If you hold Bitcoin or other cryptocurrencies in Estonia, 2025 brings a mix of familiar Estonia crypto tax rules and a few important updates. This crypto tax guide breaks down how profits are taxed, which forms to use for your crypto declaration, what changed on 1 January and 1 July 2025, and what’s coming in 2026. No jargon—just the practical steps you need.

The 2025 snapshot

Legal status. In Estonia, cryptocurrency is treated as property, not as legal tender. For private individuals, gains from the sale or exchange of crypto (including crypto‑to‑crypto) are taxed as income from transfer of property. In plain English: convert Bitcoin to euros or swap ETH for BTC, and the gain you realized is taxable.

Tax rate for individuals. The flat personal income tax rate is 22% in 2025. That rate applies to your net gain from each taxable transfer (more on calculation below). Basic exemption rules still apply to overall annual income, but there’s no special crypto rate.

New in 2025 – investment account option for regulated crypto. Estonia’s big update for this year is that certain crypto‑assets acquired through a licensed, MiCA‑regulated intermediary can now be treated like financial assets in a resident individual’s investment account. That means you can defer tax on reinvested gains when you keep all movements inside a properly set up investment account, and—importantly—offset losses against gains within that regime. This is a game‑changer compared with the old approach where crypto losses weren’t deductible and every profitable swap triggered tax immediately.

VAT update. From 1 July 2025, Estonia’s standard crypto tax rate is 24%. Day‑to‑day investing by private individuals is not subject to VAT, but if you run a business providing crypto exchange services, you need to understand how VAT applies (see Section 6).

What is taxable for private individuals?

Source: Vamosarema

Think in buckets of activity. Estonia’s crypto tax office (the Estonian Tax and Customs Board, often abbreviated MTA/EMTA) lays out clear categories for crypto taxes in Estonia. Here’s how common situations map out under Estonia cryptocurrency tax 2025:

Selling or swapping crypto (including crypto‑to‑crypto)

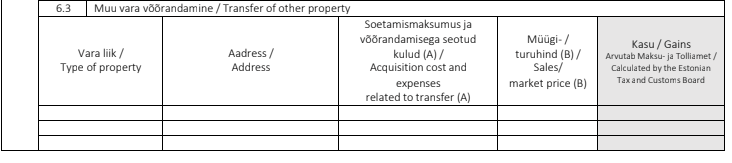

Table 6.3 (8.3). Source: Divly

- Taxable event: Yes. Selling Bitcoin (BTC) in Estonia for euros or exchanging one coin for another creates a gain or loss per transaction.

- How to compute: Gain = selling price (or value received) – acquisition cost – directly related fees (e.g., platform/trading fees, withdrawal fee charged on disposal). Each transfer is its own calculation.

- Where to report: Individuals declare profitable transactions under Gains from transfer of other property (tables 6.3 or 8.3 in the e‑MTA return). Historically, losses were not deductible in this category. In 2025, if you use the investment account route for eligible, regulated crypto, you can defer tax and net gains and losses inside that framework.

Paying for goods/services in crypto

- Taxable event: Yes. Paying with BTC/ETH is treated as if you sold crypto for its euro value and then bought the item. You recognize a gain if your crypto has appreciated since purchase.

Mining, staking, lending interest

- Mining: Income from mining is taxable; classification depends on scale (hobby vs business). Keep good records.

- Staking / interest‑like rewards: Estonia treats staking rewards similar to interest on lending your crypto. When you receive staking yield (in the same coin or another), that interest income is taxable upon receipt and goes in the wages/interest sections of the return rather than capital gains. If you later sell those rewarded coins, you also recognize transfer‑of‑property gains on any appreciation from the value at receipt.

Salary and contractor income paid in crypto

- Employment income: If your employer pays you in crypto, the employer should withhold and report payroll taxes on the euro value at the payment date. The amount is pre‑filled in your return. If tax wasn’t withheld (e.g., foreign payer), you must report the euro value yourself.

NFTs and other digital assets

- Creators: Ongoing resale royalties can be royalty income.

- Traders: Profits from buying/selling NFTs are taxable per profitable transfer; fees can be counted as costs.

Important record‑keeping tip: Download exchange platform reports showing euro values at acquisition and disposal and fees. Estonia expects transaction‑level support even if you report consolidated totals in the return.

How to calculate your gain

For Estonia Bitcoin tax (and all crypto), the formula for each disposal is:

Gain = Euro value at sale/exchange – Euro value at purchase – directly related transfer costs

- Use the market price at the place of transaction (if the pair is quoted in USD, convert to EUR using the Eesti Pank daily rate for that date).

- Fees count if they are directly tied to the disposal (e.g., the platform’s trading fee when you sold). Keep receipts.

- If a disposal shows a loss, it historically could not be used to offset other gains (crypto is not a “security” under the old rule set). The investment account regime introduced in 2025 changes this for eligible, regulated crypto kept within that system (see next section).

