Picking a crypto wallet isn’t about chasing the “best” brand — it’s about choosing a home that fits how you actually use crypto. Maybe you dollar-cost average once a week, maybe you pay with Lightning every day, or maybe you just hold and forget. This guide walks through the main types of crypto wallets, who they suit, and how to decide without hype or heavy jargon.

If you’re rebalancing while you read, you can exchange BTC to ETH in a couple of clicks.

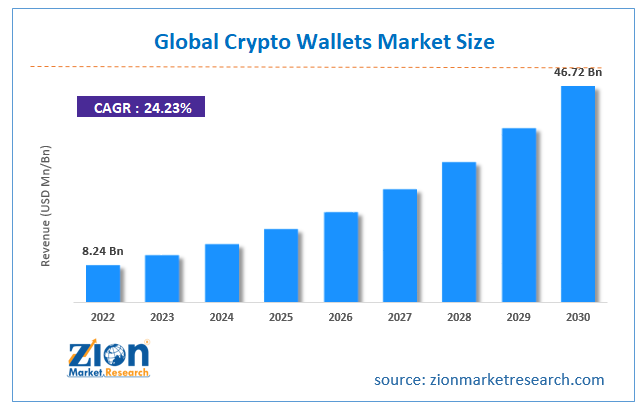

Rising global crypto wallets market 2025–2034 with 24.68% CAGR. Source: Zion Market Research

Wallet basics

Before we compare options, let’s get the vocabulary out of the way so the rest of the guide lands. Think of these as the “parts” every wallet is built around:

- Private key — the secret proving you own your coins. Guard it like a password you can’t reset.

- Public address — safe to share; people use it to send you funds.

- Seed phrase — 12–24 words that recreate your keys if you lose the device.

- Custodial vs non-custodial — custodial is when the company controls the keys; non-custodial is when you do it.

New to all this? You’ll find a useful primer here: “Crypto Wallet vs Crypto Exchange: What’s the Difference?”

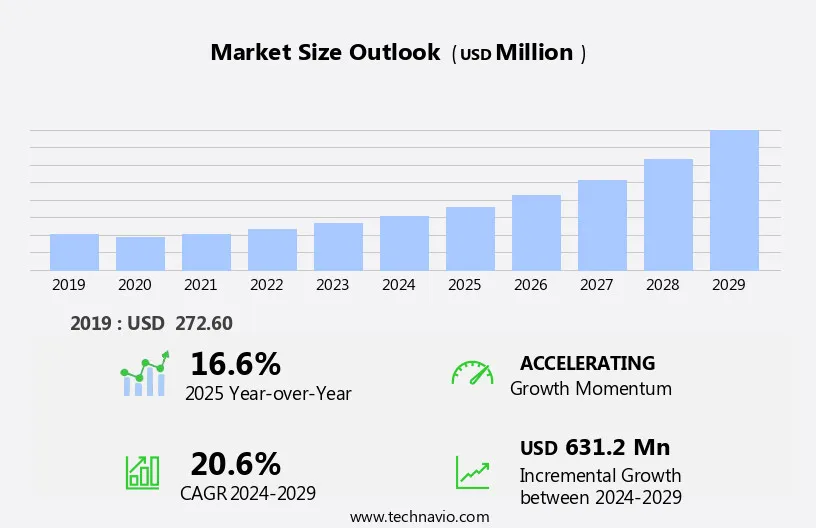

Market size outlook 2019–2029 with accelerating growth, 20.6% CAGR. Source: Technavio

What are the different types of crypto wallets?

There are many labels floating around, but most real-world setups fall into five buckets. Below is what each one actually feels like to use.

1) Hardware-wallets (cold storage)

A small device (think USB stick) that keeps your keys offline. You connect it when you need to sign a transaction.

Pros: Top-tier security, ideal for long-term holding.

Cons: Costs money; one extra step when you want to move funds.

Best for: Bigger balances, long-horizon investors.

Wallet-example: Ledger and Trezor.

2) Software-wallets (mobile & desktop)

Apps for your phone or computer that store keys locally.

Pros: Free, quick to set up, great UX, wide coin support.

Cons: If your device is compromised, your wallet can be too — use strong locks and backups.

Best for: Everyday spending, small to medium balances.

Wallet-example: Exodus and Trust Wallet.

3) Web-wallets (browser/extension)

Browser extensions or web apps — handy for DeFi and NFTs.

Pros: Fast onboarding and one-click dApp access.

Cons: Phishing and fake sites are the main hazards — bookmark the real URLs.

Best for: Active on-chain users who value convenience.

Wallet-example: MetaMask and Phantom.

4) Custodial-wallets (on exchanges or apps)

You log in with email/password; the provider holds your keys.

