in smaller pieces. But because the idea mixes law, markets and code, the real winners will be the projects that pay attention to all three. If you’re curious, start small: read the legal docs, check custody arrangements, and try a tiny investment to learn how the whole flow works. Done thoughtfully, tokenization can be a real upgrade; done carelessly, it’s just a ledger entry.