If you’ve ever scratched your head over those extra charges eating into your Bitcoin or Ethereum transfers, you’re in good company – we’ve been there too, puzzled by the costs that sneak up during a swap or send. In today’s crypto world, rates are a hot topic, and knowing the difference between blockchain fees and exchange fees can be a game-changer for your wallet. Think of blockchain fees as the toll you pay to travel the crypto highway, while them are like the service fee at a pit stop – both are part of the journey, but they serve distinct roles and hit your funds differently.

Bitcoin price circling $114,000 and Ethereum climbing past $3,600, these fees are front and center. Let’s walk through what each entails, how they compare, and some savvy ways to keep them under control. By the end, you’ll feel confident tackling these costs like a pro.

What is a Blockchain Fee?

Imagine sending some Ethereum to a buddy overseas. That move doesn’t just happen by magic – it’s handled by a network of computers (nodes) that check, log, and lock it into the blockchain. That’s the job of blockchain fees. Often called network or gas fees (especially on Ethereum), these payments go to miners or validators who keep the system humming along.

Essentially, a blockchain fee is your ticket to get your transaction noticed and confirmed. Skip it, and your transfer might sit in limbo amid spam or low-priority requests. For Bitcoin, its hinge on transaction size in bytes – more data, higher cost. As of now, mid-2025, Bitcoin fees average between $0.88 and $1.20 per transaction, a drop from the $60+ peaks during the 2024 bull rush when everyone piled in. Ethereum uses a “gas” setup, where costs depend on the effort required – simple transfers might run $0.38, but tricky smart contract tasks can climb to $5 during busy spells.

What drives these ups and downs? It’s all about demand. When the network’s packed – like during an NFT craze or market spike – fees jump as everyone vies for priority. Miners pick the highest bids for the next block. Here’s the twist: these funds go to network players, not a corporation. They’re crucial for security, motivating miners to maintain the blockchain’s integrity. Without them, troublemakers could clog it with nonsense.

The worst thing is to learn this the hard way – one day, sending bitcoins can get stuck for several hours because you saved on fees during a rush. It is wisest to always check tools such as mempool.space for bitcoins or Etherscan for Ethereum to find out the current rates before sending.

What is an Exchange Fee?

