Whether you hold coins on several exchanges, keep a hardware wallet for long-term storage, or experiment with DeFi, your balances can get scattered fast. Before we jump into a checklist, here’s the core idea: build one clean “source of truth” that ingests all your accounts automatically, and a lightweight routine you’ll actually follow. When you rebalance between assets, do it quickly and transparently, if you need to rotate positions (say, to diversify privacy risk), you can exchange BTC to XMR in minutes and then sync the new balances into your tracker in the same session. That way, execution and reporting stay in lockstep.

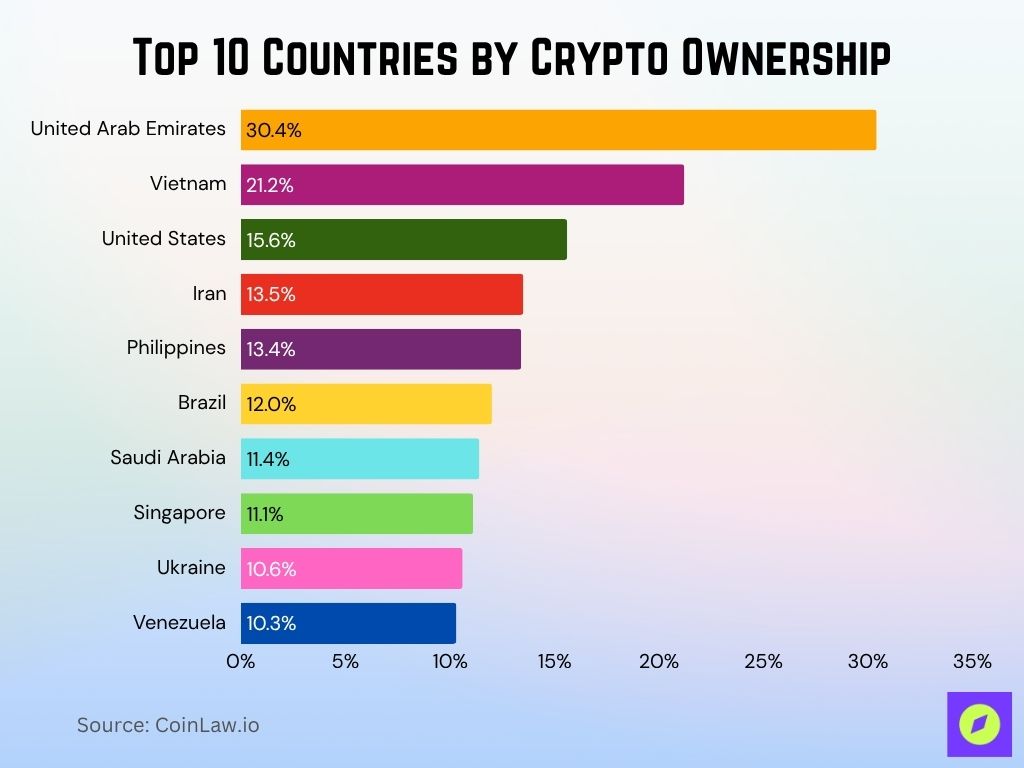

UAE leads the top ten countries by crypto ownership. Source: Coinlaw

What a reliable multi-platform workflow looks like

A good setup starts with a crypto portfolio tracker that connects to your exchanges via API and to your self-custody wallets via public addresses or a wallet bridge. The tracker should normalize coin tickers (ETH vs WETH), net out internal transfers, and tag staking rewards or mining income. You’ll complement this with a tiny “control spreadsheet” (two tabs tops) to note edge cases, OTC deals, or layer-2 bridge receipts that automated importers sometimes miss.

