Crypto arbitrage trading catches eyes as a way to snag profits from price gaps in the wild digital asset world. As 2025 pushes forward, with markets reacting to halvings and upgrades, this approach lets folks buy low on one spot and sell high on another, pocketing the difference. What is otc trading crypto? Wait, that’s off—arbitrage differs, focusing on public exchanges for quick flips, while OTC handles big, private deals. This rundown unpacks arbitrage basics, how it ticks, types, and if it pays off. Pulling from fresh takes, like how bots now scan thousands of pairs in seconds, we’ll see why it’s hot for sharp players amid volatility.

Grasping the Core Idea

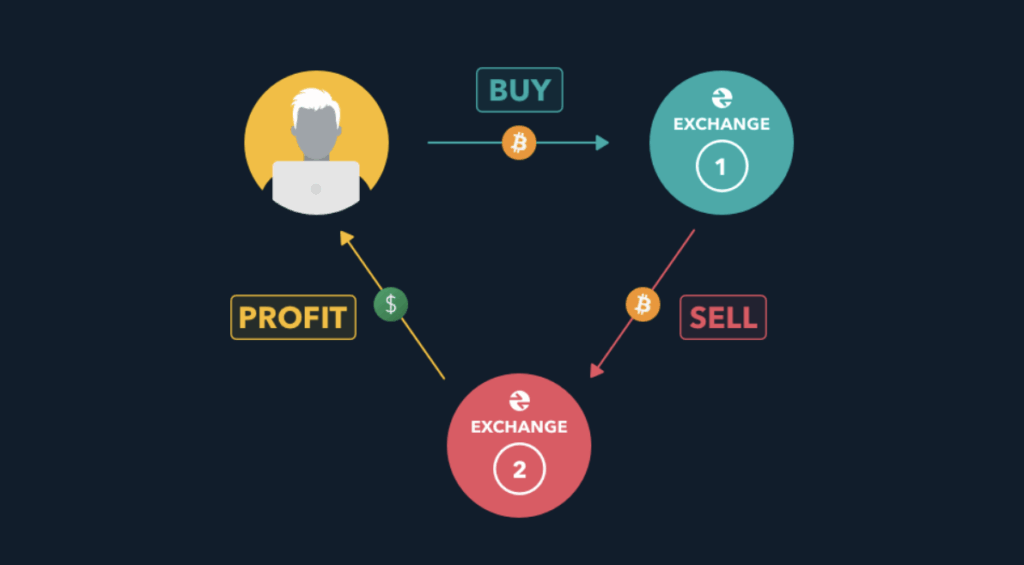

Arbitrage trading crypto boils down to spotting and jumping on price mismatches for the same coin across platforms. Say Bitcoin lists at $60,000 on Exchange A but $60,200 on B—you buy on A, shift to B, sell for a $200 gain minus fees. How does crypto arbitrage work? Markets aren’t perfect; liquidity, news lags, and regional rules create splits ripe for picks.

In 2025, automation amps this—bots like those from ArbitrageScanner hunt gaps round the clock. It’s not gambling; it’s math, needing speed to beat closures. Bitcoin arbitrage trading leads, given its volume, but alts offer bigger spreads with risks. Start small to test waters, as fees and delays can flip wins to losses.

How Deals Play Out

Crypto otc trading? Nah, arbitrage sticks to open markets or P2P for fast turns. Process: Scan prices via APIs, spot diffs, buy low, transfer, sell high. Tools like CoinAPI feed real-time data for spots. Transfers take minutes on fast chains like Solana, but Ethereum gas spikes eat edges.