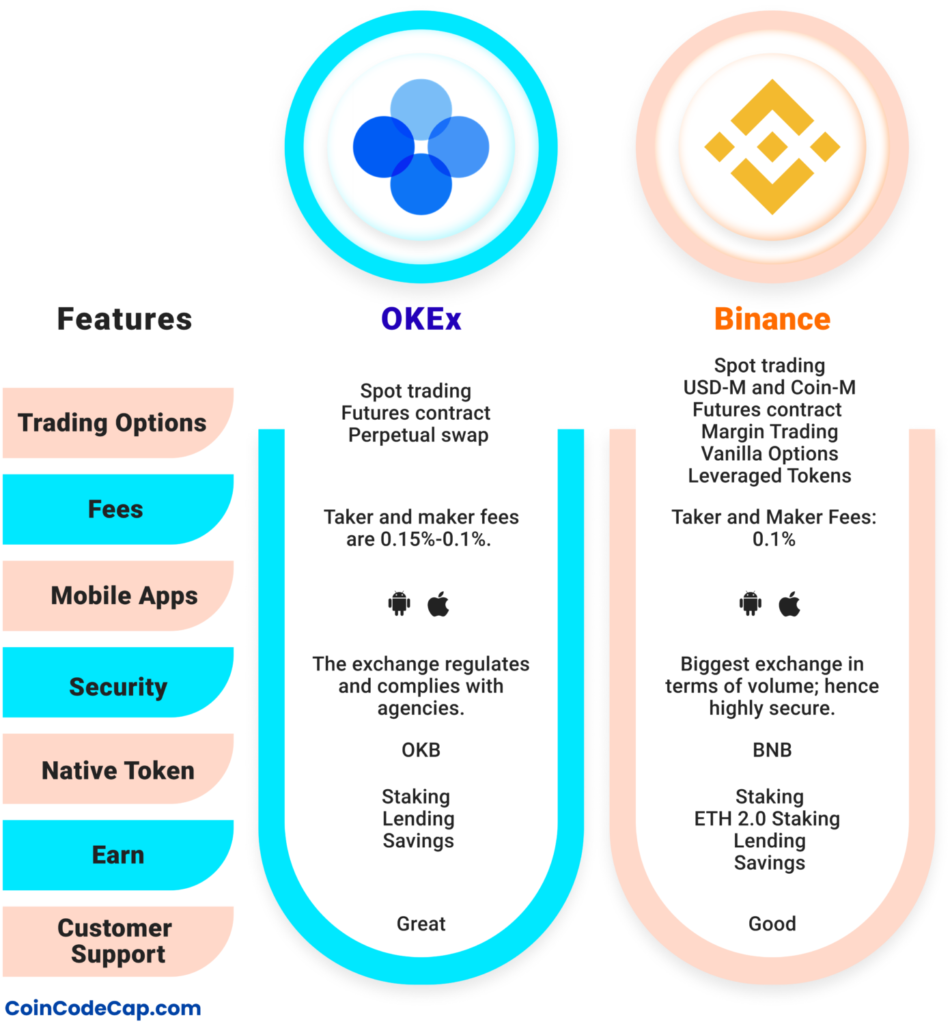

Now, let’s shift gears to exchange fees – the charges tacked on by crypto exchanges for their services. Whether you’re buying, selling, or swapping on sites like Binance or Coinbase, these fees cover running costs, safety measures, and the ease they offer. Unlike blockchain fees, which are tied to the network, exchange fees are set by the platform and can differ a lot.

Most exchanges follow a maker-taker system. Makers add liquidity with limit orders (say, “sell at $120,000”), while takers grab it with market orders (buy now!). Makers often get a fee break as a perk. Take Binance – standard spot fees are 0.1% for both, but they dip with higher volumes or if you pay with BNB. Coinbase Advanced Trade kicks off at 0.4% for makers and 0.6% for takers, sliding lower for big traders. Kraken lands in between, with up to 0.25% maker and 0.4% taker fees.

It’s not just trading, though – exchanges charge for deposits, withdrawals, or even sitting idle. Crypto deposits are usually free, but fiat wires might cost $10-25. Withdrawals often add a flat fee plus the blockchain cost passed on to you – like $5-10 extra for Bitcoin. These fees keep the exchange’s lights on, funding staff, security, and legal compliance, especially in regulated zones like the U.S.

Key Differences Between Blockchain and Exchange Fees

Let’s dig into what sets these apart. It’s not just jargon – the distinction helps you see where your money’s going and how to save. Blockchain fees are baked into the decentralized setup, while exchange rates are the platform’s price tag.

Check out this table for a quick comparison:

| Aspect | Blockchain Fee | Exchange Fee |

| Purpose | Pays miners/validators to process and secure transactions | Funds platform operations, safety, and services like order matching |

| Who Gets It | Network participants (decentralized) | The exchange (centralized) |

| How It’s Calculated | Depends on network load, transaction size/complexity (e.g., bytes for BTC, gas for ETH) | Based on trade volume (maker/taker), flat rates for deposits/withdrawals |

| Variability | Shifts with network demand; spikes during busy times | Set or tiered by user volume; discounts with loyalty or tokens |

| Examples | Bitcoin: ~$0.88-1.20/tx; Ethereum: ~$0.38/tx | Binance: 0.1%; Coinbase: 0.4-0.6% |

| User Control | Adjustable (higher for speed) | Mostly fixed, but pick platforms wisely |

| Effect on Transaction | Delays if too low; needed for confirmation | Extra cost for convenience; skip by using wallets directly |

Blockchain fees are a must for on-chain moves – they’re the cost of decentralization. Exchange fees, though, you can shop around for. Swapping ETH for USDT via a wallet just hits the blockchain rate, but an exchange adds its slice. During congestion, blockchain fees can outpace exchange ones – think Ethereum’s $70+ days in 2021. In quieter markets, exchange fees might sting more on small trades.

Factors Influencing Blockchain Fees

Blockchain fees aren’t static – they shift with a few key drivers. Congestion tops the list: more users mean tighter block space. Bitcoin, with its 1MB limit, sees rates of $1-3 typically, but they can hit $10+ during hype waves. Ethereum’s gas fees tie to “gas limit” (steps needed) and “gas price” (bid per unit), averaging under $1 lately but jumping with DeFi surges.

