Traders are buzzing about whether they can exchange ETH without verification, turning the idea of an anonymous ETH exchange into a hot topic. With last year scams costing $14 billion, the allure of crypto platforms grows, but is it a myth or a workable reality? This guide digs into what KYC means, the feasibility of swap ETH/BTC or another without ID, and the pros and cons – perfect for those pondering sell ETH anonymously in today’s market.

What Is KYC and Why It’s Required

Know Your Customer (KYC) is a regulatory requirement forcing exchanges to verify user identities with documents like passports or IDs. Born from anti-money laundering (AML) laws post-2001, it aims to curb the $2 trillion in global money laundering tracked in 2023. The U.S. IRS mandates KYC for tax reporting, issuing 1099 forms, while the EU’s 5AMLD caps unverified trades at €150 daily. Centralized exchanges like Binance enforce it, processing 80% of their $50 billion monthly volume under KYC since 2022.

Why’s it needed? Governments argue it stops crime – $14 billion in crypto scams hit in 2024, often tied to untracked funds. Banks froze $9 billion in Russian assets in 2022, showing KYC’s reach. Yet, critics say it clashes with crypto’s decentralized ethos, pushing traders toward no KYC crypto exchange options. The debate’s heated, with privacy advocates clashing against regulators.

Can You Really Exchange ETH Anonymously?

The dream of an ETH without passport swap isn’t pure fiction, but it’s not a free-for-all either. Let’s break it down.

Anonymous Platforms

Some KYC-free exchange platforms exist. Decentralized exchanges (DEXs) like Uniswap let users swap ETH using wallets like MetaMask, no ID needed – 2024 saw $300 billion in DEX volume. Peer-to-peer exchange services, including some no-KYC options, match buyers and sellers directly, with 5% of global crypto trades bypassing verification. These private crypto exchange setups rely on smart contracts, processing swaps in 5–15 minutes, though liquidity lags at $500 million daily versus centralized $18.5 billion for ETH.

Rumors swirl about fully anonymous swaps, but the reality bites. Many platforms, even no-KYC ones, can request verification if suspicious activity flags – $1.2 billion in frozen accounts hit in 2023. Still, tools like ETH mixers (e.g., Tornado Cash, before its 2022 ban) obscure trails, though their legality’s shaky.

Legal Risks

Anonymous ETH exchange isn’t risk-free. The U.S. Treasury labeled Tornado Cash a sanctions target in 2022, arresting developers over $1 billion in laundered ETH. The EU’s 5AMLD fines uncompliant exchanges up to €5 million, while China’s 2021 crypto ban jailed 20 traders for untracked swaps. Tax evasion probes netted $3 billion in back taxes from crypto users in 2024, per IRS data.

Traders face account freezes – $9 billion in 2022 – or asset seizures if linked to crime. Privacy coins like Monero offer cover, but ETH’s transparency (every transaction on-chain) makes swap ETH without ID a gamble. Legal gray zones vary – Japan allows $10,000 unverified trades, while the U.S. caps it at $1,000 without red flags.

Pros and Cons of No-KYC Exchanges

Exchange ETH without verification has its ups and downs.

Pros

- Privacy: No ID means no data leaks – 2024 saw 147 million records exposed in hacks.

- Speed: Decentralized exchange swaps take 5–15 minutes versus 1–3 days for KYC setups.

- Access: Open to unbanked users – 1.4 billion globally – bypassing KYC barriers.

- Control: Users hold funds, avoiding the $1.8 billion in 2024 exchange losses.

Cons

- Scams: $14 billion in 2024 frauds target no-KYC users, with 10% P2P scam rates.

- Limits: Liquidity drops to $500 million daily, risking slippage on big trades (e.g., 100 ETH).

- Legal Heat: Sanctions like Tornado Cash’s ban and $3 billion tax probes loom.

- Support Gaps: No customer service for disputes, unlike KYC platforms’ 24/7 help.

