For a decade, privacy coin projects have pushed the frontier of on-chain confidentiality—hiding who sent what to whom without sacrificing public verifiability. In 2025, that mission is both more relevant (surveillance is rising) and more complicated (rules are tightening). This guide explains what are privacy coins, how these coins work, and offers a curated list of privacy coins showing real traction this year—plus how to evaluate them for your own needs.

What exactly is a privacy coin?

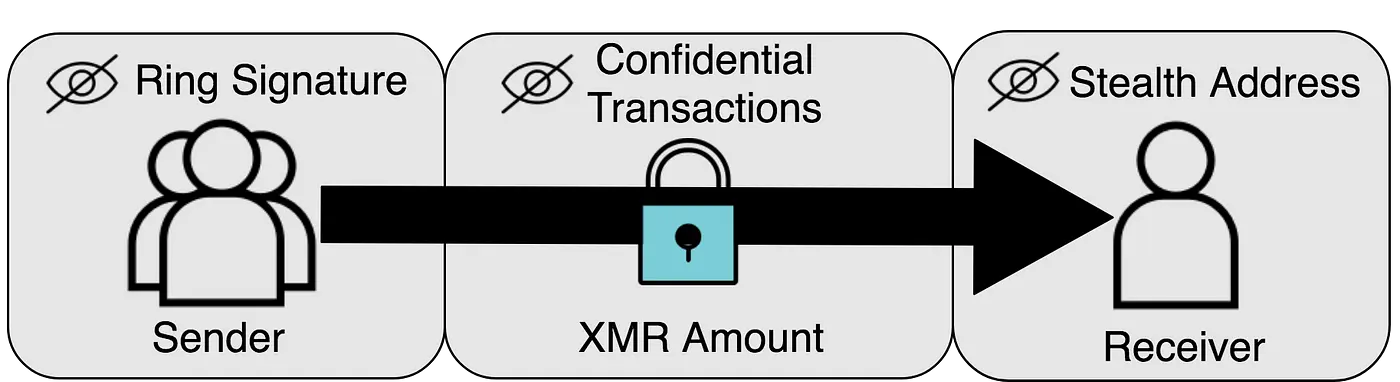

A privacy coin is a cryptocurrency that uses cryptography to conceal sender/receiver identities and often transaction amounts. The goal is cryptocurrency privacy that approaches cash-like fungibility. Unlike mixers, these coins typically make confidentiality the default at the protocol level. Projects differ in how they achieve it:

- Ring signatures & stealth addresses (Monero): the sender hides among a crowd (“ring”), and the receiver uses a one-time address so observers can’t link payments. Amounts are hidden with RingCT/Bulletproofs.

- zk-SNARKs (Zcash): zero-knowledge proofs let you prove a transaction is valid without revealing parties or amount. Modern Zcash uses the Orchard shielded pool and Unified Addresses so privacy works by default without a trusted setup.

- Mimblewimble (Beam): confidential transactions plus cut-through pruning; Beam extends this with Lelantus-MW to strengthen anonymity sets.

- Lelantus Spark (Firo): burn/redeem style privacy with large anonymity sets and view keys for optional transparency.

These design choices drive usability, performance, and compliance footprints—key to judging the future of privacy coins.

How do privacy coins work?

Source: Redot

- Hiding the sender: Ring signatures (Monero) or membership proofs (Lelantus/Spark) make it computationally ambiguous which key was actually signed.

- Hiding the receiver: One-time or stealth addresses ensure each payment lands at a fresh, unlinkable destination.

- Hiding the amount: Range proofs such as RingCT/Bulletproofs (Monero) or zk-SNARK circuits (Zcash/Orchard) prove amounts are valid without revealing them.

- Selective disclosure: Many systems support view keys so a user can show an auditor their incoming (and sometimes outgoing) activity without giving spend access—useful for compliance. (Monero, Zcash, and Firo all support variants of this.)

Top privacy coins to watch in 2025

Source: Binance

This isn’t an exhaustive list of privacy coins, but it highlights the top ones with meaningful tech progress or adoption in 2025. “Best” depends on your use case (payments, DeFi bridges, cross-chain), so weigh features against your needs.

1) Monero (XMR): battle-tested default privacy

Monero remains the canonical “always-on” privacy coin: ring signatures + stealth addresses + RingCT hide sender, receiver, and amount by default. Moneropedia remains the best technical entry point for how its ring signatures and view keys work.

Why it’s promising in 2025: The project continues to research upgrades like Seraphis/Jamtis (a redesign of the transaction model to improve privacy and scalability) and other proof system refinements. The public roadmap tracks ongoing work from the Monero Research Lab and contributors.

Caveat: Exchange access can be tougher in some regions. For example, Kraken delisted XMR in the EEA citing regulatory changes—one sign of the policy headwinds privacy coins face. Self-custody remains straightforward.

2) Zcash (ZEC): zk-SNARK pioneer with “shielded by default” UX

Zcash introduced mainstream zero-knowledge privacy with shielded transactions. The NU5 network upgrade moved Zcash to the Halo 2 proving system (no trusted setup) and brought Unified Addresses to simplify usage across pools.

