Understanding crypto market sentiment is more than reading headlines — it’s building a repeatable process that blends on-chain data, derivatives flows, social signals and traditional technicals. Below is a friendly guide that walks you through the best tools, the strongest crypto indicators, and a step-by-step workflow to judge the current crypto market sentiment — including how to isolate bitcoin sentiment for clearer, actionable insight.

Why it matters

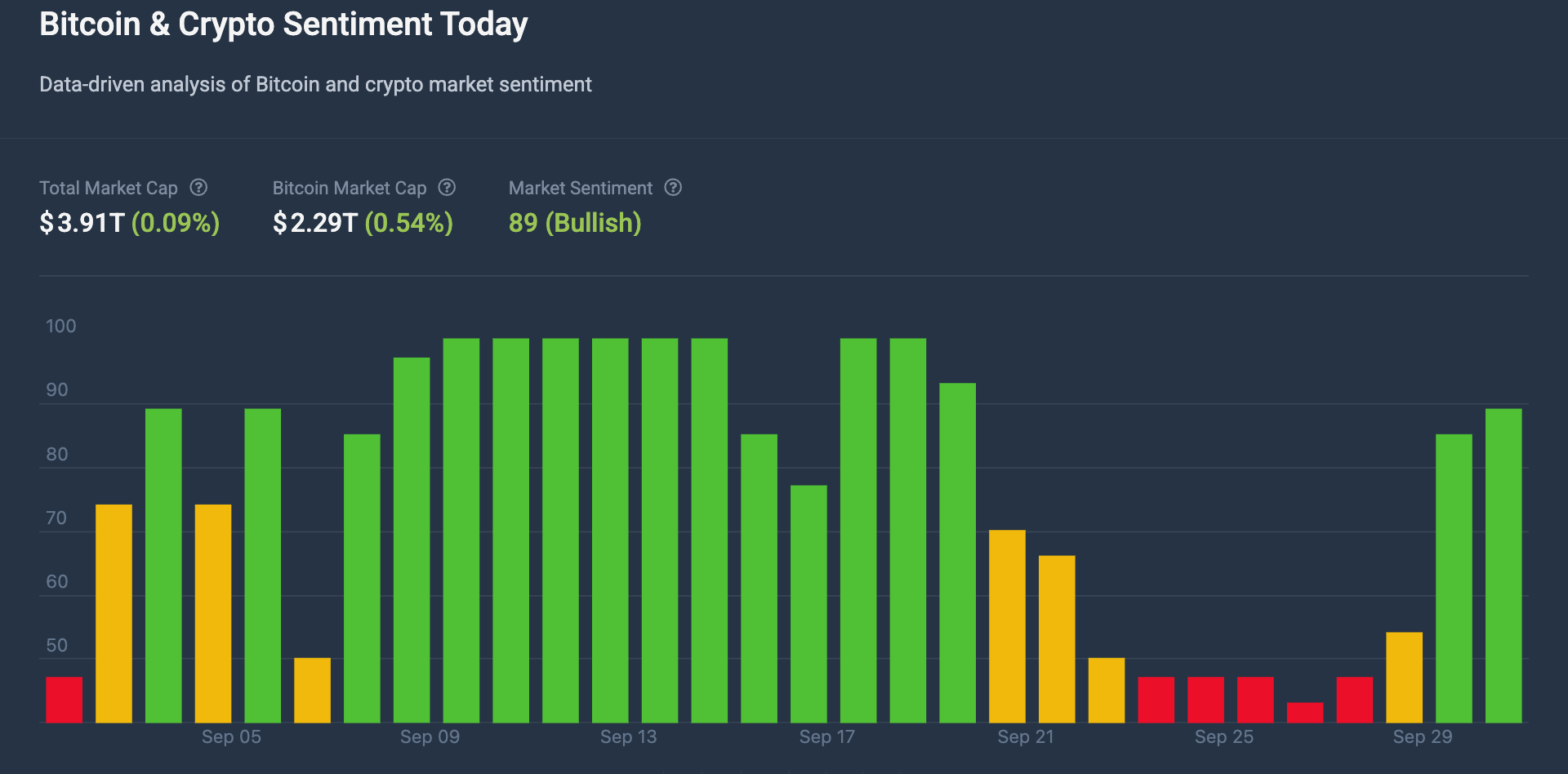

Source: Coinmarketcap

Market sentiment is the crowd’s prevailing mood: optimistic (bullish) or fearful (bearish). In crypto, that mood can accelerate moves because leverage, social virality and retail flows amplify reactions. Reading it helps you answer: Are traders over-exuberant? Is accumulation happening quietly? Or are positions stretched and ripe for a pullback?

