Debates over which makes the better investment — Ethereum vs Bitcoin — have been raging for several years. Enthusiasts of each coin have their own arguments. Let’s look at those arguments to decide which cryptocurrency is worth investing in for 2025.

Why compare Bitcoin and Ethereum

Comparing ETH vs BTC is necessary at the very least because they are the two most capitalized cryptocurrencies. They have been on the podium for years and set the tone for the entire market.

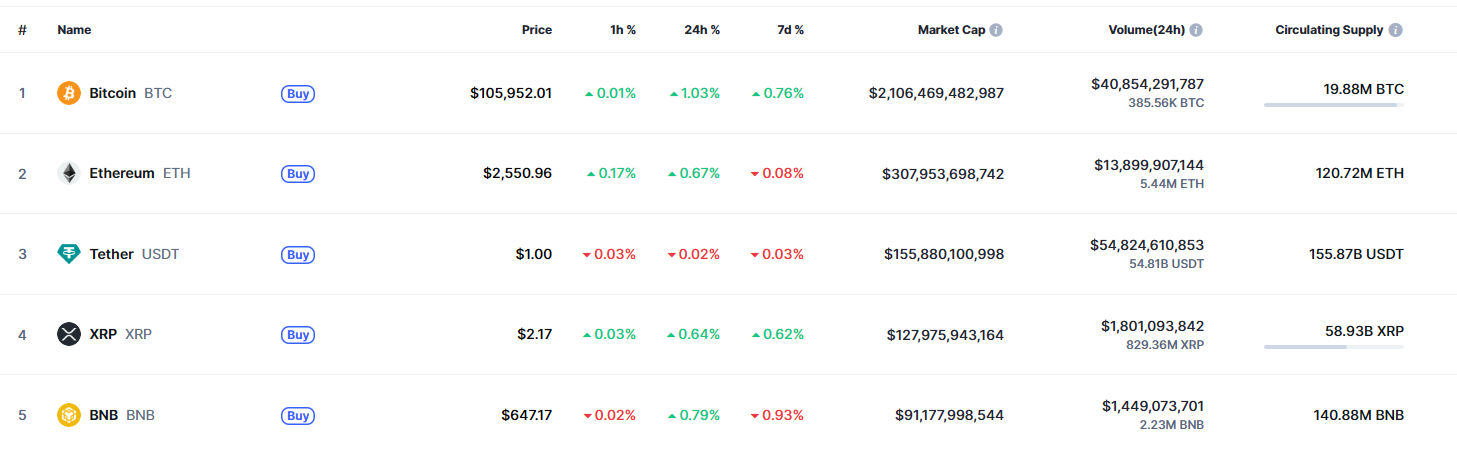

Top 5 most capitalized cryptocurrencies. Source: CoinMarketCap

By comparing them, you can determine which cryptocurrency aligns best with your investment strategy. That’s why understanding the key differences between these coins is crucial for making successful investments.

Bitcoin vs Ethereum: what’s the core difference

Bitcoin is the first cryptocurrency. Its network was launched back in what now feels like a distant 2009 — at least by crypto standards — by an anonymous developer known as Satoshi Nakamoto. To this day, no one knows who is behind that pseudonym.

