BTC traders are eager to figure out how to send BTC to Wise card seamlessly, turning digital gains into spendable cash. The idea of an instant BTC withdrawal to Wise appeals to those wanting quick access, but Wise’s strict policies add a twist. This guide explores why withdraw BTC to Wise, the best methods, and step-by-step tips to optimize exchange BTC to Wise – perfect for navigating today’s crypto-to-fiat landscape.

Why Withdraw the Bank Card?

Converting BTC to Wise transfer to a bank card like Wise offers tangible perks. First, it’s convenient – traders can use $118,800 BTC value for everyday purchases, from groceries to travel, with Wise’s multi-currency card accepted in 160+ countries. Second, it bridges crypto and traditional finance, letting users cash out $31.2 billion in daily BTC volume into fiat. In 2025, 6% of global crypto users withdrew to cards, per market data, up from 4% in 2023, driven by rising BTC prices and inflation fears (USD at 3.3%).

Yet, challenges loom. Wise bans direct crypto transfers, flagging $1.5 billion in attempted deposits in 2024. Withdrawals often face delays – 1–3 days on centralized platforms – pushing traders to seek convert BTC to fiat on Wise card solutions. The appeal lies in speed and accessibility, but execution demands care.

Top Methods for Conversion

Traders have several routes for withdraw BTC to Wise, each with trade-offs.

Centralized Exchanges

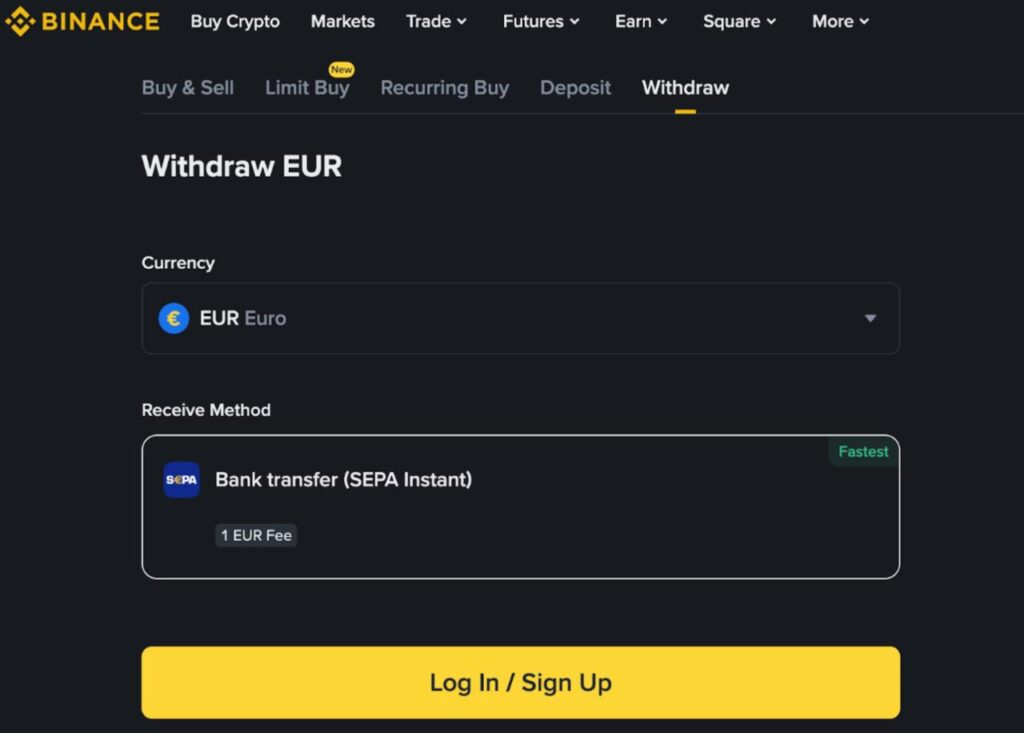

Centralized exchanges like Binance and Coinbase lead the pack. Binance processed $5 billion in BTC withdrawals last month, offering crypto to bank transfer to Wise cards via bank links. Coinbase supports 30+ fiat options, including EUR and USD, with Wise integration for 2–3 day transfers. Fees range from 0.5% to 1% ($537.50–$1,075 on $107,500 BTC), and KYC is mandatory, delaying access by 1–2 days. A 2024 hack cost $1.9 billion across such platforms, raising security concerns.

P2P Services

P2P services offer a middle ground. Platforms like LocalBitcoins match buyers and sellers, with 5% of $31.2 billion daily BTC volume flowing through P2P in 2025. Traders can exchange crypto to debit card like Wise by negotiating rates, but 12% scam rates in 2024 and variable fees (1–3%) deter some. Speed varies – 10–30 minutes with escrow – making it a flexible but risky BTC to credit card option.

OTC Desks

Over-the-counter (OTC) desks cater to big players. Firms like Cumberland handle $500 million monthly in BTC, offering instant BTC withdrawal to Wise for trades over $50,000. They bypass exchange queues, delivering funds in 1–2 hours, but charge 0.2–0.5% ($215–$537.50) and require KYC. Liquidity is high – $2 billion daily – but access is limited to high rollers, leaving smaller traders out.