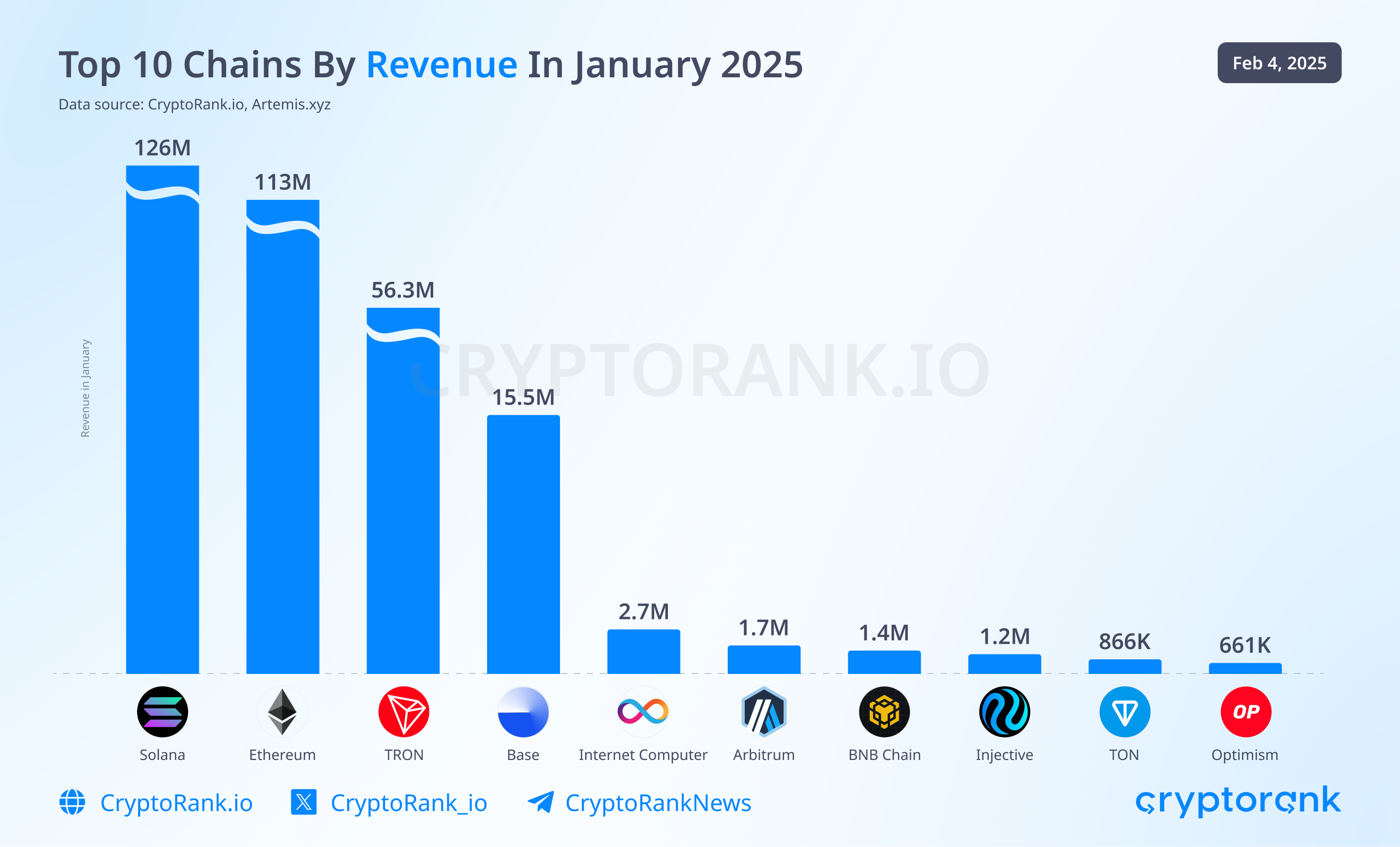

Top 15 chains by daily active addresses, January 2025. Source: Cryptorank

Must-have features

Before you commit to any tracker, sanity-check for these essentials. They prevent double-counting, keep your PnL consistent, and cut weekly maintenance from hours to minutes.

- Auto-sync from CEX + wallets: Eliminates manual typing and errors.

- Transfer recognition: Stops double-counting when you move funds.

- Cost basis + PnL modes: FIFO/LIFO/average, pick one and stick to it.

- Smart tagging: Distinguish deposits, rewards, fees, and airdrops.

- Export options: CSV/JSON for your accountant or tax tool.

- Alerts: Price, allocation drift, and large inflow/outflow notices.

If you prefer an all-in-one crypto portfolio management platform, make sure it supports your exact exchanges, chains, and tokens, not just the big ones. Multi-chain support (L2s, sidechains) and NFT visibility can be crucial if you’re active beyond spot.

Step 1: Map every account and address you’ve touched

List your exchanges (including old ones), hardware/software wallets, DeFi protocols, and layer-2s. Create read-only API keys for exchanges and paste wallet addresses into your tracker. This step alone surfaces “forgotten” balances and straggler dust.