Why it’s promising in 2025: Unified Addresses and wallet improvements aim to make “what is the best privacy coin” a usability question, not just a cryptography one. ECC’s docs go deep on unified addresses and viewing keys for selective disclosure.

Caveat: Zcash supports both transparent and shielded addresses; if you want privacy, stick to the Orchard shielded pool and follow ECC’s privacy best practices.

3) Firo (FIRO): modern protocol design with Spark

Formerly Zcoin, Firo built Lelantus and now Lelantus Spark, aiming for large anonymity sets and flexible, auditable privacy via incoming/full view keys. The 2025 roadmap adds Spark assets and better view-key tooling for “watch-only” or auditing use cases—useful in a world demanding optional transparency.

Why it’s promising in 2025: Active R&D, modular cryptography, and explicit compliance-friendly features (view keys) without a trusted setup.

4) Beam (BEAM): Mimblewimble plus Lelantus-MW

Beam implements Mimblewimble (confidential transactions + cut-through) and extends it with Lelantus-MW to mitigate linkability across blocks—strengthening default privacy in a lightweight chain. Its docs and PDFs are a solid primer on the hybrid.

Why it’s promising in 2025: A balanced approach: compact chain state, confidential values, and evolving cryptography to widen anonymity sets.

5) Namada (NAM): the “privacy layer” for many chains

New this year: Namada, a Cosmos-based L1 built to provide shielded transfers and “composable privacy” across ecosystems. In June 2025 it completed its mainnet rollout, positioning itself as a multi-chain privacy hub with “shielded swaps.” Think of it as privacy infrastructure rather than a payment coin alone—this is where a new privacy coin can differentiate in 2025.

Why it’s promising in 2025: If cross-chain activity is part of your workflow, Namada’s design (and its early roadmap) may be more future-proof than a single-chain coin.

Where regulation stands

Whether you’re holding Bitcoin or just testing a wallet, know the rules. Several jurisdictions have pressured centralized exchanges to drop privacy coins; the most visible recent example is Kraken’s XMR delisting in the EEA. South Korea has explicitly banned privacy coins from exchanges since 2021. Japan pushed exchanges to delist privacy coins as far back as 2018. If you rely on CEX liquidity, this affects on/off-ramps and pricing.

This doesn’t make privacy coins illegal everywhere; it does mean you should plan for self-custody and sometimes DEX routes. It also elevates the importance of view keys: Zcash, Monero, and Firo all support selective disclosure for audits or tax prep.

How to choose: a practical framework

If you’re comparing the best crypto privacy coins or deciding what is the best privacy coin for your situation, use this checklist:

- Default privacy vs. opt-in

- Monero: default private. Zcash: can be private (use shielded addresses, Orchard pool). Firo/Beam aim for defaults too.

- Cryptography & maturity

- Ring signatures (Monero), zk-SNARKs (Zcash), Mimblewimble (Beam), Lelantus/Spark (Firo), shielded cross-chain (Namada). Prefer audited, well-documented systems.

- Selective transparency

- Do you need to prove balances or share histories? View-key support varies; Zcash and Firo offer flexible options, and Monero supports view-only scanning for incoming funds.

- Ecosystem & UX

- Wallet quality, mobile support, exchange/DEX access, and tooling matter as much as math. Zcash’s Unified Addresses help here; Monero and Firo have active wallet ecosystems; Namada targets cross-chain privacy needs.

- Regulatory exposure

- If you must use a particular exchange, check listings first (e.g., Kraken’s EEA stance on XMR). Expect more KYC/AML frictions on CEXs; plan for self-custody.

Quick start: staying private without getting burned

- Use the right address type. On Zcash, Unified/Orchard addresses protect you; transparent addresses don’t. On Monero, everything is shielded by default.

- Mind your network layer. Zcash warns that IP metadata can deanonymize flows; consider Tor/VPN and good wallet hygiene.

- Keep receipts (privately). If you might need to disclose, pre-plan view key access rather than exposing your whole wallet.

- Verify claims. Read project docs (Moneropedia, Zcash spec, Beam/Firo docs) before trusting blog summaries—especially around “mixing,” “zk,” or “Mimblewimble.”

The future of privacy coins in 2025 and beyond

Privacy tech is getting more usable (Zcash’s Unified Addresses), more scalable (Monero’s planned Seraphis/Jamtis work), and more composable (Namada’s cross-chain shielded transfers). At the same time, policy pressure is real: some exchanges are limiting access, so the winning experiences will be wallet-first, self-custody, and auditor-friendly (via view keys and selective disclosure).

If you want a quick mental map of the top privacy coins today:

- Monero for default, cash-like payments;

- Zcash for zk-SNARK sophistication and improving UX;

- Firo for modern protocol design with flexible view keys;

- Beam for Mimblewimble efficiency with Lelantus-MW;

- Namada as a new privacy coin (and chain) oriented to cross-chain confidentiality.

Choose based on your threat model and tooling, not hype. Privacy is a feature, not a price narrative.