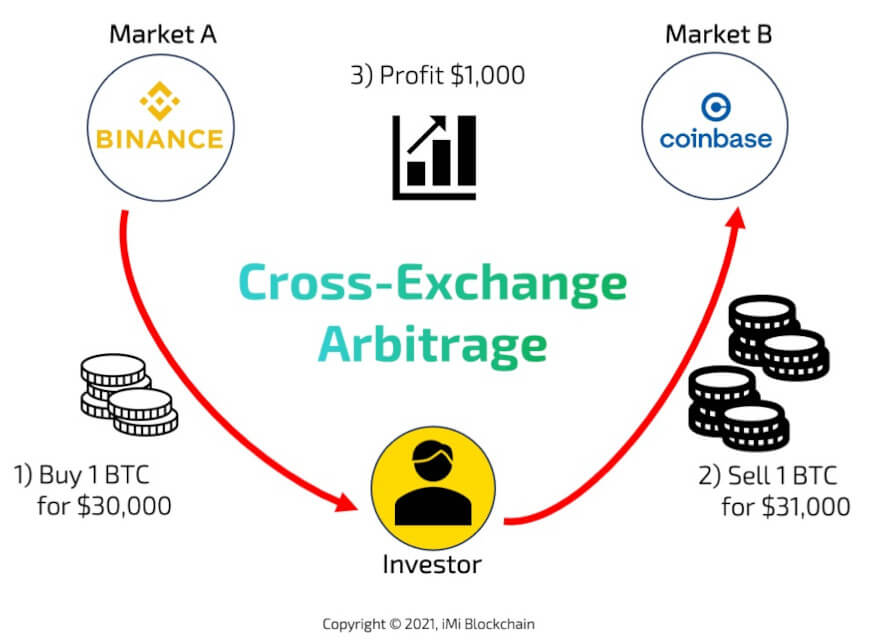

Btc arbitrage strategy often uses triangular plays: Trade BTC/ETH, ETH/USDT, USDT/BTC within one exchange for loops. Spatial hits across sites—buy on Binance, sell on Kraken. In 2025, flash loans in DeFi let borrow for arb without own cash, amping returns but risks. Key: Low-latency setups and auto-executions to snag before bots crowd.

Kinds of Arbitrage Plays

Varieties keep it fresh. Simple spatial: Cross-exchange diffs. Triangular: Cycle three pairs for imbalances. Statistical: Use models to predict convergences, like pairs trading BTC and ETH. Futures arb: Cash and carry, buy spot, sell future for premium.

This table breaks averages for 2025, based on common setups.

| Type | Average Profit | Risk Level | Tools Needed | Best For | Notes |

| Spatial | 0.1-0.5% | Low | Price scanners | Beginners | Cross-exchanges |

| Triangular | 0.2-1% | Medium | Bots | Active | Single platform |

| Statistical | 0.5-2% | High | Models/AI | Pros | Predictions |

| Futures | 1-5% annualized | Medium | Derivatives | Holders | Premium capture |

| Cross-chain | 0.3-0.8% | High | Bridges | Adventurous | Chain diffs |

Spatial leads for ease, per data.

Steps to Jump In

How to earn in crypto arbitrage? Start right. Here’s a list for newbies.

- Pick tools: Scanners like ArbitrageScanner for alerts.

- Fund accounts: Spread across exchanges for quick moves.

- Scan opps: Watch for 0.5%+ diffs after fees.

- Execute fast: Buy, transfer, sell in minutes.

- Track costs: Factor gas, withdrawal fees.

- Automate: Bots handle for 24/7.

- Review: Log trades for tweaks.

For seamless crypto-to-crypto without KYC, SwapGate offers quick executions, ideal for arb shifts. These cut manual work, boosting edges.

Weighing Profits and Legality

Is crypto arbitrage profitable? Yeah, but slim—0.1-1% per trade after cuts, scaling with volume and speed. In 2025, bots net 20-50% yearly for pros, but newbies fight fees. Is crypto arbitrage worth it? For patient folks with capital, yes; casuals might stick spot.

Is crypto arbitrage legal? Fully, as trades, but taxes apply—gains count as income in most spots. Regs like MiCA in the EU demand reports, but no bans. Offshore plays ease, but watch laundering rules.

Risks to Watch

Dangers lurk: Slippage eats if slow, exchange hacks wipe, and arb windows shut fast from bots. Fees stack—transfers cost, especially cross-chain. Vol flips opps to losses. Mitigate with low-fee chains and limits.

In 2025, AI amps competition, shrinking windows—diversify strats.

Tools and Exchanges for Arb

Scanners like Crypto Arbitrage Scanner or custom Python bots spot deals. Exchanges: Binance for liquidity, Kraken for fiat pairs. DeFi like Uniswap for on-chain arb, but gas bites.

Outlook in 2025

Volumes grow with liquidity, but bots tighten spreads—focus on niches like new listings or chains. Regs add transparency, aiding fair plays. DeFi arb surges with flash loans, netting 100%+ on opps. Future: Cross-chain bridges speed, opening more.

Crypto arbitrage trading suits quick thinkers chasing edges in mismatches. From how crypto arbitrage works to weighing worth, it’s a tool for the kit. In 2025’s buzz, start small, automate, and watch risks—done right, it adds steady wins to portfolios.