Quick sanity check: if you hold XMR, bookmarking a price page like Monero price today makes rebalancing decisions faster when volatility spikes.

Step 2: Clean your data

Tag internal transfers, so they don’t inflate PnL. Merge duplicate tickers. Mark legacy coins as “archived” instead of deleting, history is gold for audits.

Avoid common pitfalls:

- Mixing stablecoins with different pegs/risks under one symbol.

- Treating staking redelegations as income.

- Forgetting bridge wrappers (e.g., moving assets to a rollup).

Step 3: Standardize cost basis and tax lots

Pick a single cost-basis method and document it in your control sheet. If you realize gains frequently, schedule a monthly “lot review” to harvest losses or trim winners. Consistency here keeps your cryptocurrency portfolio tracker in sync with whatever tax tool you use later.

Step 4: Set a cadence you’ll actually keep

Consistency beats intensity: a light, repeatable routine keeps your data fresh without burning you out. Start with the rhythm below and tweak it only if you miss steps two weeks in a row.

- Daily (5 minutes): Glance at total equity and drift vs target allocation.

- Weekly (15 minutes): Review alerts, tag any odd transactions, and rebalance tiny deviations.

- Monthly (30–45 minutes): Export PnL, snapshot allocations, and archive notes on big moves.

That rhythm turns crypto portfolio tracking from a chore into muscle memory.

Step 5: Rebalance and document in one pass

When you swap assets, finalize the trade and immediately refresh your tracker so the ledger and reality match. For example, rotating ETH profits into BTC? Execute the trade, capture the fee, refresh the API sync, and note the reason in your control sheet. The same applies if you exchange ETH to BTC — execute, sync, and tag, in that order. (If you already used a service link above, keep this as your working example without adding extra links.)

How to compare tracking methods

Below is a quick, practical comparison, no vendor hype.

Spreadsheets:

- Pros: Free, fully customizable, transparent math.

- Cons: Manual, error-prone, poor at multi-chain reconciliation.

- Best for: Archival snapshots and bespoke formulas, not best for tracking crypto portfolio day-to-day if you trade often.

Dedicated apps:

- Pros: APIs, labeling, alerts, mobile access; a good Bitcoin portfolio tracker can be perfect for BTC-first stacks.

- Cons: Coverage gaps for niche chains, occasional API throttling.

Aggregator dashboards (power-user):

- Pros: Combine on-chain indexing, CEX APIs, and DeFi positions; can act as your crypto portfolio management platform.

- Cons: Setup time, learning curve, and you still need that tiny control sheet.

If your holdings are Bitcoin-heavy with rare rebalances, a focused Bitcoin portfolio tracker might be enough. If you’re chain-agnostic and active, lean toward an aggregator plus that minimalist control sheet.

Practical mini-playbook

How to track crypto portfolio without chaos:

- Connect every CEX by read-only API; paste every wallet address.

- Tag transfers and wrappers; merge duplicate tickers.

- Choose FIFO/LIFO/average; document the choice.

- Set daily/weekly/monthly review blocks.

- Rebalance and immediately resync; write one-line reasons.

FAQs

What’s the best way to track crypto portfolio?

Use a tool that auto-syncs every account you use, plus a tiny control sheet for edge cases; then follow a fixed review cadence. Automation for 95% + a manual note for the 5% is the winning combo.

How do I keep records for swaps and fees?

Attach the tx hash or trade ID in your tracker notes the same day. That makes audits and tax seasons painless.

To go deeper on risk and discipline, this primer on market structure and entries: ”Technical Analysis Basics for Trading” — pairs well with a robust tracking routine.

Pro tips to reduce noise and mistakes

Once your pipeline is connected and clean, these small habits stop drift and make audits painless. Layer them in gradually and keep the ones you actually use.

- Naming rules: Use consistent wallet nicknames (“Ledger-Cold-2025”).

- Tags library: Keep a small list (income, staking, airdrop, bridge, fee).

- Stablecoin hygiene: Separate cash-equivalents (redeemable) from floating-peg tokens.

- Snapshotted baselines: Monthly CSV exports to a folder like /Reports/2025-08.

- Single source of truth: Your tracker is canonical; the spreadsheet is only for edge notes.

Wrap-up

A clean workflow beats fancy dashboards. Connect everything once, clean it once, and review on rails. With that in place, you’ll keep track of crypto portfolio changes in minutes, not hours, and you’ll always know what you own and why.