A simple place many traders start is the Crypto Fear & Greed Index, which compresses several inputs into a single 0–100 score that provides a quick snapshot of crypto sentiment today. It’s a helpful thermometer but not a roadmap on its own.

The core categories of sentiment signals

To get a reliable view of market sentiment in crypto, use a mix of independent signal types — each explains a different part of the market:

- On-chain metrics (supply, flows, accumulation) — These show what holders and whales are doing: are coins moving to exchanges, are long-term holders accumulating, is stablecoin supply rising? On-chain analytics providers publish easy-to-read dashboards and research that make these trends visible.

- Derivatives & risk indicators (funding rates, open interest, option skew) — Funding rates and open interest reveal position bias: persistently positive funding suggests too many longs; rising open interest with price rally indicates fresh leverage coming in. These metrics are real-time sentiment indicators for professional desks.

- Social and news sentiment (Twitter/X, Reddit, mainstream coverage) — Volume and tone of social discussion often lead retail moves. Platforms that analyze social volume, polarity and trending narratives help quantify noise and detect early mania or panic.

- Technical and on-exchange data (volume, liquidity, orderflow) — Classic price+volume analysis still matters: a move on thin volume is less trustworthy than one backed by expanding volume or improving liquidity. Combine exchange orderbook snapshots and volume metrics to validate price action.

Practical tools to use

- Alternative.me (Fear & Greed Index) — quick, single-number sentiment snapshot.

- Glassnode — robust on-chain data (supply cohorts, exchange flows, accumulation metrics and research). Great for long-term and intermediate-term sentiment work.

- CryptoQuant — derivatives metrics, funding rates and open interest dashboards used by desks to gauge leverage.

- Santiment — social and narrative analytics: sentiment polarity, social dominance and trending topics.

- TradingView / Exchange APIs — for price, volume, and on-book liquidity snapshots. Use these to confirm technical setups and volume-backed moves.

Step-by-step workflow to read crypto market sentiment

Follow this repeatable process whenever you want a clear, defensible view of current crypto market sentiment.

- Start with the index snapshot. Check the Crypto Fear & Greed Index to see whether the baseline mood is fear, greed or neutral. This gives you a fast orientation for the day.

- Scan on-chain flows. Look at exchange inflows/outflows, long-term holder supply, and stablecoin supply. Increasing exchange inflows with falling price usually signals selling pressure; growing stablecoin balances can indicate dry powder waiting to buy. Glassnode is a good source for these signals.

- Check derivatives for leverage bias. Inspect funding rates and open interest across major perpetuals. Strong positive funding + rising open interest = bullish leverage; negative funding suggests short dominance. CryptoQuant provides consolidated dashboards for these metrics.

- Measure social momentum. Use Santiment or similar tools to see whether social volume is spiking and whether sentiment polarity is positive or negative. A social spike with euphoric sentiment often precedes volatility.

- Confirm with price/volume action. On TradingView, check whether moves are confirmed by expanding volume and healthy orderbook depth. If price climbs but volume is thin, treat signals with caution.

- Synthesize into a view. Weigh signals: are on-chain accumulators buying while social sentiment is subdued? That can be constructive. Or is social euphoria coinciding with extreme Fear & Greed readings and stretched funding rates? That’s a red flag. Build a short, evidence-backed note: “On-chain: accumulation; Derivatives: neutral; Social: euphoric → Market Sentiment Crypto = cautiously bullish/overheated.”

Applying this to Bitcoin

Source: Coincodex

Bitcoin often leads sentiment for the larger market. To read bitcoin price sentiment, apply the same workflow but prioritize BTC-specific metrics: BTC exchange flows, BTC funding rates, miner selling, and long-term holder behavior. Looking at bitcoin market sentiment separately can prevent altcoin noise from skewing your view. Use Glassnode’s BTC cohort charts and CryptoQuant’s BTC derivatives dashboards for this slice.

Practical tips and pitfalls

- Don’t rely on a single signal. Indexes are helpful but easily gamed; corroborate with at least two independent indicators.

- Be aware of timeframes. Social spikes move fast; on-chain accumulation is slower. Align your trades with the time horizon you’re targeting.

- Account for context. Macro news (rate decisions, bankruptcies, ETF flows) can flip sentiment quickly — always scan top headlines.

- Test a “small first” rule. If you’re using sentiment to inform position sizing, scale in with small sizes and increase when multiple indicators confirm.

Conclusion

Reading crypto market sentiment is less art than disciplined practice. Build a short checklist from the steps above, use the trusted tools identified here, and update your view often — sentiment changes quickly, but a consistent method keeps your decisions grounded. Whether you’re tracking broader crypto market sentiment or zooming in on bitcoin sentiment, this toolkit helps you turn noisy signals into clearer, actionable insight.