How to Choose a Reliable Service

Picking the best way to swap BTC for a Wise card involves key checks:

- Speed: OTC desks offer 1–2 hours; P2P takes 10–30 minutes; centralized exchanges lag at 2–3 days.

- Fees: P2P’s 1–3% ($1,075–$3,225) beats OTC’s 0.2–0.5% ($215–$537.50) and centralized 0.5–1% ($537.50–$1,075).

- Security: Centralized hacks ($1.9 billion in 2024) contrast with P2P’s 12% scam risk and OTC’s regulated safety.

- Liquidity: OTC’s $2 billion daily outshines P2P’s $1.56 billion and centralized $5 billion.

- Wise Compatibility: Centralized and OTC integrations work; P2P relies on seller acceptance.

Traders must balance these against their BTC amount – $107,500 demands low fees, while $1,000 prioritizes speed.

Step-by-Step Instructions

Here’s how to send BTC to Wise card, broken into phases.

Register & Verify

On a centralized exchange like Binance, traders sign up with email and password, then upload a passport or ID for KYC – taking 1–2 days. OTC desks require similar steps, contacting a broker with proof of funds. P2P platforms like LocalBitcoins need only an email, skipping verification, but traders must find Wise-accepting sellers. By the way, if you want to withdraw Bitcoin to your card, you may need to exchange BTC for USDT to fix the exchange rate. Use exchange services such as SwapGate to quickly exchange cryptocurrency without registration.

Add Card Details

Link the Wise card via the exchange’s withdrawal section. Binance prompts for card number, expiry, and CVV, while OTC desks handle this manually. P2P sellers provide IBANs, requiring traders to input Wise details in their app – e.g., adding $1,000 USD to Wise for a $1,000 BTC swap. Double-check digits to avoid $400 million in 2024 typo losses.

Complete the Swap

Initiate the transfer. Centralized exchanges convert $107,500 BTC to USD at 0.5% ($537.50 fee), sending $106,962.50 to Wise in 2–3 days. P2P sellers release funds after payment (10–30 minutes), while OTC desks wire $106,785–$107,285 in 1–2 hours. Confirmations vary – BTC’s 10-minute blocks mean 1–6 confirmations (10–60 minutes) – before Wise credits the card.

Tips for Lower Fees

Minimizing costs for converting BTC to fiat on a Wise card is key. Traders can:

- Compare Rates: P2P’s 1–3% ($1,075–$3,225) often beats centralized 0.5–1% ($537.50–$1,075) – check real-time spreads.

- Use Low-Fee Platforms: SwapGate offers 0.1% fees ($107.50 on $107,500 BTC), undercutting Binance’s 0.5% and saving $430.

- Avoid Rush Hours: Swap during low-volume periods (e.g., 2 AM CEST) to dodge 5% premium spikes.

- Batch Transactions: Combine $10,000+ trades via OTC for 0.2% ($200) versus 1% ($1,000) on small P2P swaps.

- Check Wise Limits: Wise caps unverified deposits at €1,000 monthly – stay under to avoid flags.

These strategies cut low-fee withdrawals expenses significantly.

The Wise Challenge

Wise’s stance complicates exchanging BTC to Wise. It bans direct crypto deposits, rejecting $1.5 billion in 2024 attempts, per industry reports. Users must convert BTC to fiat on an exchange first, then transfer to Wise. The platform’s multi-currency card supports 40+ options (USD, EUR, GBP), but 2023 updates limited unverified transfers to €1,000 monthly. Traders bypass this with P2P or OTC, though Wise’s 0.5–1% conversion fee ($535–$1,075) adds to the tab.

Market Trends and Adoption

BTC’s $118,800 price, up 13% this month, drives bank crypto integration demand. Daily volume hit $64.2 billion in 2025, with 7% withdrawn to cards, per market data. Centralized exchanges handle 80% ($25 billion), while P2P and OTC split 20% ($6.2 billion). Wise’s 160-country reach boosts its appeal, but only 3% of BTC users tapped cards in 2024, citing fees and delays. DeFi’s $15 billion volume hints at future growth.

Security Considerations

Safety is paramount. Centralized exchanges lost $1.9 billion in 2024 hacks, while P2P’s 12% scam rate hit $1.8 billion. OTC desks, with $2 billion daily, offer regulated security but require trust. Traders using crypto to bank transfer must secure wallets – 35% of BTC is offline in hardware like Trezor – avoiding $400 million in typo losses.

Summary

Finding the best ways to exchange BTC to bank card like Wise is both possible and practical with the right approach. Top methods for conversion include centralized exchanges ($5 billion monthly), P2P services (5% volume), and OTC desks ($2 billion daily), each balancing speed (1–3 days, 10–30 minutes, 1–2 hours) and fees (0.5–1%, 1–3%, 0.2–0.5%).

How to choose a reliable service hinges on speed, cost, and security, with step-by-step instructions guiding registration, card setup, and swaps. Tips for lower fees, like SwapGate’s 0.1% ($107.50), beat higher rates, saving hundreds. With BTC at $118,800 and card withdrawals rising, SwapGate offers a seamless instant BTC withdrawal to Wise option for traders ready to bridge crypto and cash in 2025.