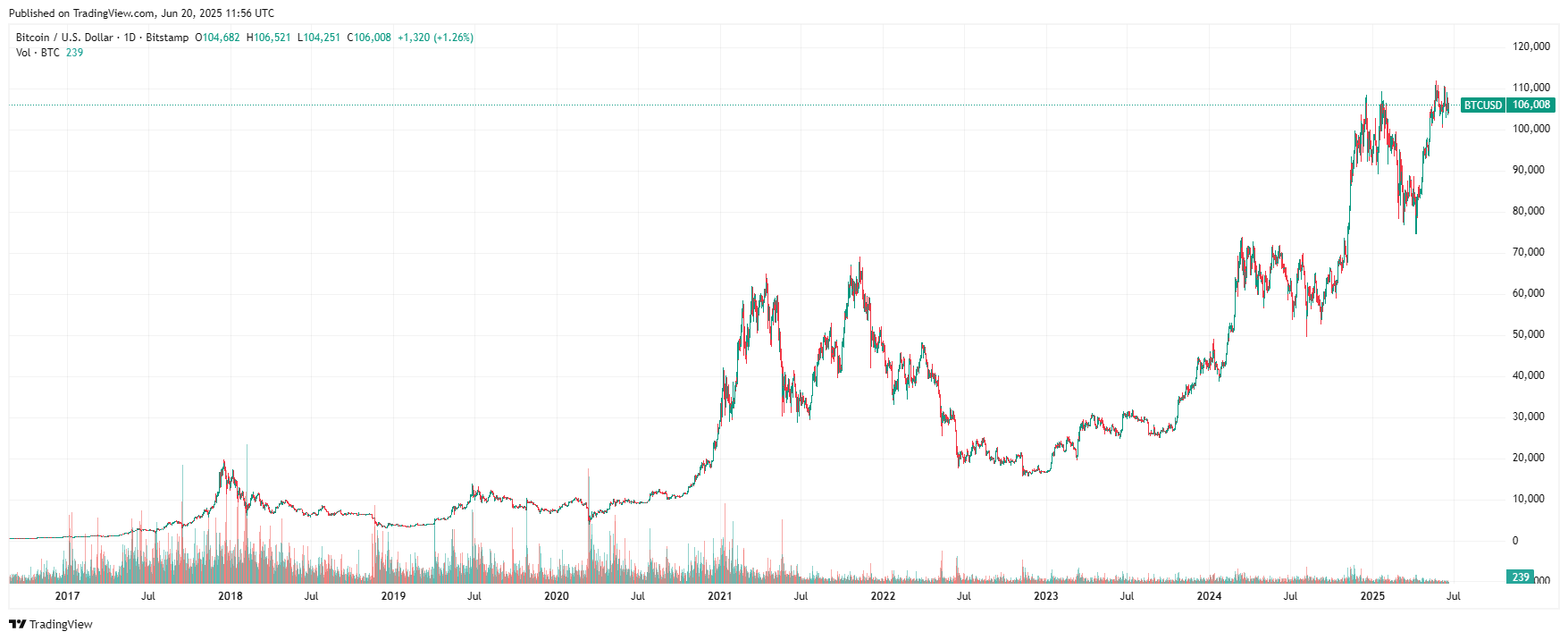

Bitcoin chart. Source: TradingView

Check crypto prices on Swapgate

The coin has a limited supply — only 21 million bitcoins will ever be mined. This scarcity is one of the cryptocurrency’s key advantages, especially in a world where central banks are printing fiat money with little to no restraint.

ETH was launched in 2015. Its developers introduced a more technically advanced version of cryptocurrency. Unfortunately, in its second year, the project suffered a major blow — a hack of its Decentralized Autonomous Organization (DAO). To mitigate the consequences, the developers launched a new network, now known as Ethereum (ETH). The original chain continued to exist under the name Ethereum Classic (ETC).

Ethereum chart. Source: TradingView

The coin’s supply is regulated through a burning mechanism.

When evaluating Ethereum vs Bitcoin long term, it’s important to keep in mind that these crypto projects have different goals. BTC was created as a response to outdated fiat systems, while ETH demonstrated just how technologically advanced a cryptocurrency can be.

Technology comparison

Bitcoin vs Ethereum comparison isn’t complete without looking at the technical foundations of each project.

BTC runs on the Proof-of-Work (PoW) algorithm. It’s designed so that the biggest mining rewards — meaning the extraction of new coins from the network — go to participants who contribute the most computing power.

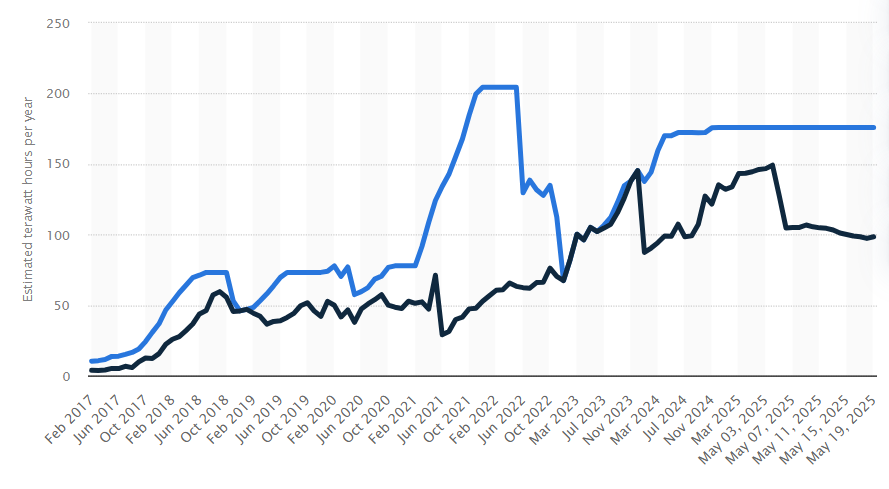

Mining Bitcoin requires enormous amounts of electricity, comparable to the energy consumption of entire countries like Poland. However, the PoW system also provides a high level of decentralization for the project.

