If you invest in Bitcoin or other digital assets in Czechia, 2025 is a big year. Parliament has aligned the rules with the EU’s MiCA regime and—most importantly for individuals—introduced clear exemptions that can make your crypto tax in Czech Republic simpler (and sometimes zero). This guide explains what changed, what you still need to report, and how crypto taxes in Czechia work in practice.

What changed in 2025

Two new tests now sit at the heart of Czech Republic crypto tax for individual investors:

- Time test (3-year holding): If you sell or spend crypto you’ve held for more than three years, the gain is exempt from income tax.

- Value test (low-value transactions): If your total gross income from crypto transfers in a calendar year is ≤ CZK 100,000, those transactions are tax-exempt and don’t need to be reported. (A general annual cap of CZK 40 million applies to certain exemptions, mirroring rules for securities.)

These tests took effect with the Digital Finance Act and related Amendment Act on February 15, 2025—laws that also designated the Czech National Bank (ČNB) as the competent MiCA authority and set a transition path for service providers.

Bottom line: For many long-term holders in the Bitcoin Czech Republic community, this is a genuine tax break. If you qualify under the time or value test, you may owe no tax on covered transactions in 2025. (Transactions before the effective date follow the old rules.)

Who pays tax—and at what rate?

Czech law taxes profits when you monetize your crypto—by selling for fiat, swapping coin-to-coin, or paying for goods/services with crypto. (Simply holding or moving coins between your own wallets is not a taxable event.) For individuals outside a business, gains are generally taxed within the personal income tax system.

Rates in 2025: Czech personal income tax is 15% up to a base equal to 36× the average wage, and 23% on the part above that threshold. For 2025, the threshold commonly referenced is CZK 1,676,052 per year.

If your crypto activity is business-like (e.g., professional trading, mining as a business), different classification and social/health rules can apply—speak to a local advisor.

Important 2025 nuance: Even with the new exemptions, if you sell before 3 years and your yearly crypto receipts exceed CZK 100,000, your net profit is taxable at 15%/23% with the income aggregated into your overall tax base.

What is a taxable “transfer” of crypto?

Under Czech guidance and EU practice:

- Selling crypto for CZK/EUR → taxable transfer.

- Swapping crypto-to-crypto (e.g., BTC→ETH) → treated like a sale and repurchase (taxable unless you pass the 3-year time test).

- Paying for goods/services with crypto → treated like selling crypto at market value, then buying the item (taxable event).

That means an active Czech Republic BTC trader who rotates between coins triggers taxable events unless protected by the time or value test.

VAT: Is exchanging crypto subject to VAT?

No—exchanging crypto for fiat (and vice versa) is VAT-exempt across the EU under the CJEU’s Hedqvist ruling. The Czech tax administration issued guidance that specifically follows this approach. Mining has its own VAT nuances (usually outside the scope due to no direct consideration), and renting mining equipment is a taxable service.

This is good news for platforms and for users paying exchange fees: the exchange service is treated like a currency exchange, not a VAT-taxable supply.

How to calculate your taxable profit

When you don’t qualify for an exemption, the basic formula is:

Gain = Proceeds (CZK) – Acquisition cost (CZK) – Direct transaction fees

Keep solid records of each acquisition and disposal: date/time, amount, price in CZK, and fees. Many Czech tax practitioners aggregate trades and use consistent cost-basis methods (e.g., FIFO or an average method) for year-end calculations—speak to an advisor about the method that fits your facts and the 2025 amendments.

Tip: Because the value test uses gross receipts (not net profit), track both the total value of your 2025 crypto sales/spends and your holding periods, especially if you plan to rely on the CZK 100,000 exemption.

How and where do you report?

For most non-business individuals, crypto gains are reported in the personal income tax return alongside other income. Helpful government resources explain the two-rate system (15%/23%) and how your income aggregates into the base. Filing happens the year after you earn the income (e.g., 2025 income is filed in 2026), with electronic and tax-advisor deadlines that can extend the due date.

