Crypto Taxation in Turkey — What to Know in 2025

With trades now settling in seconds on modern non‑custodial exchanges, it’s easy to overlook the paperwork that follows each swap. Yet slick execution means little if crypto taxes in Turkey ambush you when the fiscal year closes. Many people ask: “Do I pay tax on crypto in Turkey?” In 2025 the answer is yes — and the rules are detailed.

Source: https://www.lexology.com/library/detail.aspx?g=26228889-020d-4333-bb87-68d334d696f1

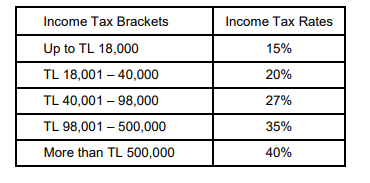

Income tax brackets and rates in Turkey:

- Up to TL 18,000 – 15%

- TL 18,001–40,000 – 20%

- TL 40,001–98,000 – 27%

- TL 98,001–500,000 – 35%

- Over TL 500,000 – 40%

This guide unpacks the latest Turkey regulations 2025, explains how to declare crypto in Turkey correctly, and offers practical tactics to trim tax on crypto income, whether you’re a casual holder or an active trader.

Is Crypto Legal in Turkey?

Yes, holding and trading digital assets is legal. Turkey’s central bank banned crypto as a means of payment back in 2021, yet buying, selling, and investing remain lawful. That legal‑but‑restricted status shapes the crypto tax rules 2025 set by the Turkish Revenue Administration (TRA).

Source: https://www.complycube.com/en/what-do-turkey-crypto-regulations-look-like/

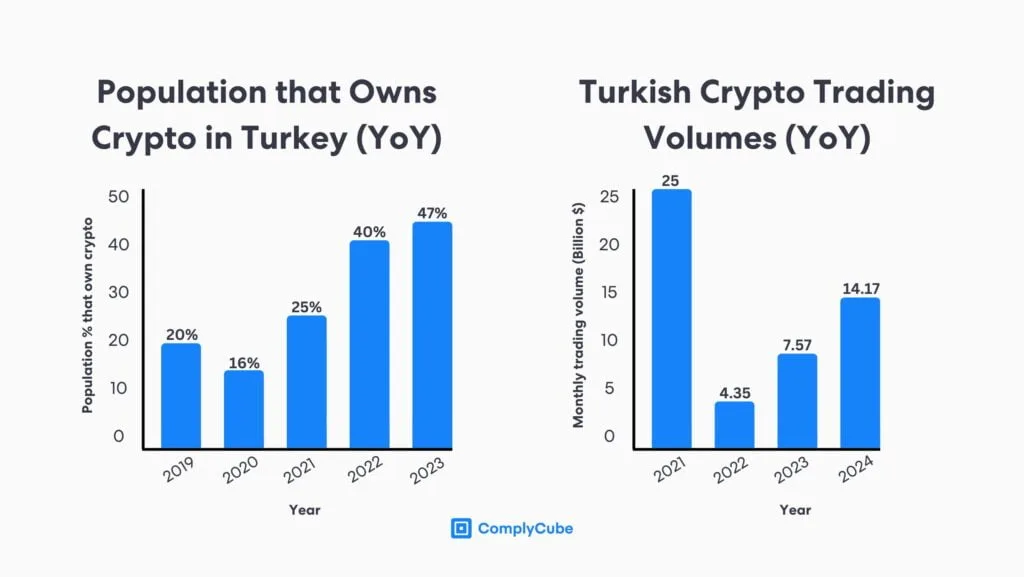

Crypto ownership in Turkey rose to 47% (2023); trading volume peaked at $25B (2021), then fell and rebounded to $14.17B (2024).

Tax Categories for Crypto

The TRA divides every lira you earn from digital assets into clear buckets so that each income type is taxed under its own logic and eligible deductions. Knowing which bucket you fall into is step one to staying compliant and avoiding surprise bills.

Trading

Profits from spot or derivatives fall under “capital gains”. If you declare crypto in Turkey correctly, the gain (₺ net proceeds – cost basis) is added to annual income and taxed at progressive personal‑income rates up to 40%.

Staking

Block‑reward income is treated like interest: it’s ordinary income the moment coins hit your wallet. Track market values on the day you receive rewards, not when you later sell them.

Mining

Solo or pool mining counts as self‑employment. Hardware depreciation and electricity costs are deductible, but you must register as a taxpayer and issue e‑invoices if annual revenue breaks the small‑business threshold.

Reporting Requirements

Turkey’s filing window opens each March, and crypto data goes into the same online portal you use for salary or rental income. Treat digital assets as another line item, not a parallel universe, to stay on the tax office’s good side.

- Annual return (Gelir Vergisi Beyannamesi). Include every realized gain or loss — even if the exchange is abroad.

- Foreign‑account disclosure. Offshore wallets or exchanges with balances above US $50 000 on December 31 must be reported in the “Overseas Financial Account Form”

- Exchange data sharing. Major Turkish platforms already share user records with the TRA; international exchanges may be compelled under OECD CRS deals.

Failing to report crypto income can trigger fines of up to 50% of the undeclared tax plus late‑payment interest.

How to Calculate Taxes

Source: https://take-profit.org/en/statistics/corporate-tax-rate/turkey/

Line chart showing a steady increase from 20 (2014–2017) to 25 (2021 & 2023), with a dip to ~23.5 in 2022.

Because active traders can rack up hundreds of transactions, a manual spreadsheet often collapses under its own weight. A clear costing method and reliable price feeds keep your numbers defensible should the TRA ever come knocking.

- FIFO default. Turkey’s tax code applies First‑In‑First‑Out unless you opt for average cost by filing a method election.

- Track cost basis in lira. Record the lira value at the time of each acquisition; convert foreign‑currency prices using the Central Bank’s daily FX rate.

- Offsetting losses. Capital losses from crypto can offset crypto gains in the same year but not other income categories. Unused losses carry forward five years.

Need a quick market snapshot for your records? Check the live Bitcoin price today before closing a trade.

Tips to Stay Compliant

Think of compliance as cheap insurance: a few minutes of routine admin save you from audits, penalties, and sleepless nights. Most habits become automatic once you schedule exports and label wallets correctly.

- Keep detailed logs. Export CSVs from exchanges every month; the TRA accepts digital records.

- Segregate wallets. Use one wallet for long‑term holding and another for active trades to simplify FIFO tracking.

- Set aside tax reserves. Assuming a top bracket of 40%, sock away two lira for every five lira of net profit.

- Use professional software. A dedicated crypto tax guide app can calculate cost basis automatically and generate Turkish tax‑form outputs.

- Swap smartly. Fixed‑rate swaps can reduce slippage, helping you lock in gains before tax rates shift. For deeper background, see: “Crypto Wallet vs Crypto Exchange: What’s the Difference?”

Summary

The legal landscape is still evolving, and draft bills could add withholding or VAT‑style levies as early as 2026. Staying informed today positions you to pivot quickly when rules change.

- Crypto is legal in Turkey, but payments with it are banned; trading is fully taxable.

- You must report offshore wallets and follow FIFO unless you elect an average cost.

- Careful record‑keeping and proactive planning reduce tax on crypto income while keeping the TRA happy.

- Ready to realign your portfolio? A low‑friction swap like exchange ETH to BTC takes seconds — just remember to log the cost basis for next year’s return.