Bitcoin electricity consumption. The dark blue line shows actual usage; the light blue line indicates projected consumption. Source: Statista

Ethereum also initially launched on Proof-of-Work, but after years of preparation, the cryptocurrency transitioned in September 2022 to a more eco-friendly algorithm: Proof-of-Stake (PoS).

Fun fact: Ethereum Classic still runs on PoW.

Ethereum also differs from the first cryptocurrency on a technical level. It was the first project to implement smart contract technology. This innovation paved the way for the rapid growth of the decentralized finance (DeFi) industry on its blockchain.

Performance and market metrics

A Bitcoin vs Ethereum investment strategy should take into account how each cryptocurrency behaves over time. As the market leader, BTC carries the most weight. Its price is heavily influenced by halving — a process that reduces the rate of new coin production by half.

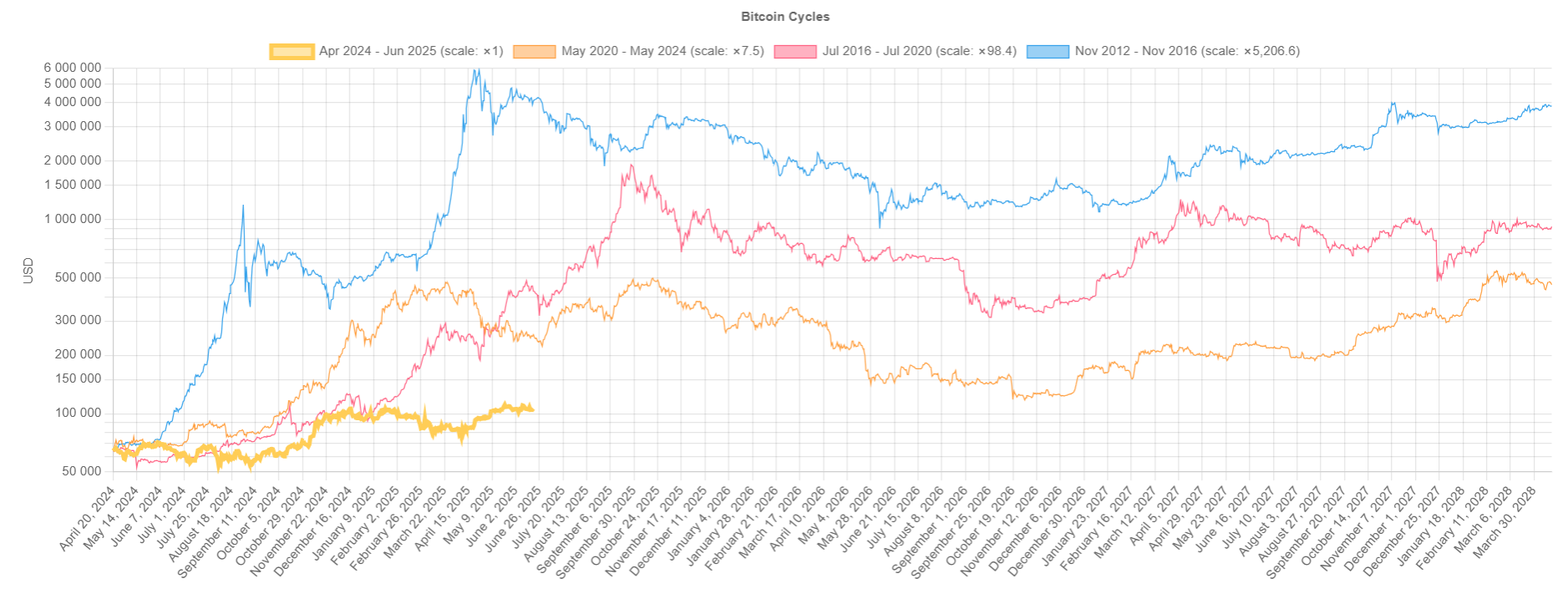

The chart below shows how Bitcoin has performed in each cycle following a halving event, which occurs approximately every four years. The current cycle is highlighted with a bold orange line.

Notice how Bitcoin reaches a new all-time high after each halving. This happens due to the growing scarcity of the coin in the market. As supply tightens, the price is pushed to new heights.