Pros: Password resets, integrated trading, simple for newcomers.

Cons: Third-party risk and potential withdrawal delays — don’t keep life savings there.

Best for: New users testing the waters; frequent traders.

Wallet-example: Coinbase and Kraken.

5) Paper-wallets (legacy)

Printed keys/QRs stored offline.

Pros: Air-gapped by default.

Cons: Easy to damage or lose; not beginner-friendly; largely outdated.

Best for: Very niche cold-storage needs with careful handling.

Wallet-example: BitAddress and WalletGenerator.

If you’re wondering how many types of crypto-wallets are there, you’ll see more sub-types online, but these five cover what most people actually use.

What are the 5 types of cryptocurrency wallets?

If you just want the cheat sheet before diving deeper, here’s the list you’ll hear in most guides about types of digital wallets for cryptocurrency:

- Hardware

- Software (mobile/desktop)

- Web (browser/extension)

- Custodial

- Paper

Types of Bitcoin wallets

Bitcoin adds a couple nuances that are worth calling out:

- Full-node vs light (SPV). Full nodes verify the entire chain (powerful, heavier). Light wallets rely on network nodes (lighter, better for phones).

- Lightning wallets for fast, low-fee BTC payments. Great for everyday spending — just pick a beginner-friendly option if channel management sounds daunting.

You’ll see terms like different types of bitcoin wallets used interchangeably. That’s fine — just check the wallet supports the features you need (e.g., Lightning).

A simple decision framework

Treat this like choosing the right tool for a job: define the job, pick your comfort level with risk, set up recovery, then add safety rails. Follow the steps below and you’ll land on a setup that matches your habits — not someone else’s.

Step 1: Define your primary use case

Nailing this saves hours of second-guessing. Ask, “What will I do most often?”

- Long-term holding? Lean hardware (or well-managed cold storage).

- Daily spending or dApps? Choose software or web wallets with good security.

- Frequent trading? A custodial exchange wallet can be practical — then move profits to self-custody.

Step 2: Match your risk tolerance

Be honest about the trade-off between control and convenience:

- Want maximum control and no middlemen? Go non-custodial (hardware/software).

- Prefer account recovery and support? Custodial may fit — accept that you’re trusting a third party.

Step 3: Plan your backup

Your wallet is only as good as your recovery plan. Before moving any real money:

- Write the seed phrase on paper (not in screenshots or cloud notes).

- Store duplicates in separate, safe locations.

- Consider a metal backup for water/fire resistance.

Step 4: Layer in protections

Small tweaks go a long way:

- Enable PIN/biometrics and 2FA.

- Add a passphrase if you’re comfortable with advanced settings.

- Keep firmware/apps updated; avoid public Wi-Fi for transactions.

Types of crypto wallets for beginners

Start simple, then harden as your balance grows:

- Begin with a reputable mobile software wallet and practice with small amounts.

- Add a hardware wallet for savings; keep a small “spend” balance on your phone.

- If you trade often, keep just enough on a custodial exchange for speed — withdraw profits to self-custody.

While you learn, it helps to know what your coins are worth right now. Keep an eye on the BTC price today before you move funds.

Security checklist (copy-paste friendly)

Quick pre-flight before any significant transfer:

- Create wallet — write seed phrase — verify recovery — store securely.

- Lock your device; set a PIN; enable 2FA.

- Bookmark official wallet/exchange URLs to dodge phishing.

- Test with a small send before moving a large amount.

- Review balances occasionally; update firmware/apps.

FAQs

What are the different types of crypto wallets for beginners?

Start with software wallets to learn the ropes, then graduate to a hardware wallet for long-term holdings. Skip paper wallets unless you know exactly what you’re doing.

Are hardware wallets worth it?

For meaningful balances — yes. Keeping keys offline removes a lot of everyday attack surfaces.

Can I use multiple wallets?

Absolutely. Many people split funds: hardware for savings, software for daily use, custodial for quick trades.

Where do I track the market while managing wallets?

Any reliable price tracker works or your exchange. If you’re rebalancing, you can exchange BTC to ETH directly.

How many types of crypto wallets are there?

Typically five: hardware, software, web, custodial, and paper (with “hot vs cold” as a broader split).

Conclusion

Here’s the unglamorous truth: there’s no perfect wallet — only a setup you’ll actually use without cutting corners. Start with a tidy mobile app for day-to-day moves. When the number gets big enough that losing it would hurt, park most of it on a hardware wallet. Keep only “lunch money” on a custodial exchange for quick trades.

Write your 12–24 words by hand — twice. Stash the copies in two different places (think: with passports, and somewhere a spill can’t reach). Before any “real” transfer, do a tiny test send. Put wallet/app updates on your calendar once a quarter.