Crypto portfolio rebalancing keeps investments aligned amid wild market swings, a must in the fast-paced world of digital assets. As mid-2025 rolls on, with Bitcoin steadying after halvings and Ethereum scaling up post-Dencun, rebalancing helps lock in gains and curb risks. Crypto rebalancing involves tweaking asset weights back to targets, countering drifts from price jumps or dips. Exchanges like KuCoin and Phemex now bake in tools for this, making it easier than manual trades. This guide covers why it matters, strategies, tools, and hands-on steps on platforms. Drawing from 2025 trends, where DeFi TVL hits $150B and bots automate flows, we’ll see how rebalancing boosts long-term plays. For beginners or pros, mastering this on exchanges cuts emotional calls, aiming for steady growth.

Why Bother with Portfolio Tweaks

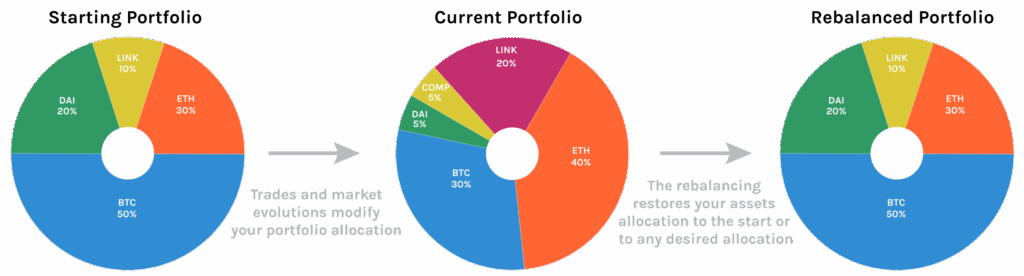

Rebalancing fights drift—say a 50/50 BTC/ETH split shifts to 70/30 on BTC’s run-up, amping risk. In crypto’s volatile arena, this realigns to original goals, selling highs and buying lows automatically. Crypto portfolio rebalancing strategies cut exposure to bubbles, like during 2025’s altcoin surges where overweights led to crashes.

Benefits stack up: It enforces discipline, dodging greed or fear. Studies show rebalanced portfolios outperform buy-and-hold by 1-3% yearly in crypto, per Shrimpy analyses. Tax perks emerge too—selling winners harvests losses elsewhere. On exchanges, built-in features like Altrady’s masters streamline this across accounts. Downsides? Fees nibble returns, especially on high-frequency tweaks. Still, for diversified holds, it’s key to weathering storms like 2025’s regulatory dips.

Common Approaches to Rebalancing

Strategies vary by style and risk. Threshold-based triggers when assets stray 5-10% from targets, ideal for volatile crypto. Calendar rebalancing hits set dates—monthly or quarterly—simple for hands-off folks. Hybrid mixes both, adjusting on big moves or schedules.

Cryptocurrency portfolio rebalancing strategies in 2025 lean automated, with bots scanning drifts. For example, constant mix keeps ratios fixed via ongoing buys/sells, suiting active traders. Risk parity weighs by volatility, overweighting stables during turmoil. Pick based on goals: Growth chases thresholds, preservation favors calendars. Exchanges like Phemex offer guides for these, tailoring to spot or futures.

Tools and Bots Making It Easier

Crypto portfolio rebalancing tool options abound in 2025, from exchange-built to third-party. Shrimpy integrates multiple platforms for automated tweaks, charging low fees. Altrady masters multi-exchange management, with visual dashboards. Crypto rebalancing bot like KuCoin’s Smart Rebalance handles diversification, free for users.

For seamless crypto-to-crypto swaps without KYC hassles, SwapGate fits right in—quick executions keep rebalancing smooth across assets.

Third-parties like 3Commas add AI for predictive shifts, while Peaks focuses on volatility-adjusted plans. Choose based on integrations; most link APIs for real-time action.

Comparing Rebalancing Options

To pick wisely, stack tools side-by-side. This table highlights 2025 standouts, focusing on features, costs, and ease.

| Tool/Platform | Type | Fees | Automation Level | Exchanges Supported | Best For |

| Shrimpy | Third-party | 0.05-0.2% | High (bots) | 20+ like Binance, Coinbase | Multi-exchange pros |

| KuCoin Smart Rebalance | Built-in | Free | Medium | KuCoin only | Beginners on one platform |

| Altrady | Third-party | Subscription $15/mo+ | High | Multiple | Visual trackers |

| Phemex | Built-in | Trading fees | Low-manual | Phemex | Futures-integrated |

| 3Commas | Third-party | $29/mo+ | AI-high | 15+ | Advanced strategies |

| Peaks | App-based | Variable | Medium | Custom | Volatility focus |

| EarnBIT | Custom | Varies | High | Flexible | DeFi leaners |

Shrimpy leads for breadth, per user reviews, while KuCoin suits starters. Crypto portfolio rebalancing strategy 2025 favors bots for efficiency amid high volumes.

Hands-On Steps on Exchanges

Rebalancing on platforms follows clear paths. Start by logging in, viewing holdings. Set targets—say 40% BTC, 30% ETH, 30% alts.

- Scan drifts: Use dashboards to spot imbalances.

- Calculate sells/buys: Figure amounts to realign.

- Execute trades: Sell overweights, buy under.

- Confirm fees: Preview costs before hitting go.

- Automate if available: Set bots for thresholds.

- Log changes: Track for taxes and reviews.

- Review quarterly: Adjust targets as markets shift.

On Binance, use portfolio views; KuCoin’s bot handles auto. Crypto portfolio rebalancing strategies 2025 emphasize small, frequent tweaks to capture upsides.

Weighing Upsides and Downsides

Pros abound: Reduces risk, locks profits, enforces plans. In 2025’s bull phases, it prevented overexposure to memecoins. Cons include fees eroding small portfolios and tax events from sells.

Mitigate with low-fee exchanges or longer intervals. For crypto, volatility amps benefits—rebalanced holds beat indexes by 5% in backtests. Balance frequency: Monthly suits most, avoiding overtrading.

Final Notes on Keeping Balance

Crypto rebalancing bots evolve with AI, predicting drifts via sentiment analysis. Exchanges integrate more, like Phemex’s futures rebalancing. DeFi tools on chains like Solana offer gas-free tweaks. Regs might mandate transparency, aiding tax tracking. As adoption grows, rebalancing becomes standard for sustainable gains.

Crypto portfolio rebalancing on exchanges turns chaos into control, vital for 2025’s ups and downs. From strategies to bots, tools abound to fit any style. Start simple, scale with experience—consistent tweaks yield compounding wins. In this dynamic field, staying aligned powers through cycles.