Bitcoin performance by cycle comparison. Source: bitcoincyclescomparison

In the post-2024 halving cycle, Bitcoin is significantly outperforming ETH. This is largely due to the approval of spot BTC ETFs in the U.S. Growing interest in this investment vehicle has driven fund issuers to actively buy up coins.

In contrast, market interest in ETH during this cycle is declining — despite the continuous efforts by the development team to improve the project’s technical foundation.

Bitcoin and Ethereum chart comparison. Source: TradingView

Investment potential in 2025

Investment potential plays a major role in shaping the future of Ethereum vs Bitcoin. In 2025, most investor attention is focused on Bitcoin. The hype isn’t just driven by spot crypto ETFs in the U.S. — it’s also fueled by large institutions following the lead of Strategy, the biggest BTC holder among public companies, by adding Bitcoin to their balance sheets. Notably, Metaplanet and GameStop have also invested in cryptocurrency.

Investors’ interest in Ether isn’t as high-profile. However, the coin still receives support — for instance, through purchases by the world’s largest asset manager, BlackRock.

Pros and cons: Bitcoin vs Ethereum

When asking should I buy Bitcoin or Ethereum, it’s important to consider the pros and cons of each coin:

| Bitcoin | Ethereum | |

|---|---|---|

| Pros | – Anonymous creator, making the project less susceptible to external pressure. | – More technologically advanced crypto project. |

| – Proven high level of decentralization. | – Has been in the market for many years. | |

| – The oldest cryptocurrency with a long track record. | – Hosts a thriving DeFi industry, where users constantly need Ether to pay transaction fees. | |

| – Actively being accumulated by institutional investors. | – Runs on the eco-friendly PoS algorithm. | |

| – Historically, each halving pushes the price to new highs due to increasing scarcity. | ||

| Cons | – Institutional interest could reduce decentralization, as a large portion of coins may end up in corporate reserves. | – Competitors like Solana are gradually capturing market share with lower fees and faster transactions. |

| – Not suitable for everyday spending. | – Weak price performance in the cycle following Bitcoin’s 2024 halving suggests declining investor interest. | |

| – Mining harms the environment. |

When deciding whether to invest in Bitcoin or Ethereum, it’s essential to weigh the advantages and disadvantages of each coin in advance.

Which is better for different types of investors ETH or BTC

Understanding how Ethereum is different from Bitcoin helps determine which coin is better suited for different types of investors.

ETH may be the right choice for those who believe in the long-term growth of the DeFi market.

Bitcoin, on the other hand, is a solid option for long-term investors. It has consistently shown the ability to reach new all-time highs after each halving — something Ether has yet to consistently achieve.

Future of Bitcoin and Ethereum

The future of Bitcoin and Ethereum largely depends on regulatory actions. In the U.S., for example, authorities are actively building up BTC reserves. Additionally, since 2021, Bitcoin has held the status of legal tender in El Salvador, alongside the U.S. dollar. This kind of government interest adds legitimacy to the coin.

Ethereum, however, is in a different position. In 2024, the U.S. Securities and Exchange Commission (SEC) attempted to argue that ETH violated the country’s securities laws. Although the regulator eventually closed the case, its pressure on the project left a negative impression and weakened the cryptocurrency’s investment appeal.

FAQ

Will Bitcoin or Ethereum grow more in 2025?

When discussing what is the difference between Bitcoin and Ethereum, we mentioned that Bitcoin undergoes halvings approximately every four years. This event creates a supply shortage in the market, which — as past cycles show — tends to drive the price to new highs. Typically, it takes the coin about a year and a half to reach its cyclical peak.

If the timing holds true again, a new all-time high (ATH) could be reached in autumn 2025. Ether will likely follow Bitcoin’s lead and rise as well, although usually with less momentum.

Should you invest in ETH or BTC in 2025?

In the context of 2025, Bitcoin is performing significantly better than Ether. There are several reasons for this — from the successful launch of ETFs to surging interest from major corporations and the beginning of BTC reserve accumulation in the United States.

Should beginners choose Bitcoin or Ethereum first?

The key differences between Bitcoin and Ethereum suggest that Bitcoin (BTC) may be the better choice for beginners. Its behavior is more thoroughly studied and understood.

When evaluating both projects in terms of legitimacy, Bitcoin also comes out ahead — making it a safer entry point for those new to cryptocurrency investing.

How do Bitcoin and Ethereum differ in long-term value?

When asking what is the better investment: Bitcoin or Ethereum, timing also plays a crucial role. As the fully decentralized market leader, Bitcoin has a higher chance of long-term survival. That’s why, over a longer time horizon, investing in BTC may be the more prudent choice.

Learn more about ways of crypto storage.