Checklist for your 2025 file:

- Transaction log (date, asset, quantity, price in CZK, fees).

- Wallet/exchange statements (CSV exports).

- Evidence of holding periods (to support the 3-year time test).

- Running total of 2025 crypto receipts (to test the CZK 100,000 value threshold).

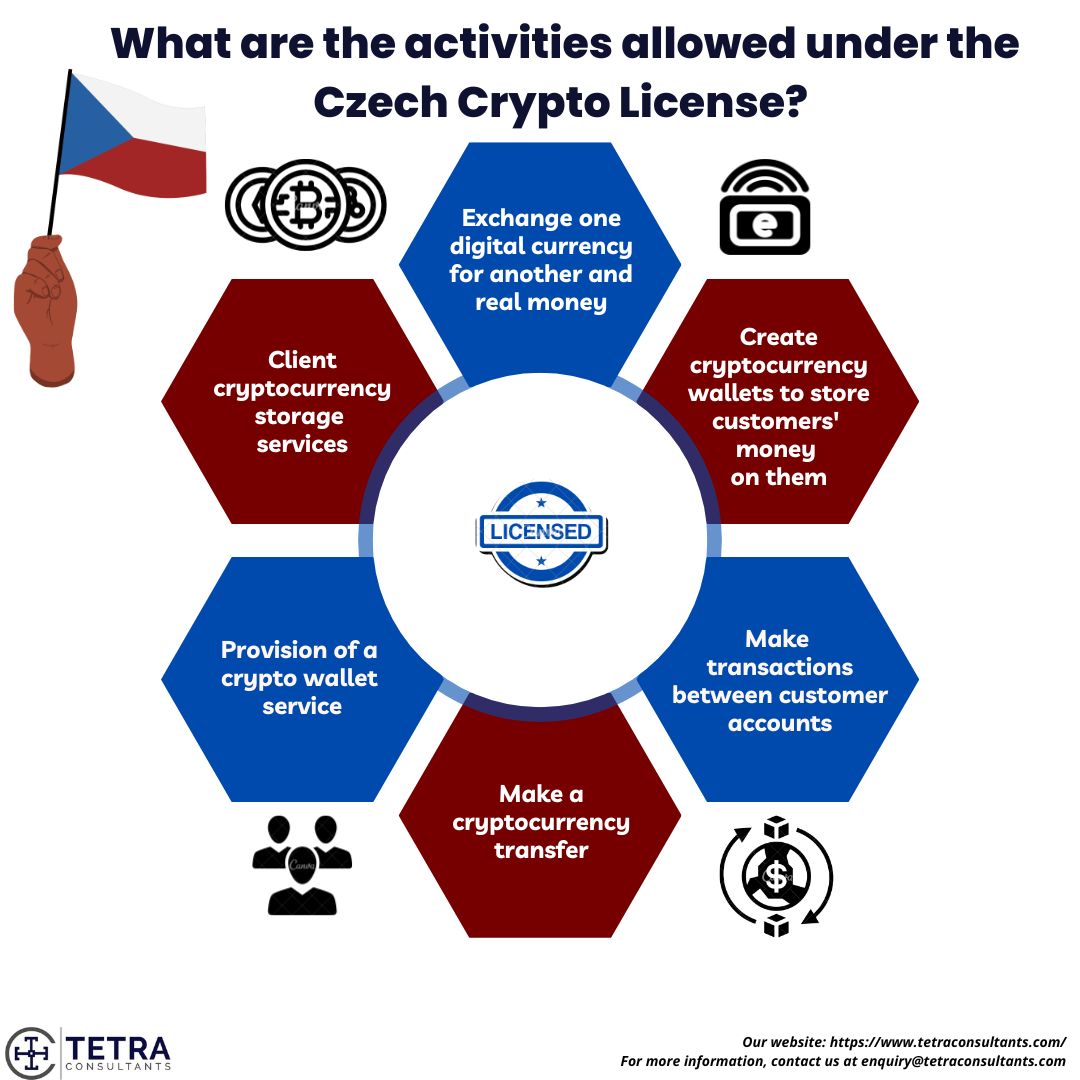

MiCA supervision and platform transition

Since Feb 15, 2025, Czechia’s Digital Finance Act (No. 31/2025 Coll.) designates the ČNB as the MiCA supervisor. Existing local providers can rely on grandfathering until July 1, 2026 if they submit a CASP license application by July 31, 2025. This should gradually standardize disclosures, custody, and complaint handling—good news for consumer protection in the Czech Republic crypto ecosystem.

What about “automatic reporting” of your crypto?

From January 1, 2026, the EU’s DAC8 and the OECD’s CARF will bring automatic reporting obligations for crypto-asset service providers. If you’re a Czech Republic Bitcoin holder using EU platforms, expect more tax-authority visibility into your disposals and income; clean records will matter even more.

Practical examples

- Example A: Long-term HODL (exempt). You bought BTC in January 2022 and sell in March 2025. You’ve held >3 years, so the time test applies—no income tax on the gain. (Document your acquisition date and amount.)

- Example B: Active trader under CZK 100k (exempt). You made several small swaps in 2025 totaling CZK 85,000 in sales proceeds. Even if you have gains, your crypto gross receipts stay under CZK 100,000—value test exemption applies. Track the value of all disposals to prove it.

- Example C: Coffee with BTC (often exempt now). You use Czech Republic BTC to buy coffee a few times. The government’s stated policy aim is to stop taxing tiny spend—the value test is meant to cover everyday low-value use. If your year’s total crypto receipts stay ≤ CZK 100,000, those spend events are exempt.

- Example D: Short-term trade above limits (taxable). You rotate BTC→ETH→CZK in 2025 with CZK 300,000 total proceeds and a CZK 60,000 profit. With no 3-year hold and receipts > CZK 100,000, the profit is taxable at 15%/23% within your annual tax base.

