If you only remember the headlines—Beeple’s $69M sale, pixelated avatars, and a crash—you might assume the NFT era ended with the hype cycle. Reality is messier (and more interesting). In 2026, NFT use cases have shifted from speculative collectibles to practical tools in nft gaming, ticketing, brand loyalty, and digital identity. Trading volumes ebb and flow, but on-chain activity keeps climbing—just with different buyers and different reasons to own.

What is an NFT—really?

Source: Wallpapers

At its core, an NFT is a blockchain token that is unique—a deed to something digital (or a bridge to something physical). Where a dollar or an ETH coin is interchangeable, each NFT is distinct. The most common Ethereum standards are ERC-721 and ERC-1155. Think: one-of-one artworks, limited game items, tickets, membership passes. That uniqueness—and the global ledger behind it—lets apps prove ownership, scarcity, and history for digital stuff.

The market in 2026: lower prices, higher participation

After the boom-and-bust of 2021–2022, today’s market looks more like a long tail than a moonshot chart. The big picture:

- Sales counts are up even when prices aren’t. October 2025 saw 10.1 million NFT sales and a 30% month-over-month volume increase. Lower average prices have brought in more casual buyers rather than shutting the market down.

- Market share keeps rotating. After Blur burst onto the scene (airdrop incentives, pro-trader tools) and briefly overtook OpenSea, leadership has see-sawed through 2024–2025. Recent snapshots show OpenSea regaining share as volumes normalize. Translation: competition is alive, and power users aren’t the only users anymore.

So, are NFTs still a thing? Yes—just different. Average sale prices are saner; utility and convenience matter more than flexing a profile picture.

Where NFTs actually work now

1) Gaming: Ownable items, seasons, and marketplaces

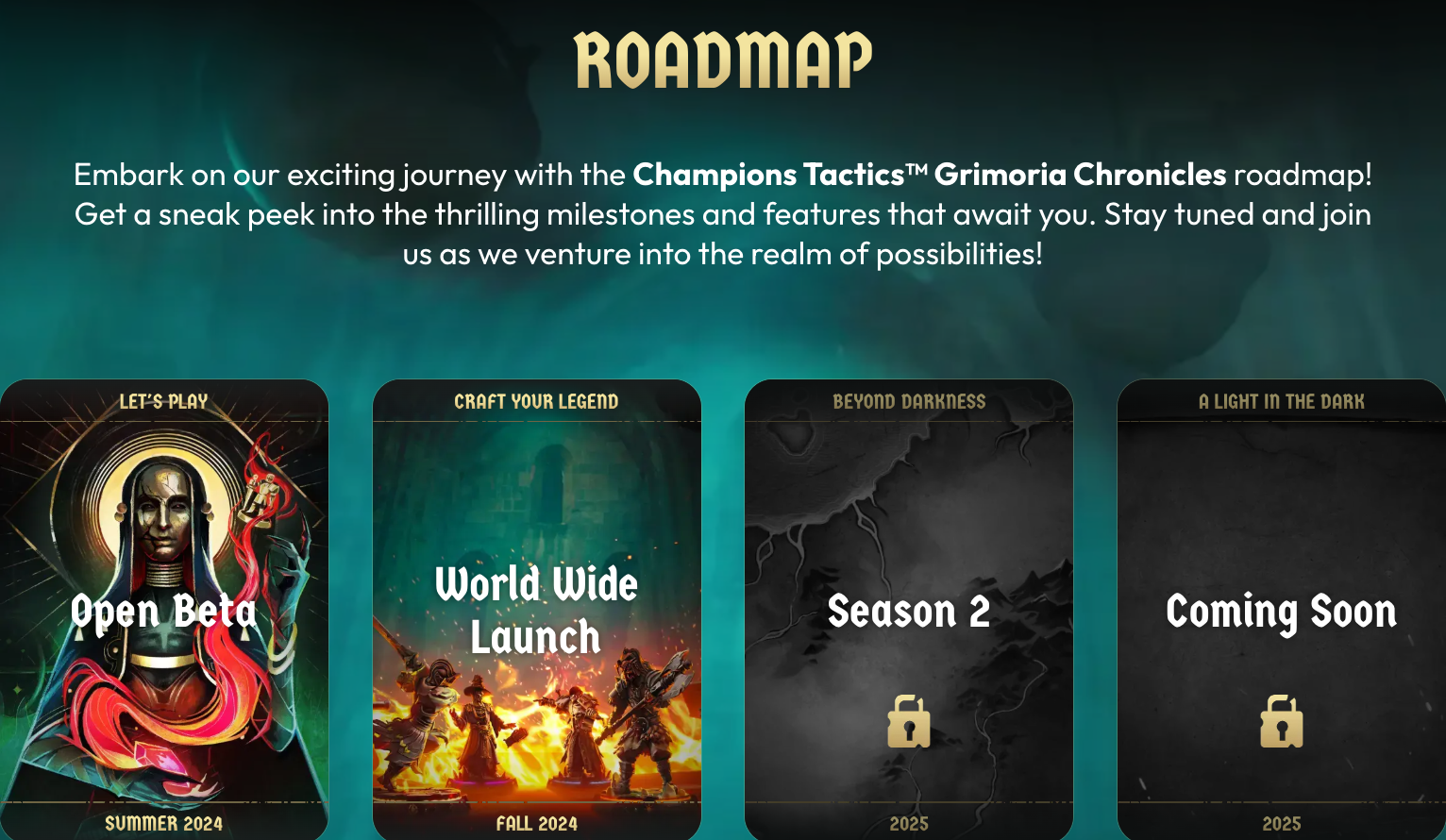

Game studios are edging from experiments to real launches. Ubisoft re-entered with Champions Tactics and has been building on Immutable’s zkEVM stack—part of a broader push where NFTs represent tradable, seasonal items or figurines you truly own. That matters because it ties value to play rather than to pure speculation.

