If you hang around crypto long enough, you’ll hear “fork” tossed around like everyone took the same class. In reality, blockchain forks are simple: they’re changes to the rules a network follows. Sometimes those changes are smooth (a soft fork). Sometimes they’re incompatible and split the chain into two histories (a hard fork in blockchain terms). This guide gives you blockchain forks explained, with battle-tested examples and a checklist for staying safe whether you self-custody or exchange crypto on a platform.

What are blockchain forks?

Source: Researchgate

At the highest level, a blockchain is a shared database where nodes enforce rules about blocks and transactions—what is blockchain 101. When those rules change, or when the network briefly disagrees about the next block, you get a fork. Some forks are routine and temporary (different miners find a block at the same time). Others are deliberate protocol changes that everyone (ideally) upgrades to. And a few are contentious, producing two chains that keep running separately. Think of a fork as either an upgrade path or a split—the outcome depends on compatibility and social consensus.

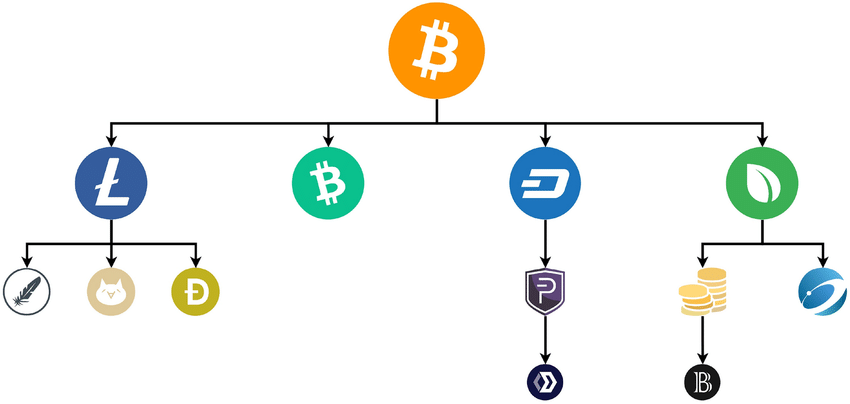

Soft fork vs. hard fork

Source: Financemagnates

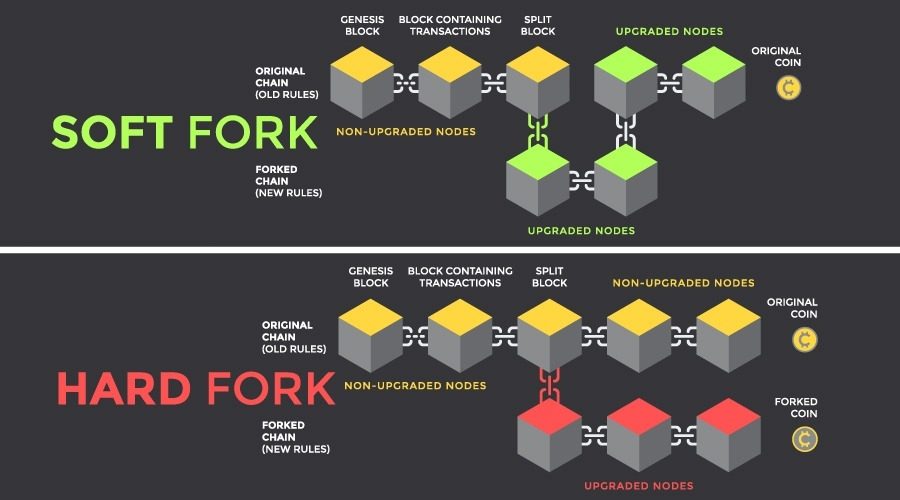

- Soft fork (backward-compatible): New rules are stricter than old ones. Upgraded nodes accept only the tighter rules, while older nodes still see upgraded blocks as valid. If most miners/validators upgrade, the network converges without splitting.

- Hard fork (backward-incompatible): New rules are not accepted by old software. If part of the network refuses to upgrade, the blockchain can split into two communities and two assets with a shared history up to the fork point—classic bitcoin fork stories and Ethereum’s DAO fork.

Put simply: soft forks tighten the rules, hard forks change them in ways the old software can’t follow.

Why do blockchains fork?

- Upgrades and features. Developers add new opcodes, fee mechanics, or efficiency improvements (e.g., Ethereum’s upgrade cycles like Byzantium).

- Fixing bugs or security events. In extreme cases, communities choose to rewrite outcomes—famously, the 2016 DAO hack led to an Ethereum hard fork that returned funds, while a minority kept the original chain as Ethereum Classic.

- Governance disputes. Differing views on block size, monetary policy, or roadmap can produce long-lived splits and new assets (various Bitcoin price offshoots over the years).

The human side of forks: coordination beats code

It’s tempting to view forks as purely technical. They’re not. They’re coordination events. A “safe” upgrade is one where developers, miners/validators, wallets, and exchanges align on timing and software versions. Education sites and law analyses underline the same idea: hard forks are simply upgrades that break compatibility; whether they split depends on social consensus at go-time.

Famous fork moments in history

- Ethereum, July 2016 — The DAO hard fork. After a smart-contract exploit drained ~3.6 million ETH, Ethereum hard-forked to move funds to a recovery contract; a minority rejected the change and continued as Ethereum Classic (ETC). This is the go-to example of a contentious hard fork driven by ethics, risk, and community norms.