Business, mining, and staking—special notes

Source: Tetra Consultants

- Mining: Generally outside VAT scope due to no direct consideration, but mined coins later sold for fiat are taxable income. If you mine as a business, income and input VAT rules differ (no VAT deduction on mining inputs).

- Staking/interest-like rewards: Typically taxable when received (recognized in CZK at the date you get the reward), and later disposals can create additional gain. (Check treatment with your accountant.)

- Exchanges & brokers: Under MiCA, more providers will be ČNB-supervised CASPs, with clear complaint and disclosure standards. Expect stronger KYC/AML and cleaner statements for your records.

Quick FAQ for 2025

Do I still pay tax when I swap coin-to-coin?

Yes—unless you pass the 3-year time test or the CZK 100,000 value test. Crypto-to-crypto is treated like a sale and repurchase.

Are exchange fees VAT-taxed?

The exchange of crypto for fiat/other crypto is VAT-exempt (Hedqvist). Other services (e.g., hardware rental) can be taxable.

What rates apply if I do owe tax?

15% up to the 36× average wage threshold (≈ CZK 1,676,052 in 2025) and 23% above that.

Does the law apply retroactively?

No. The new exemptions apply to income from 2025 onward (the acts came into force Feb 15, 2025). Earlier disposals follow old rules.

Will the tax office see my exchange activity?

From 2026, DAC8/CARF extends automatic reporting for crypto—so keep good records in 2025 and beyond.

The takeaway for investors

Czechia just made crypto tax clearer and friendlier. If you’re a long-term Bitcoin holder in the Czech Republic, the 3-year time test can fully exempt your gains; if you only dabble with small amounts, the CZK 100,000 value test can shield you from paperwork. If you’re actively trading larger sums, keep meticulous records and budget for the 15%/23%personal income tax bands. With ČNB supervising the market under MiCA and DAC8 data-sharing coming in 2026, the Czech Republic crypto landscape is moving toward mainstream finance—more protection, clearer rules, and fewer grey areas.