Looking for yield on idle coins or fast liquidity without selling your stack? A crypto lending platform can help—but only if you understand how it works and where the risks sit. This guide breaks down what is crypto lending, how does crypto lending work, how Bitcoin lending differs, and what to look for when comparing the top crypto lending platforms in 2025. You’ll get explanations, a practical risk checklist, and trustworthy references throughout.

What is crypto lending? (CeFi vs. DeFi)

At a high level, lending markets match liquidity suppliers (depositors seeking yield) with borrowers (traders, market makers, funds, or individuals who post collateral and pay interest). Two big models dominate:

- DeFi (on-chain): Protocols like Aave and Compound are sets of smart contracts. You deposit to a pool, earn a variable APY, and borrowers take over-collateralized loans that auto-liquidate if their health factor falls below 1. No account required—just a wallet.

- CeFi (off-chain/custodial): Centralized companies pool customer assets and lend them out to vetted borrowers. You see a posted rate; the platform manages collateral, credit checks, and rehypothecation. Transparency varies by provider. Recent history shows that counterparty and governance risks are real (see Celsius, BlockFi, Voyager).

Where does the yield come from? In both models, borrowers pay interest to access capital. In DeFi, rates float algorithmically with supply/demand; in CeFi, they are set by the platform’s book of loans and hedging strategies. Protocol docs explain the mechanics; for example, Aave and Compound outline over-collateralized borrowing and variable rate curves.

