Thinking about an exchange DAI without verification? Privacy‑oriented traders often want to move their stablecoins fast, without handing over passports or selfies. But keep in mind that even popular instant services, which allow you to swap ETH to DAI in a matter of minutes — still comply with regional rules. Let’s see what a no KYC crypto exchange really means for DAI in 2025.

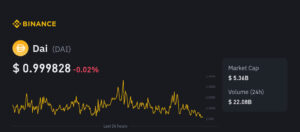

Source: https://www.binance.com/en/price/multi-collateral-dai

Binance chart showing Dai (DAI) price at $0.999828 with a 0.02% decrease over 24 hours, featuring a line graph of price fluctuations, market cap of $5.3B, and 24h volume of $22.08B.

What Is KYC and Why It’s Required

Know‑Your‑Customer (KYC) rules ask exchanges to collect:

- A government‑issued ID

- Proof of address

- Sometimes a short video selfie that matches the documents

Source: https://sumsub.com/blog/crypto-kyc-guide/

Bar chart comparing fraud rates in 2023 and 2024 across regions: Global (2.2% up 48%), Europe (1.3% up 31%), APAC (2.0% down 23%), Africa (3.6% up 112%), Middle East (1.4% up 79%), LATAM & Caribbean (1.5% up 50%), US & Canada (2.6% up 86%).

Regulators demand these checks to slow down money laundering, terror financing, and tax fraud. In most countries, a licensed platform that holds client funds must request KYC once deposits pass a modest limit (often USD 1,000–2,000). Failure to comply can lead to heavy fines or loss of a license, so when withdrawing DAI, large sites almost do not risk ignoring identity verification.

Can You Really Exchange DAI Anonymously?

Short answer: yes, but only within clear limits and strict conditions. Below we look at the services that still let you stay out of the spotlight — and the compromises they bring.

Anonymous Platforms

Purely code‑based services that never touch fiat or order books give you the best chance for an anonymous DAI exchange. The main roads are:

- Decentralized exchanges (DEXs) – Platforms such as Uniswap or Curve run on smart contracts. They need no account and keep only on‑chain data.

- Liquidity bridges – Tools like THORChain help you move assets between chains. Deposits and withdrawals land on one‑time addresses.

- Peer‑to‑peer (P2P) marketplaces – You post your offer and work directly with another user via an escrow smart contract. Many P2P sites now cap daily limits for non‑verified users at 1,000 USDT to stay under the radar.

Each of these paths is suitable if you want to quickly exchange DAI without disclosing data. Below those limits, swapping DAI no KYC is still doable. Once you touch fiat — bank transfer, card refill, or cash pickup — the other side will likely ask for at least a proof of identity.

Tip: Check the DAI price today before you swap. On thin DEX pairs, slippage can widen fast.

Legal Risks

Local law may treat anonymous trades differently from anonymous holding. Common pitfalls include:

- Reporting duties – In Germany and many EU countries, every “crypto-crypto” transaction, including transactions with DAI, is subject to tax accounting, even if KYC has not been conducted.

- Source‑of‑funds checks – When you cash out to fiat, banks can freeze funds until you explain where the DAI came from.

- Travel Rule updates – Global watchdogs now test analytics that flag transfers from “self‑hosted wallets” over USD 1,000. The receiving exchange can demand KYC later, retroactively.

No KYC today does not promise anonymity tomorrow.

Pros and Cons of No‑KYC Exchanges

Before you leap into a swap DAI without ID, weigh the speed of skipping verification against the future headaches. The table below shows the biggest upsides and drawbacks at a glance.

| Factor | Upside | Trade‑Off |

| Speed | One‑step deposit — swap — withdrawal. No wait for document review. | Smart‑contract delays, higher network fees. |

| Privacy | No central database stores your passport. | On‑chain data is public; chain analysis can find the trail. |

| Accessibility | Helpful for users in sanctioned or unbanked regions. | Hard limits (usually < 2,000 USD/day) and no fiat ramps. |

| Support | No ticket queues for “document mismatch” issues. | Minimal human help; mistakes on‑chain are final. |

How to Do It Safely

Choosing the no‑KYC road? Follow these best practices to guard your funds and privacy and keep future paperwork manageable.

- Use audited smart contracts – Read the reports and trust code you can check.

- Keep swaps small – Stay under daily limits (for example, 900 USDT) to avoid automatic flags.

- Rotate addresses – New deposit and withdrawal addresses make clustering harder.

- Watch network fees – Ethereum gas can rise; time your trades off‑peak or consider Layer‑2 routes.

- Keep records – Even if you sell DAI anonymously, save transaction hashes and screenshots for future tax filings.

- Know local rules – The US fines hidden gains heavily, while Hong Kong focuses on custodial entities.

For broader context, read the guide “How to Stay Anonymous While Swapping Crypto”.

Final Thoughts

Is swapping DAI without passport control a myth? Not fully. DEXs, bridges, and small P2P deals let you sell DAI anonymously — within limits. The real question is whether the convenience beats the long‑term hassle of tax records or later compliance checks.

If it is critical for you to manage DAI anonymously, keep transactions small, practice good on‑chain hygiene, and learn local laws. When you need bigger liquidity or fiat off‑ramps, a registered exchange may fit better, even if that means a one‑time KYC upload.