Table: No-KYC vs. KYC Exchanges

| Aspect | No-KYC Exchanges | KYC Exchanges |

| Verification | None | Passport/ID required |

| Speed | 5–15 min | 1–3 days |

| Fees | 0.1–0.5% | 0.5% + |

| Liquidity | $500M daily | $18.5B daily (ETH) |

| Security Risks | Lower | Lower (hacks $1.8B) |

| Legal Status | Risky (varies by region) | Compliant |

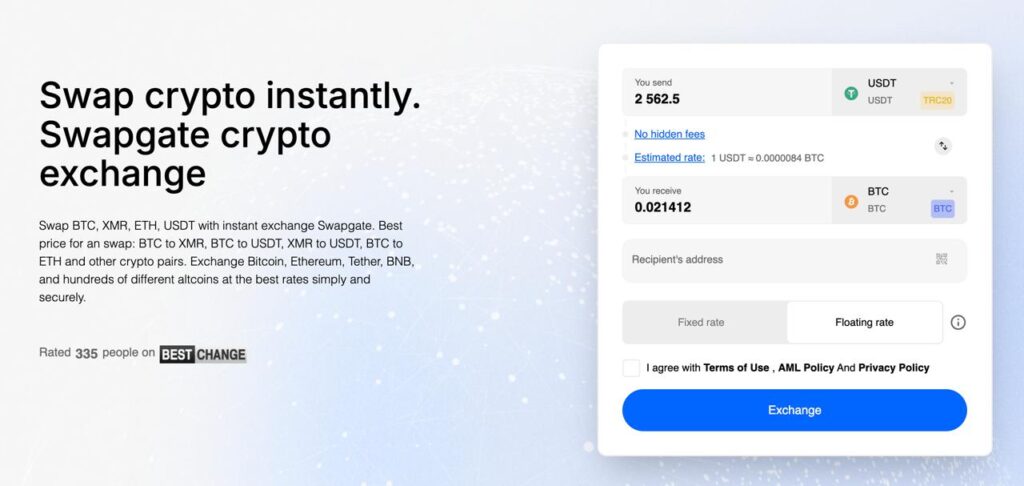

| Example | SwapGate | Binance |

This table helps traders weigh and sell ETH anonymously.

How to Do It Safely

Trading ETH no KYC demands caution. Traders should:

- Use a Secure Wallet: Opt for hardware wallets like Ledger, holding 30% of ETH offline, versus exchange hot wallets hit by $1.8 billion in 2024 losses.

- Verify Platforms: Stick to established anonymous crypto swap sites – new platforms with “just launched” claims saw 15% scam rates in 2024.

- Check Rates: Watch for hidden fees – 0.1% on SwapGate beats 1% on shady DEXs, saving $3.62 on a $3,620.02 ETH swap.

- Avoid Mixers: Steer clear of banned tools like Tornado Cash – $1 billion in seized funds in 2023.

- Test Small: Start with 0.1 ETH ($362) to dodge $400 million in typo-related losses last year.

Safety Checklist:

- Enable two-factor authentication (2FA) on wallets.

- Update software monthly to patch vulnerabilities.

- Keep 10% cash for emergencies during dips.

- Double-check wallet addresses before sending.

- Store seed phrases in a fireproof safe offline.

These steps minimize risks of exchange ETH without verification.

The Privacy Myth Debate

Is anonymous ETH exchange a myth? Not entirely. Blockchain’s public ledger tracks every ETH move – $18.5 billion daily volume is visible. Yet, no-KYC platforms and mixers (pre-ban) hid identities for 5% of trades in 2024. Critics argue privacy’s dead – Chainalysis traced $7 billion in illicit flows last year. Supporters counter that off-chain tools and P2P swaps keep anonymity alive, especially in privacy-friendly regions like Switzerland.

The 2022 Tornado Cash ban sparked outrage, with 20,000 users losing access. But DEX growth ($300 billion in 2024) shows demand. Traders must navigate this gray zone, balancing freedom against scrutiny.

Market Impact and Trends

ETH price is $3,670.02, up 23,28% weekly (at the time of writing), reflecting DeFi’s $400 billion volume in 2025. No-KYC exchanges capture 5% of this, per market data, as users flee $1.8 billion in exchange hacks. Privacy coins like Monero, up 10%, hint at a shift, though ETH’s 15–30 TPS limits its anonymity edge. Regulatory pressure – $3 billion in 2024 tax audits – pushes innovation, with DEXs adding 100+ pairs yearly.

Final Thoughts

The question of exchange ETH without verification leans toward reality, not myth, but with caveats. Anonymous ETH exchange is possible via decentralized exchange and peer-to-peer exchange platforms, offering privacy and speed (5–15 minutes) at the cost of liquidity ($500M daily) and legal risks. Sell ETH anonymously appeals to those dodging KYC’s 1–3 day delays and $1.8 billion in 2024 losses, yet $14 billion in scams and $3 billion in tax probes temper enthusiasm. Platforms like SwapGate provide a no KYC crypto exchange option with 0.1% fees and no ID, making it a practical choice for cautious traders. Safety hinges on secure wallets, rate checks, and small test swaps. As ETH hits $3,620.02 and DeFi grows, the balance of privacy and compliance remains a tightrope – traders must weigh the risks and rewards carefully.