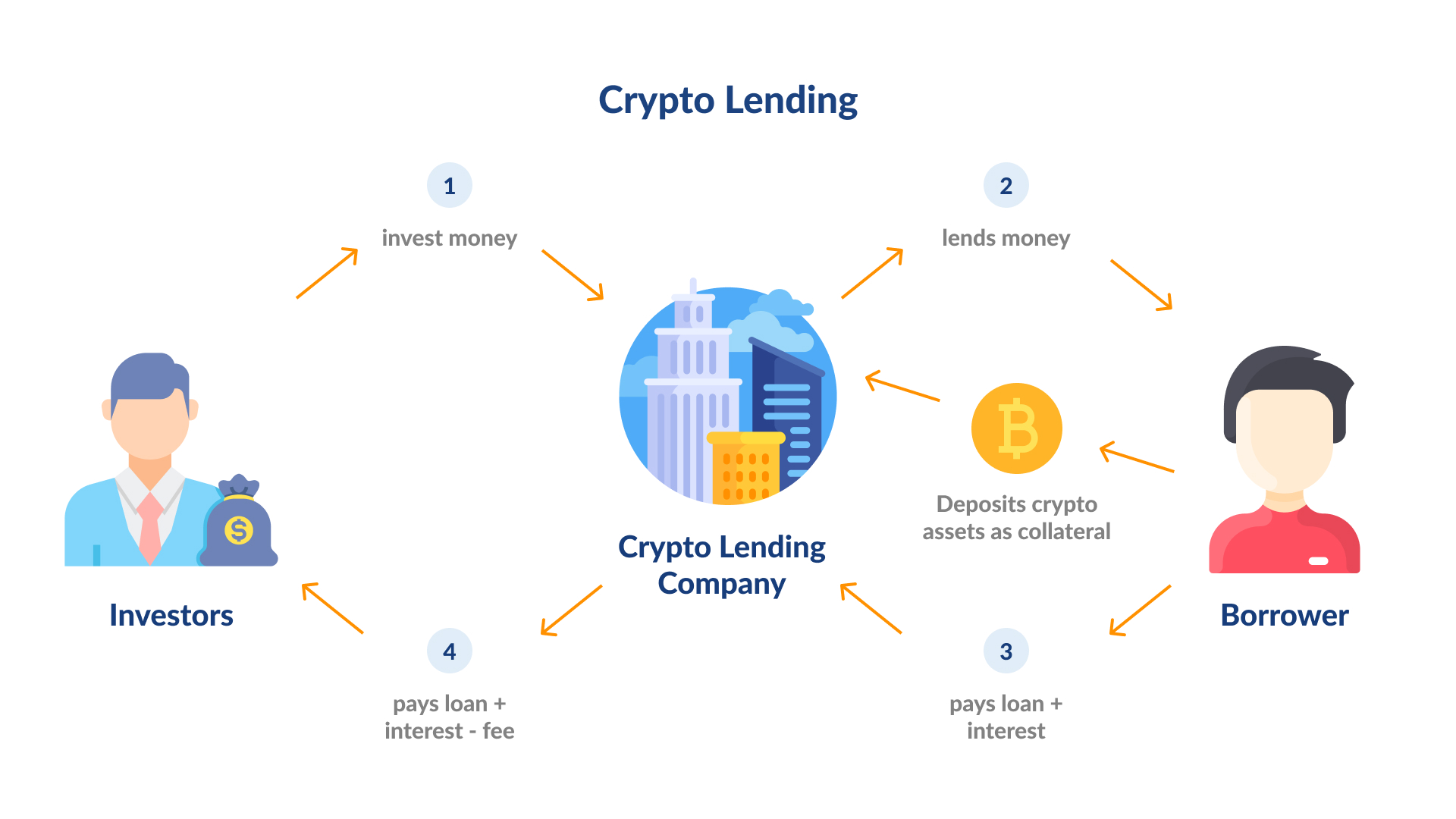

How does crypto lending work

Source: Vamosarema

- Deposit/Supply: You deposit assets (e.g., USDC, ETH, WBTC) to a pool (DeFi) or account (CeFi).

- Borrow: Another user posts collateral (usually worth more than the loan) and borrows against it.

- Interest accrues: Lenders earn a share of interest paid; rates move with utilization. In DeFi, oracles and parameters (e.g., liquidation thresholds) govern risk and when positions get liquidated.

- Redemption/Withdrawal: You can withdraw your principal and accrued interest—subject to liquidity in DeFi pools or platform terms in CeFi.

Key differences: DeFi is transparent and programmatic but introduces smart-contract and oracle risk. CeFi can feel simpler and may offer fiat ramps, but introduces counterparty risk and opaque rehypothecation.

How does Bitcoin lending work?

BTC doesn’t natively support smart contracts like Ethereum, so on DeFi you often use wrapped BTC (WBTC) to participate in protocols such as Aave/Compound. On CeFi, bitcoin lending platforms offer BTC-backed loans (you post BTC, receive cash or stablecoins) or yield accounts for BTC/USDC. For example, Ledn advertises BTC-backed loans and runs periodic Proof-of-Reserves (PoR) attestations; Nexo has published risk and reserves-attestation materials (note that the audit landscape has evolved). Always read what an attestation actually proves (and what it doesn’t).

Risks you must price in

- Counterparty failure (CeFi): Lenders Celsius and BlockFi both collapsed. Courts confirmed harsh realities for account holders (e.g., assets in certain Celsius accounts were part of the estate; BlockFi settled with the SEC over unregistered interest accounts). Recoveries for Voyager customers were well below 100%. These are not FDIC-insured deposits.

- No deposit insurance: The FDIC explicitly warns that crypto assets at non-banks are not insured, and firms must not imply otherwise.

- Regulatory actions: U.S. regulators scrutinize interest-bearing crypto accounts; enforcement has been frequent (see SEC updates). Consider jurisdiction and licensure when you assess the “best crypto lending platforms 2025.”

- Smart-contract/oracle risk (DeFi): Code bugs or oracle manipulation can drain pools or trigger bad liquidations. Review audits, bug-bounty programs, and protocol parameters. Aave’s docs explain liquidation mechanics and health factors—study them before borrowing.

- Proof-of-Reserves caveats: PoR is helpful, but doesn’t prove solvency by itself (it’s a snapshot, often without full liability context). Treat PoR as one data point, not a guarantee.

Investor alerts: The SEC issued a bulletin on risks of crypto asset interest-bearing accounts; read it before you deposit a single satoshi.

Examples you’ll actually encounter

- Aave (DeFi): Non-custodial pools on multiple chains; over-collateralized borrowing; transparent parameters and liquidation rules. Good for learning how how does crypto lending work in code.

- Compound (DeFi): Interest-rate model driven by utilization; supply/borrow in supported assets (including WBTC variants).

- Maple Finance (institutional credit): Credit pools to KYC’d borrowers with on-chain transparency; targeted at professionals. Useful to understand how under-collateralized credit is being rebuilt with better disclosures.

- Ledn, Nexo (CeFi examples): BTC-backed loans and yield products; both publish materials on risk and PoR/attestations. Evaluate frequency, auditor, and scope; verify whether the attestor is independent and whether liabilities are included.

None of the above are endorsements. They’re starting points to research the best crypto lending platform for your situation.