- Bitcoin’s block-size wars (2015–2017). A series of proposals and client variants (XT, Classic, Unlimited) sought bigger blocks; the saga is why people talk about Bitcoin fork politics. Some offshoots became independent networks with their own tickers and communities.

- Routine, planned forks. Many upgrades are non-contentious: they roll in at a scheduled block/epoch, node operators upgrade in time, and the chain keeps marching—e.g., Ethereum’s historical Byzantium upgrade to improve performance and privacy features.

The fork landscape at a glance

| Fork type | Compatibility | What triggers it | Does the chain split? | Token impact | User action | Typical examples |

| Temporary chain fork (orphan/uncle) | Fully compatible | Two miners/validators find blocks near-simultaneously | No (the longest/most-work chain wins) | None | None | Common, resolves within minutes |

| Soft fork (upgrade) | Backward-compatible | Stricter rules added | Usually no if majority upgrades | One asset, same ticker | Update wallet/node when prompted | Bitcoin soft-fork upgrades like SegWit-style rule-tightening (general pattern) |

| Hard fork (planned, non-contentious) | Incompatible | Major feature or rules change | Split avoided if everyone upgrades | One asset continues (no airdrop) | Upgrade before activation | Many scheduled network upgrades in major chains |

| Hard fork (contentious chain split) | Incompatible | Policy or ethics dispute; part of network refuses | Yes—two chains continue | New coin appears on the new/old side | Custody both keys or rely on exchange support | Ethereum → ETH/ETC (2016); various Bitcoin offshoots |

| Software/code fork (no new chain) | N/A | Copying open-source client to launch a variant | Only if users adopt and mine/validate | Depends (often new chain + token) | N/A | Many altcoins begin as software forks |

Under the hood: how soft forks “tighten” rules

Education sources describe soft forks as forward-compatible constraints. Imagine a rule that says: “Blocks must now use feature X and never feature Y.” Old nodes don’t object because upgraded blocks look valid under old rules; upgraded nodes still enforce the stricter set. That’s why soft forks are a favorite when a change can be expressed as “accepting less than before.”

Why hard forks feel bigger and riskier

Hard forks flip the logic: the new chain accepts things the old chain would reject. Old software considers those blocks invalid, so non-upgraded nodes peel off and keep extending the old rule-set. Legally and operationally, hard forks are the ones that can produce new assets, create taxable events, and force infrastructure to pick sides. (Legal guides call out the hard/soft distinction precisely for that reason.)

How do forks affect you?

If you self-custody

- Before a scheduled fork: Update your wallet/client, back up seed phrases, and read the network’s upgrade notes.

- Contentious forks: Holding your own keys often means you control coins on both branches after a split. But don’t rush to claim forked coins without reputable tools; replay protection, derivation paths, and phishing risks vary.

If you use an exchange

Most platforms pause deposits/withdrawals around activation, then re-open on the chosen chain. In a split, the exchange may or may not list the minority coin. Read the status page before you exchange BTC to USDT or convert other assets during the window—you don’t want to get stuck mid-transfer.

If you build or integrate

Test against the new client version and confirm chain ID / fork ID changes (to avoid replay). Update dependencies that validate headers or parse receipts. In EVM land, ensure gas logic or precompile changes are reflected in your code.

Lessons from Ethereum’s DAO fork

Two ideas recur in the best explainers:

- Forks are social choices first, software changes second. Ethereum’s DAO decision hinged on values (immutability vs. user restitution) and risk management, not just code. The outcome produced ETH and ETC, both still live today.

- Naming is politics. In Bitcoin’s block-size era, multiple client proposals framed themselves as “the real fix,” but markets finally decided which chains had network effects—hashpower, developers, wallets, and economic activity. Lists of Bitcoin forks read like a record of that social sorting.

How to prepare for a fork

- Follow the canonical source. Each network publishes upgrade blocks/epochs and client versions. Read the announcement, not just social threads.

- Freeze critical moves near activation. If you must exchange crypto (rebalance, payroll), do it before or after the window so you’re not caught by paused deposits.

- Verify addresses and chains. In a contentious split, tickers and explorers can be confusing. Confirm chain IDs and official contract lists before signing anything.

- Wait for dust to settle (if unsure). Liquidity, wallets, and tooling take time to adapt. Early hours of a split attract scammers; you won’t miss much by letting markets find equilibrium.

Quick FAQ

Do all hard forks create a new coin?

No. If everyone upgrades, there’s just one chain after activation—no airdrop, no second coin. A new coin appears only when two chains continue after the fork.

Why do “temporary forks” happen every day?

Latency: two blocks can arrive at similar times. Consensus rules resolve it automatically; one becomes the canonical chain, the other an “orphan/uncle” reference.

Is a soft fork always safer?

Usually easier to coordinate, yes. But any rule-change has risk if infra upgrades late or if the new constraints introduce edge cases.

What about tax on forked coins?

Jurisdictions differ, but legal analyses treat hard fork windfalls distinctly from normal income. Speak to a professional if you receive new assets due to a split.

Conclusion

If you’re a user, keep your wallet updated, use reputable tools, and avoid big transfers during activation. If you’re a builder, test early against fork clients and watch chain IDs. And if you’re trading, plan around maintenance windows so your exchange BTC to USDT or other conversions don’t get caught mid-fork.

Forks can be stressful, but they’re also proof that open systems can evolve in public. Learn the patterns once, and every future “upgrade” headline will feel a lot less mysterious.