Complexity matters too – basic sends are light, but NFT mints or DeFi actions burn more gas. Timing plays a role; weekends or off-hours often bring lower rates. Layer-2 options like Polygon or Arbitrum drop Ethereum fees to cents by grouping transactions. Upgrades also help – Ethereum’s Dencun tweak in 2024 slashed some costs by up to 90%. Watching these trends can help you pick the right moment to move.

Factors Influencing Exchange Fees

Exchange fees are steadier but still vary. Trading volume is a big factor – high rollers snag VIP tiers with fee cuts. Binance dips to 0.01% for top users, and Coinbase offers similar breaks. Payment type shifts costs: credit cards add 3-4%, while bank transfers are free.

Platform style affects it – DEXs like Uniswap charge ~0.3% plus gas, while CEXs like Kraken average 0.16% for pros. Native tokens (like BNB on Binance) trim 25% off. Regulations hike costs in the U.S., where compliance adds expenses.

How to Minimize Fees in Crypto Transactions

No one enjoys overpaying – here’s how to trim both fee types:

- Pick quiet times: For blockchain fees, check low-congestion slots with tools like BitcoinFees.net or GasNow.org.

- Go for cheap chains: Try Solana (~$0.00025/tx) or layer-2s instead of mainnet Ethereum.

- Bundle moves: Group multiple actions to split the fee cost.

- Choose low-fee platforms: SwapGate (swapgate.io) offers competitive rates with no surprises for swaps.

- Use limit orders: Be a maker to score lower exchange fees.

- Leverage native tokens: BNB on Binance cuts costs; look for similar perks.

- Avoid rush hours: Trade when networks are calm to dodge spikes.

- Skip exchanges: Use wallets for direct transfers to avoid extra charges.

These tricks have saved a bundle over time – small changes add up fast!

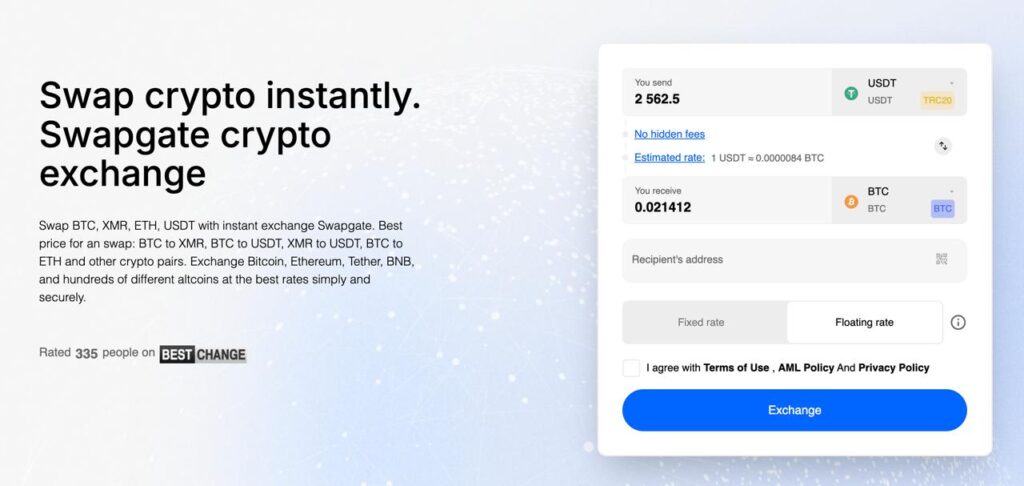

The Role of Platforms Like SwapGate

Amid the exchange crowd, SwapGate stands out by balancing blockchain and exchange fees. This swap platform keeps costs down with exchange fees often below 0.5%, while passing blockchain fees clearly. No custody means no extra withdrawal hits – you stay in charge. In 2025’s growing crypto scene, SwapGate makes fee navigation simple, letting you focus on profits.

Conclusion

To sum it up, blockchain fees keep the decentralized system alive, while exchange fees pay for the platforms we rely on. They’re different by nature – one’s a network must, the other’s a choice to shop. With Bitcoin fees around $1 and exchange rates from 0.1-0.6%, staying sharp pays off. Tools like SwapGate show how innovation trims costs while keeping security tight. Next time you trade, check those fees – you could save a lot. Got a wild fee tale? Drop it below, and happy trading!