How to choose the best crypto lending platforms 2025

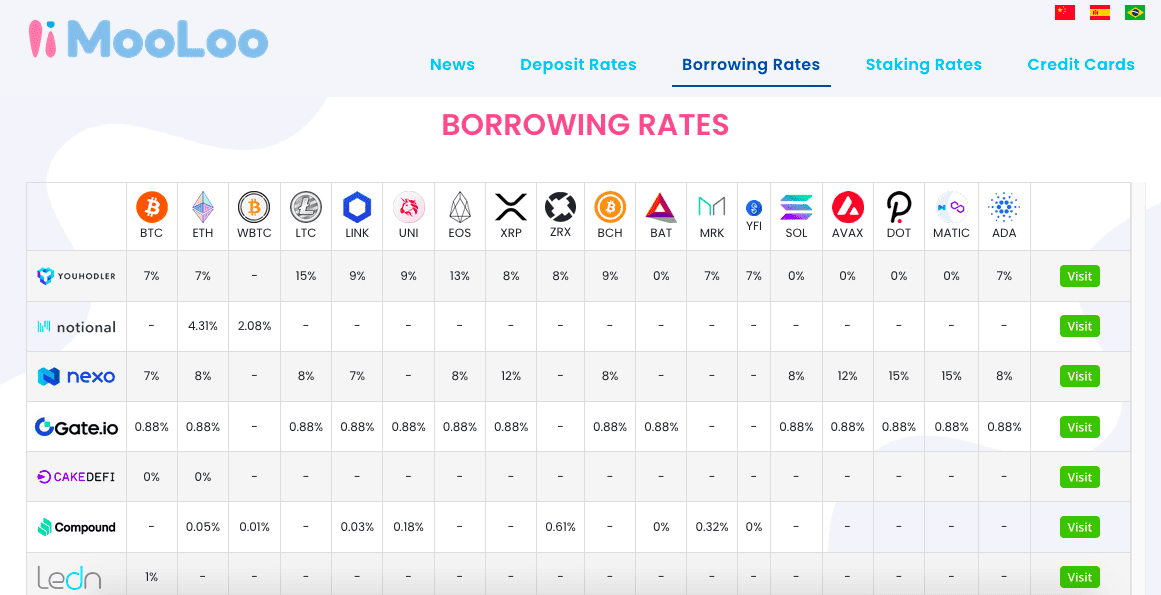

This table of borrowing rates from mooloo.net shows the extreme variability of borrower interest rates on crypto loans, from 0% per year to as high as 15%.

Use this before you deposit a cent:

- Who holds the keys?

- DeFi = you hold keys (via wallet). CeFi = they hold keys. Self-custody reduces counterparty risk but adds operational risk.

- Transparency & attestation

- DeFi: on-chain reserves/liabilities and open contracts.

- CeFi: ask for regular, independent PoR with liabilities and a clear auditor (e.g., The Network Firm for Ledn). Remember: PoR ≠ full solvency audit.

- Risk parameters

- DeFi: liquidation thresholds, reserve factors, oracle design.

- CeFi: loan book concentration, collateral policies, rehypothecation limits.

- Jurisdiction & compliance

- Check licensing, disclosures, and any history with regulators/enforcement. In the U.S., interest-bearing products have drawn scrutiny and penalties (e.g., BlockFi).

- Track record under stress

- How did the platform perform during 2022–2023? Search for bankruptcy filings, recovery percentages, or forced delistings.

- Operational features

- Withdrawal notice periods, lockups, rate-change policy, and whether rates are promotional or sustainable.

- For Bitcoin specifically

- Best bitcoin lending platforms 2025 should explain custody setup for BTC, margining practices, and margin-call thresholds. If using DeFi, understand WBTC wrapping and bridge risk.

A safe way to start

DeFi (Aave/Compound) – learn-by-doing with tiny funds

- Connect a wallet to a test network or allocate a very small amount on mainnet/L2.

- Supply a stablecoin; watch your aTokens/cTokens accrue.

- Borrow a small amount against collateral; monitor your health factor.

- Change prices in your head (what if your collateral drops 20%?)—note how close you are to liquidation. Then repay and withdraw.

CeFi – paper-check the platform before funds

- Read risk disclosures and PoR methodology (who attests, how often, do they include liabilities?).

- Test operational friction with a tiny deposit and withdrawal.

- Set alerts: if the company pauses withdrawals or changes terms, you should know within minutes. (If you ever see opaque communications about “bank-like safety,” remember the FDIC advisory—no coverage at non-banks.)

The 2025 outlook

DeFi money markets (Aave, Compound) continue to mature with clearer parameters and multi-chain deployments, while institutional credit protocols (Maple) are rebuilding under tighter transparency. CeFi lenders that survived the shake-out are emphasizing risk management and attestations, but you should still scrutinize disclosures and jurisdiction. As regulators keep a close eye on yield products, especially in the U.S., your best defense is a repeatable process: size small, diversify venues, understand liquidation math, and verify claims—every time.