2) Ticketing and access: Less fraud, better loyalty

Tokenized tickets—often minted as NFTs—help with authenticity and post-event memorabilia. Ticketmaster has supported organizers issuing NFT add-ons at scale; sports and concerts have quietly distributed millions of on-chain tickets or keepsakes across seasons. Expect “proof-of-attendance” to keep blending with loyalty perks.

3) Brands & “phygital” drops: Learning by shipping

From .SWOOSH (Nike) to luxury houses, brands have tried digital collectibles tied to product access, in-game wearables, and physical redemptions. Some efforts were sunset (e.g., Nike winding down RTFKT), but the lesson is clear: utility wins, and “NFT as a receipt for perks” has staying power.

4) Creators & communities: Memberships > moonshots

Musicians, artists, and DAOs use NFTs as passes—to unlock content, drops, meetups, or voting—shifting the center of gravity from one-time sales to ongoing community. Lower fees after Ethereum’s scaling upgrades have helped small on-chain actions (mints, claims) feel tolerable again.

Timeline: how we got here

| Year | Milestone | Why it mattered |

| 2017 | CryptoKitties congests Ethereum | First mass-market NFT moment; exposed scalability limits and proved demand for on-chain collectibles. |

| 2021 | Beeple’s $69.3M sale at Christie’s | Put “NFT meaning” on the cultural map; ignited the art and nft collectibles boom. |

| 2022–2023 | Bear market, Blur launches (pro-trader incentives) | Trading rotated from retail to pros; market structure competition began in earnest. |

| 2024 | Brands, ticketing pilots; legal agencies publish IP guidance | Less hype, more policy clarity around intellectual property and NFTs. |

| 2025 | Gaming & utility push; sales counts hit yearly highs in October | Lower prices + more transactions = broader participation; OpenSea vs. Blur rivalry stabilizes. |

The legal/IP piece: not as scary as it sounds

Two U.S. agencies—the USPTO and U.S. Copyright Office—told Congress in 2024 that new NFT-specific IP laws aren’t necessary right now. In short: existing copyright, trademark, and patent rules mostly cover NFT disputes; the tricky part is education (buyers often don’t know what rights they actually get) and enforcement (fraud still exists). If you care about the future of NFTs, this is good news: policy is catching up without reinventing the wheel.

- Owning an NFT usually doesn’t give you copyright to the underlying art unless the license says so.

- Purely AI-generated outputs (with no meaningful human authorship) aren’t eligible for U.S. copyright protection today. That nuance matters for NFT projects built with generative AI.

Market structure: who sells the most, and why it changes

OpenSea aims for mainstream discovery and better UX; Blur caters to power users with bulk listing, bidding, and token incentives. This split mirrors the two audiences that now coexist: collectors/community members and traders/liquidity providers. In 2023, incentives helped Blur overtake OpenSea by volume; in 2025, as rewards normalized, OpenSea regained ground—suggesting “organic” demand is moving toward utility-driven categories again.

Are NFTs still a thing? The data-driven answer

- Yes, if you look at activity. 2025 saw multi-million monthly sales and periodic volume surges even with lower average prices—more users, smaller tickets.

- Yes, if you look at use cases. Nft gaming titles, ticketing, and brand membership passes now account for a rising share of transactions. (Crypto gaming alone can represent a hefty chunk of NFT action in 2025 datasets.)

- But hype ≠ health. Some high-end art collections retrenched, and certain brand experiments wound down. That pruning is normal for new tech—and it’s leaving behind things that people actually use.

Top nft use cases to watch next

Source: Champions Tactics

Gaming economies that travel

Expect more games to let you bring seasonal items or cosmetics between titles or to official marketplaces, with royalties and sinks designed from day one. Ubisoft and Immutable’s work hints at how major publishers will integrate ownership without breaking game balance.

Tickets, passes, and proof-of-attendance

NFT tickets do three jobs well: anti-fraud, instant transfer with rules, and post-event perks. As issuers see lower support costs and better retention, this becomes a standard pattern—especially when fees are low on L2s.

Brand memberships (“own the receipt, not just the hoodie”)

Instead of one-off drops, memberships can unlock physical redemptions, priority access, and on-chain histories that travel with you. Some early projects fizzled, but those leaning into utility and community are sticking.

Risks you shouldn’t ignore

- Scams and drainers: Social engineering and fake sites remain the #1 threat; 2024 set grim records for crypto scam revenue. Use hardware wallets and approve fewer, trusted contracts.

- Illiquidity: Many NFTs won’t have deep markets. If you need out fast, expect slippage.

- IP confusion: Read the license. “I own the token” ≠ “I can print this on T-shirts forever.” The 2024 USPTO/USCO study is a must-skim for creators and buyers alike.

How to participate responsibly

- Pick your lane. Are you here for collectibles, game items, or memberships? Your security setup and budget will differ.

- Minimize permissions. Revoke dodgy approvals; use hardware wallets for valuable assets.

- Fund the wallet you actually use. Many marketplaces support stablecoin checkout. If you need to exchange crypto (say, exchange ETH to USDT for minting), consider reputable exchanges like Swapgate and always test with a small transaction first.

NFTs aren’t dead—they’re maturing

The most honest answer to “are NFTs still a thing?” is that NFTs are less about headlines and more about plumbing. As fees trend lower and UX gets easier, tokens that prove ownership—of game items, tickets, and memberships—quietly do their job. Collectible art won’t vanish, but the center of gravity has shifted to useful. That’s exactly where new tech belongs.