Reporting deadlines and the e‑MTA flow

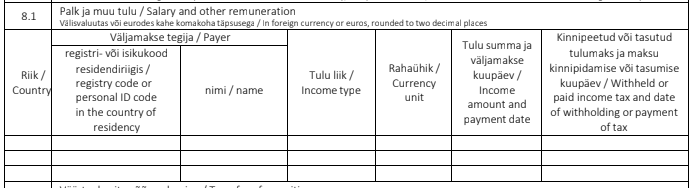

Table 5.1 (8.1). Source: Divly

- When to file: For income earned in 2024, individuals filed 15 February – 30 April 2025 in the e‑MTA portal (paper returns allowed, same deadline). The Estonia crypto tax payment/refund due date connected to the 2024 return is 1 October 2025.

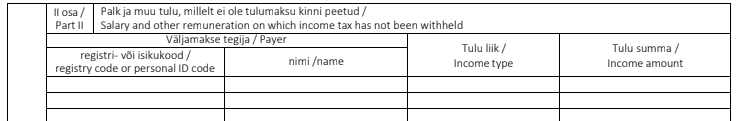

- Where crypto goes on the return: Profitable transfers in 2024 go to Table 6.3/8.3 as Gains from transfer of other property. Interest/staking income goes to Table 5.1/8.1 depending on source. If you were paid in crypto and no withholding was done, you also report the euro value in Table 5.1 (II) or 8.1.

- Corrections: Returns can be corrected within three years if you missed entries or need to revise your crypto reporting.

Table 5.1 (8.1) part II. Source: Divly

The big 2025 change: using an investment account for regulated crypto

Estonia’s investment account lets residents postpone paying tax on reinvested gains from financial assets, provided all flows stay inside the account and you follow the rules. As of 1 January 2025, the list of permitted assets expands to include certain crypto‑assets—specifically, those acquired through a licensed crypto‑asset service provider or issuer under the EU’s MiCA framework.

What this means in practice

- If you buy/hold/sell eligible, regulated crypto entirely within an investment account, you can defer tax on gains you keep reinvested.

- You can also offset losses against gains within that regime—something you couldn’t do under the classic “transfer of other property” rules.

- If/when you withdraw more than you’ve contributed (net), the excess becomes taxable at that time at the 22% rate for individuals.

Caveats

- The crypto must be acquired via a MiCA‑licensed intermediary/issuer. Self‑custody purchases on DEXs may not qualify. Check your broker/exchange status.

- You must properly designate and report the investment account in the tax return and keep the statement consistent (all contributions/withdrawals, purchases/sales recorded).

- This is new. Expect more clarifications from the Estonia crypto tax office; save thorough documentation.

VAT and business activities (for entrepreneurs and CASPs)

- From 1 July 2025, the standard crypto tax VAT rate is 24% in Estonia. However, per the EU Court of Justice ruling, the exchange of cryptocurrency for fiat (and vice versa) is treated like a financial service and is exempt from VAT—similar to exchanging one fiat currency for another.

- Other crypto‑related services (e.g., consulting, software) may be taxable supplies and subject to the 24% VAT unless a specific exemption applies. If you operate a crypto‑asset service provider (CASP), monitor MiCA licensing and VAT obligations together.

Looking ahead to 2026: automatic exchange of crypto information (DAC8/CARF)

The EU’s DAC8 (aligned with the OECD CARF) kicks in from 1 January 2026, requiring crypto‑asset service providers to collect and report customer transaction data to tax authorities. For Estonian crypto tax payers, that means your local or foreign platforms may report your crypto sales/exchanges and income to the MTA automatically. This doesn’t change 2025 filing—but it does raise the stakes for accurate records and timely declarations.

Company‑side: quick notes for OÜs and founders

- Estonia’s famous corporate crypto tax model taxes profits upon distribution, not annually. From 2025, the standard distribution tax rises to 22% (and the previous 14% lower rate is gone). Crypto sitting on a company balance sheet can defer corporate tax until distributed, but realized gains can still affect accounting profit and the ability to pay dividends.

- If your company offers crypto services, note that Estonia has transposed EU MiCA into national law and licensing moves from the FIU to the FSA. Existing FIU licensees face a transition timeline into 2026. Build tax/VAT compliance into that migration.

Practical checklist for 2025 filers

- Map your activity: trading, swapping, staking, wages, NFTs, mining. Different boxes on the return.

- Pull statements: exchange CSVs with euro values and fees for each disposal; staking/interest receipts with dates.

- Decide on regime: classic per‑transaction reporting or move eligible holdings to an investment account for deferral and loss netting going forward.

- Mind timelines: file in e‑MTA by 30 April; pay/refund by 1 October (for the prior year).

- If you’re a business: confirm VAT treatment and MiCA/FSA licensing path; if you provide services beyond spot exchange, check whether VAT applies at 24%.

- Get ready for DAC8: from 2026 your platforms will start reporting; clean data now avoids headaches later.

Final Words

For Estonia crypto tax payers, the core remains simple: sell or swap = taxable gain at a 22% personal rate in 2025, and you report it in e‑MTA. The big upgrade is the option to treat regulated crypto like other financial assets inside an investment account—letting you defer tax and offset losses when you keep flows in that channel. Add the 24% VATchange (relevant mainly to businesses) and DAC8 reporting from 2026, and you have a clear picture of where Estonia cryptocurrency taxation is headed.

When in doubt, save everything (TxIDs, exchange CSVs, euro conversions), and if your situation is complex (DAO comp, business‑scale mining, cross‑border wallets), consider a local advisor. Estonia’s crypto tax system is straightforward—if you follow the rules and keep your paperwork tidy.